Fed Rate Cut at 92.2% for September: Crypto Market Braces for Impact

Markets are pricing in near-certainty of a Fed pivot—here's why crypto traders are leaning into the hype.

Liquidity tsunami incoming?

With 92.2% odds flashing on rate-cut dashboards, Bitcoin and altcoins are already sniffing out the cheap-money fumes. History says risk assets party when the Fed turns dovish—but this cycle's got more asterisks than a hedge fund's fine print.

Altcoin leverage goes brrr

Expect degenerate yield farming plays and perpetual swaps trading at 50x leverage. The smart money's already rotating out of 'risk-free' Treasury bills—what could possibly go wrong?

The cynical take

Wall Street will front-run the actual rate cut by six months, then blame retail traders when the bubble pops. Place your bets accordingly.

Market Sees 92.2% Chance of Fed Rate Cuts by September 2025

Since December 2024, the Federal Reserve has held interest rates steady between 4.25% and 4.5%. However, market watchers are increasingly optimistic that this trend may finally break in September.

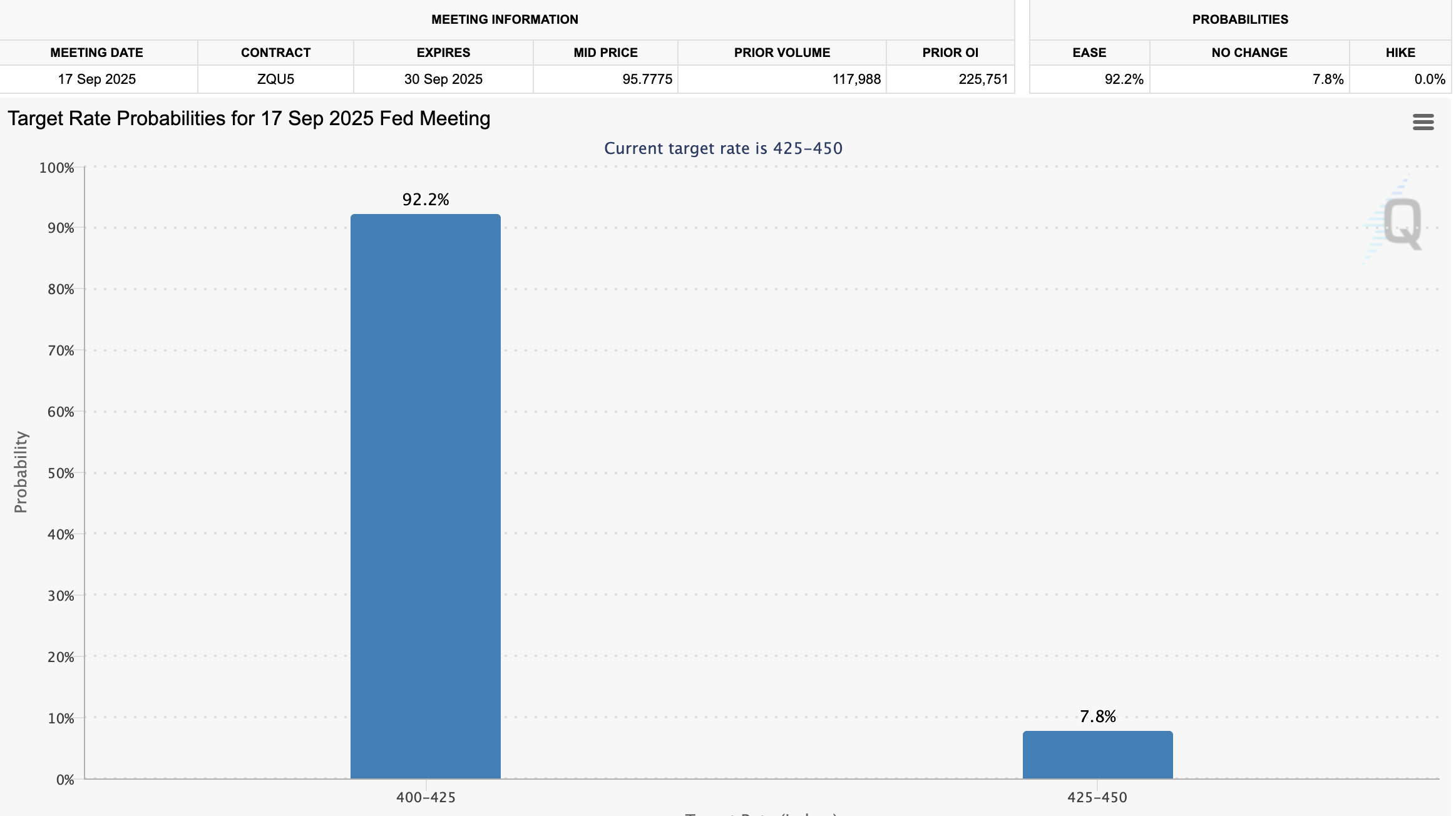

This shift is reflected in the increased probability of rate cuts. At press time, the probability of a Fed rate cut in September stood at 92.2%, a significant jump from the 41% probability at the end of July.

Furthermore, four key financial institutions expect rate cuts to begin in September. Goldman Sachs recently raised its forecast, now expecting three 25-basis-point reductions.

The rate cuts are predicted for September, October, and December. The firm also adjusted its 2026 outlook, expecting two additional cuts, targeting a terminal rate of 3.00% to 3.25%.

“We had previously thought that the peak summer tariff effects on monthly inflation and the recent large increases in some measures of household inflation expectations WOULD make it overly awkward and controversial to cut sooner. Early evidence suggests that the tariff effects look a bit smaller than we expected,” Goldman analysts noted.

Other institutions, such as Citigroup, Wells Fargo, and UBS, also expect rate cuts this year, with UBS forecasting a 100-basis-point reduction.

The increase comes ahead of the US Job Report. BeInCrypto reported that the job market slowed in July, with the unemployment rate increasing to 4.2%.

Nonetheless, economist and crypto-critic, Peter Schiff, raised concerns about the accuracy of the data.

“Many now expect the Fed to cut rates because prior jobs numbers have been revealed to have grossly overestimated job creation. However, the inflation data has also been equally inaccurate. The labor market is much weaker, but inflation is also much stronger than the Fed claimed,” he said.

Crypto in Focus: How Will Fed Rate Cuts Impact the Market

But how would the Fed’s cutting of interest rates impact crypto? Lower interest rates typically reduce borrowing costs, encouraging investment in riskier assets like cryptocurrencies.

Historically, such monetary policy shifts have driven capital flows into digital assets, often leading to price surges. Similarly, the absence of anticipated cuts in July contributed to drops in Bitcoin and other cryptocurrencies, highlighting the correlation.

The current sentiment is reflected in commentary from prominent voices in the crypto community, who express bullish outlooks for the market’s prospects.

“As I mentioned yesterday, I’m very bullish on Q4. Key drivers include potential Fed rate cuts, continued economic strength, and increasing regulatory clarity,” analyst Ted Pillows wrote.

Therefore, the high probability of a September rate cut, supported by revised forecasts and labor market trends, positions the cryptocurrency market for potential growth.

The shift from earlier pessimism to current Optimism highlights the market’s sensitivity to monetary policy expectations, setting the stage for a potentially transformative moment in 2025.