3 Altcoins Primed to Explode in August 2025 – Don’t Miss These Plays

Crypto markets are heating up—here’s where smart money’s lurking this week.

1. The Ethereum Killer That’s Actually Delivering

Move over, ETH 2.0 delays—this Layer 1’s got institutional inflows and developer traction while Vitalik’s crew misses another deadline.

2. The Meme Coin That Outlived Its Hype (Somehow)

Against all odds—and basic financial logic—this dog-themed shitcoin keeps printing new ATHs. Traders are either geniuses or high on hopium.

3. The BNB Chain Dark Horse

Binance’s ecosystem play that even CZ’s legal team can’t kill. Low-cap gem or regulatory timebomb? Place your bets.

Bullish or not, August’s first week always delivers drama—just ask the bagholders from 2022. Pro tip: maybe don’t YOLO your kid’s college fund this time.

Immutable (IMX)

IMX price is at $0.502, reflecting the broader bearish market trends. Despite this, the altcoin may find support at $0.497, giving it a potential chance to recover. If support holds, IMX could attempt a rise towards $0.548, offering an opportunity for traders to capitalize on potential gains.

The upcoming token unlock, which will release 24.52 million IMX worth $12.4 million, could impact the market. While token unlocks typically lead to bearish price movements, IMX’s relatively low price may attract buyers. This demand could offset the negative impact of the additional supply, giving IMX a chance to recover.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

However, if investor sentiment remains uncertain and demand does not materialize, IMX could face continued selling pressure. In such a scenario, the price may fall below $0.497 and drop to $0.470 or lower. This WOULD invalidate the bullish outlook, signaling further downside risks for the altcoin.

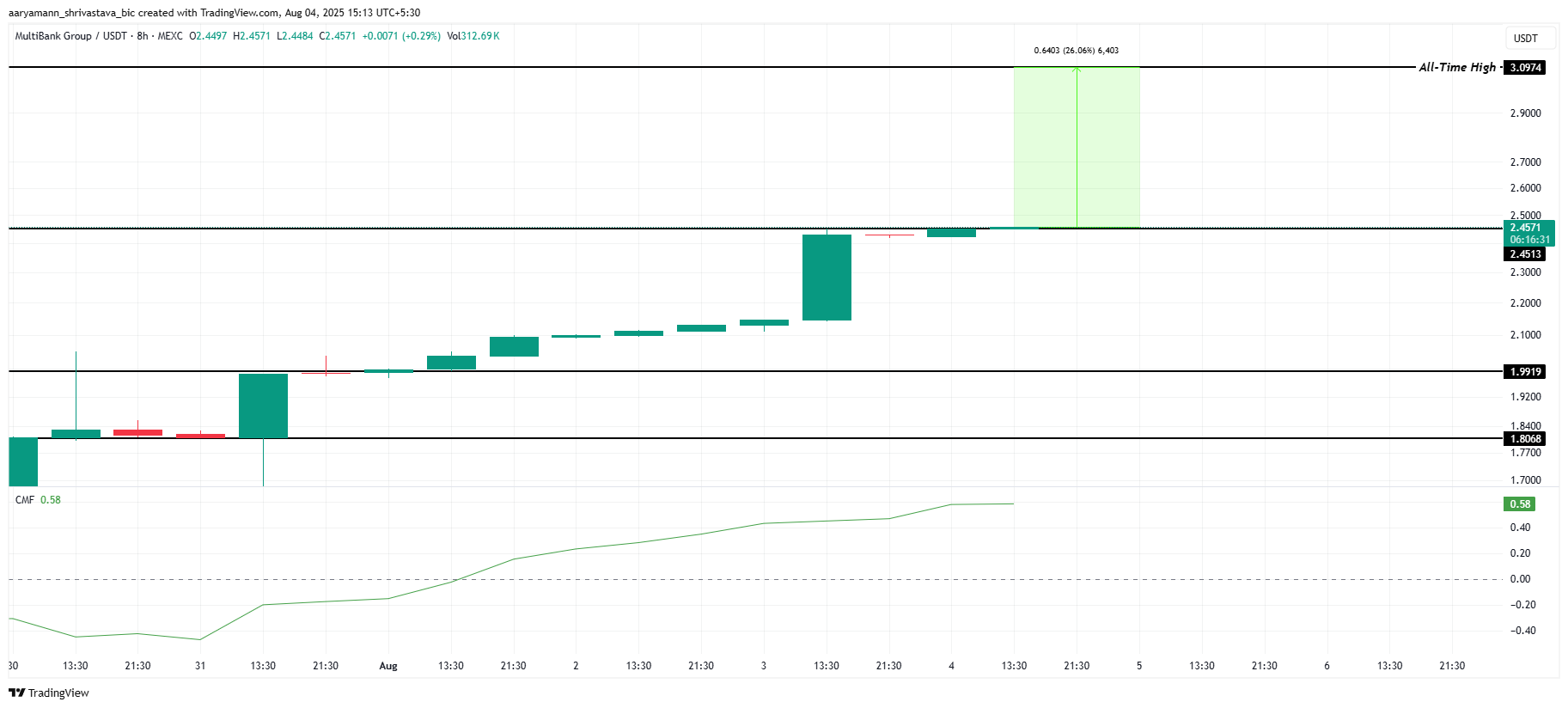

MBG By Multibank Group (MBG)

MBG, a recently launched cryptocurrency, has captured significant attention from investors. In less than two weeks, MBG’s market capitalization reached $212 million, showcasing its rapid growth.

The inflow of capital, as noted on the CMF, into MBG is a positive indicator, suggesting investor confidence. With continued demand, MBG could potentially revisit its all-time high of $3.09, which is just over 26% away from its current position. Securing the support level of $2.45 is crucial for maintaining upward momentum and reaching new heights.

However, if selling pressure intensifies from skeptical investors, MBG could face a halt in its upward trajectory. A failure to hold the support of $2.45 could result in a decline, pushing MBG down to $1.99 or lower. Losing this support level would invalidate the bullish thesis for the altcoin.

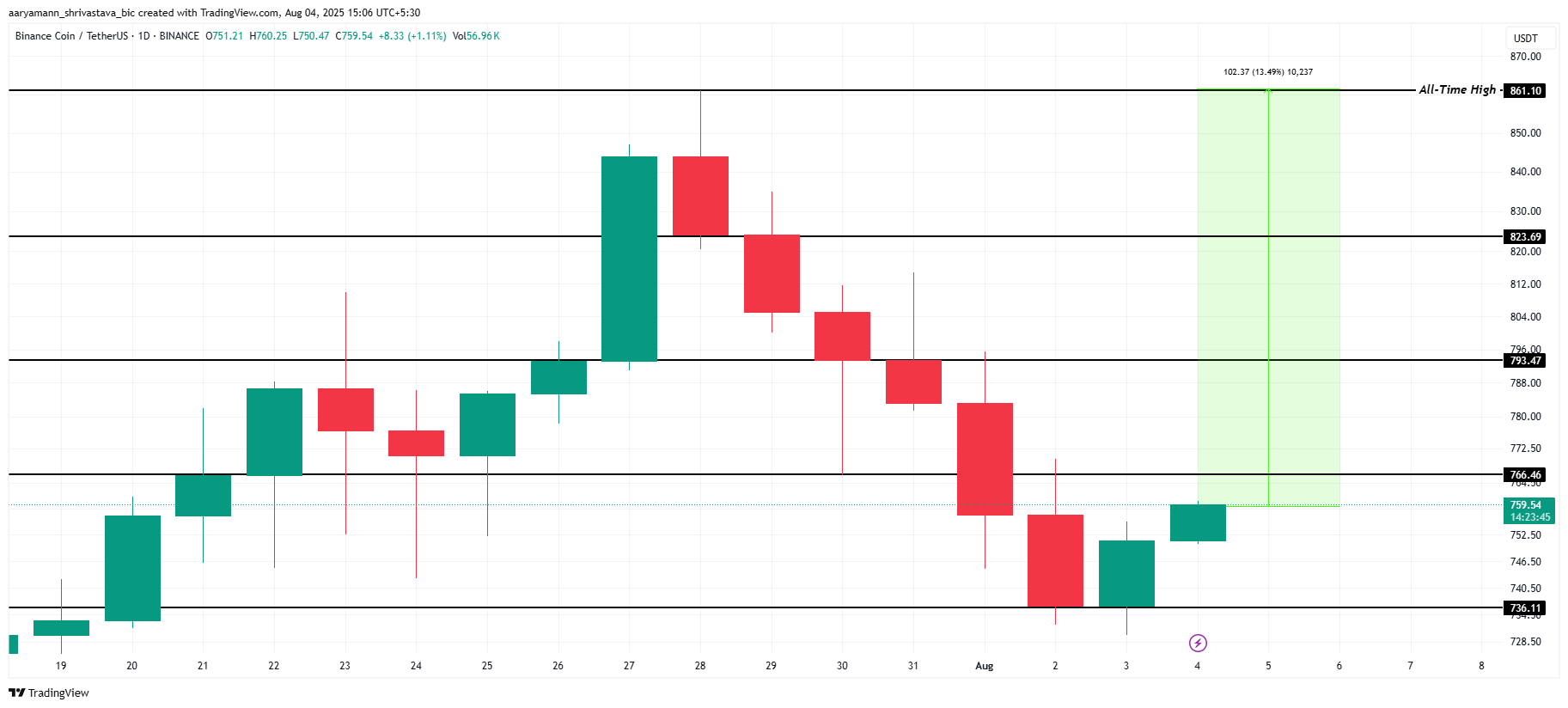

BNB

BNB formed a new all-time high (ATH) in late July, reaching $861, but has since declined to $736. Despite this setback, bullish market signals suggest that BNB is showing signs of recovery, currently trading at $759. The altcoin remains within reach of previous highs if it maintains momentum.

Currently, BNB stands 13.5% below its ATH of $816. If BNB can break through key resistance levels at $793 and $823, it is likely to approach the ATH again. Securing the $766 support level will be crucial for sustaining upward momentum and achieving further gains in the NEAR term.

However, if BNB fails to hold the $766 level, it could experience further downside. A drop below this support could push BNB back down to $736 or even lower. Such a MOVE would invalidate the current bullish outlook and suggest a potential bearish reversal.