Crypto Whales Dump These Assets Before Trump’s August 7 Tariff Bomb – Here’s What’s Moving

Crypto's big players aren't waiting around to see how tariffs shake out. They're dumping positions fast—here's where the smart money's fleeing.

Whale wallets show unusual sell pressure on three major tokens. Exchanges are seeing abnormal volume spikes in what looks like preemptive risk-off moves.

Trump’s August 7 deadline has traders spooked. The usual 'buy the rumor, sell the news' playbook gets tossed when geopolitical risks enter the chat.

One hedge fund manager quipped: 'When elephants dance, the grass gets trampled. When politicians tweet, portfolios get rekt.' Classic Wall Street wisdom—just with more leverage and memes now.

Watch for cascading liquidations if key support levels break. Nothing brings out the sharks like a little blood in algorithmic trading pools.

Uniswap (UNI)

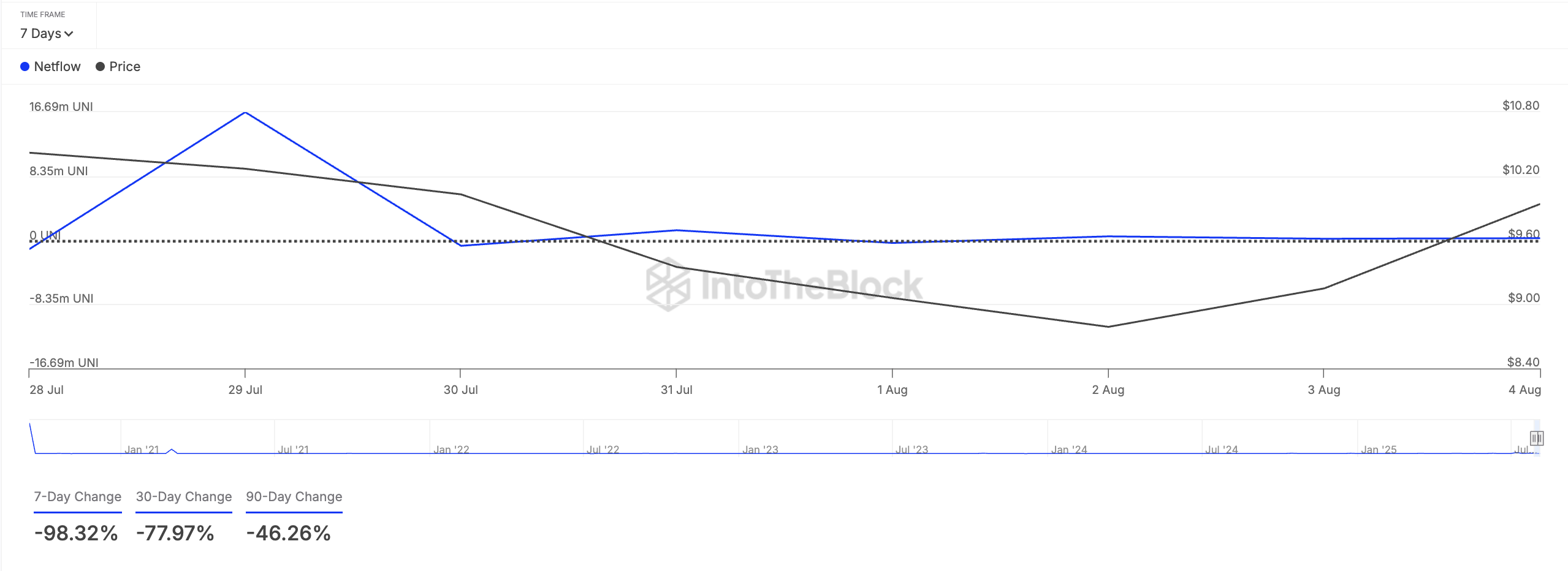

Decentralized finance (DeFi) token UNI is one of the assets that crypto whales appear to be distributing ahead of August 7. This is reflected by its large holders’ netflow, which has plunged 98% in the past seven days, per IntoTheBlock.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Large holders are addresses that hold more than 1% of an asset’s circulating supply. According to the data provider, the large holders’ netflow metric tracks the difference between the inflows and outflows of tokens to and from the wallets of these addresses.

When it falls, these large holders are moving their assets out of accumulation wallets, often toward exchanges or other destinations where they can be sold.

In UNI’s case, the 98% drop in large holders’ netflow over the past week suggests that whale wallets have sharply reduced their token intake. This signals a wave of distribution that could add selling pressure to UNI’s sell-side pressure ahead of August 7.

If selloffs continue, the token’s price could fall to $8.67.

However, if buying pressure builds up and traders take more positions, it could push UNI’s price to $10.25.

Ethena (ENA)

ENA, the native token that powers the Ethereum-based synthetic dollar protocol Ethena, is another asset that crypto whales are selling ahead of August 7.

Data from Nansen reveals a decline in ENA’s large holder activity over the past week. According to the on-chain data provider, the token balance of whale wallets that hold tokens worth above $1 million has declined by 25% in the past seven days.

As of this writing, this cohort of ENA investors holds nearly 42 million tokens.

This sell-off trend follows ENA’s steady retreat from its cycle peak of $0.70, recorded on July 28, as traders rush to lock in profits. If the downward momentum persists, ENA could slide further toward the $0.48 support zone.

Conversely, a resurgence in buying pressure could pave the way for a rebound toward $0.64.

Cardano (ADA)

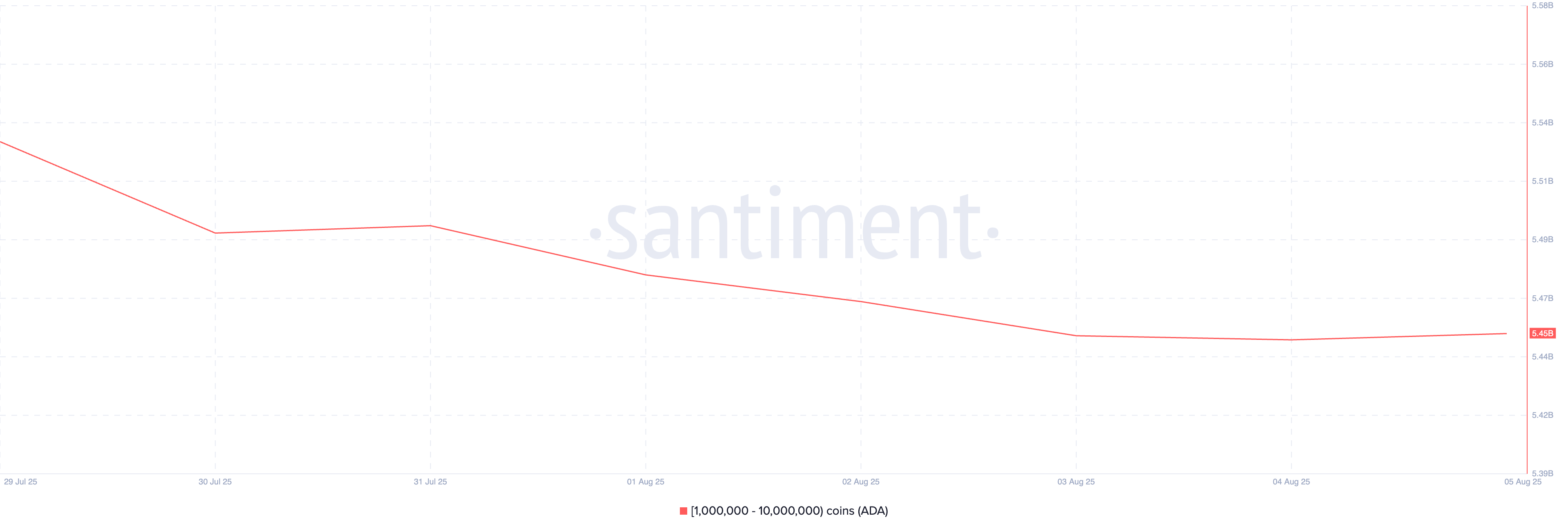

Layer-1 (L1) coin ADA is another digital asset that large investors are distributing ahead of Trump’s global tariffs announcement on August 7.

According to on-chain data from Santiment, whale addresses holding between 1 million and 10 million coins have sold 80 million ADA in the last seven days.

If these large whales maintain their distribution, flooding the market with supply that outpaces demand, ADA could slide toward $0.66.

However, a sharp surge in buying interest could propel the altcoin beyond the $0.76 resistance level.