3 Altcoins Primed to Shatter All-Time Highs This August

Crypto markets are heating up—and these three altcoins have the fuel to rocket past previous peaks. Buckle up.

BNB: The Exchange Giant's Silent Ascent

Binance's native token isn’t just riding coattails—it’s rewriting the playbook. With burn mechanisms tighter than a VC’s purse strings, BNB’s supply crunch could send it stratospheric.

The Dark Horse Protocol Defying Market Gravity

While Bitcoin waffles, this Layer 1’s developer activity screams institutional interest. ATH? More like a stepping stone.

The Meme Coin That Outlived the Hype Cycle

Somehow still standing after the 2023 meme-pocalypse, this dog-themed outlier’s got more bite than bark. Retail’s back—and so are the Lambo dreams.

Will they deliver? In crypto, certainty’s as rare as a trader who admits losses. But with volatility this juicy, even hedge funds might glance up from their Excel sheets.

BNB (BNB)

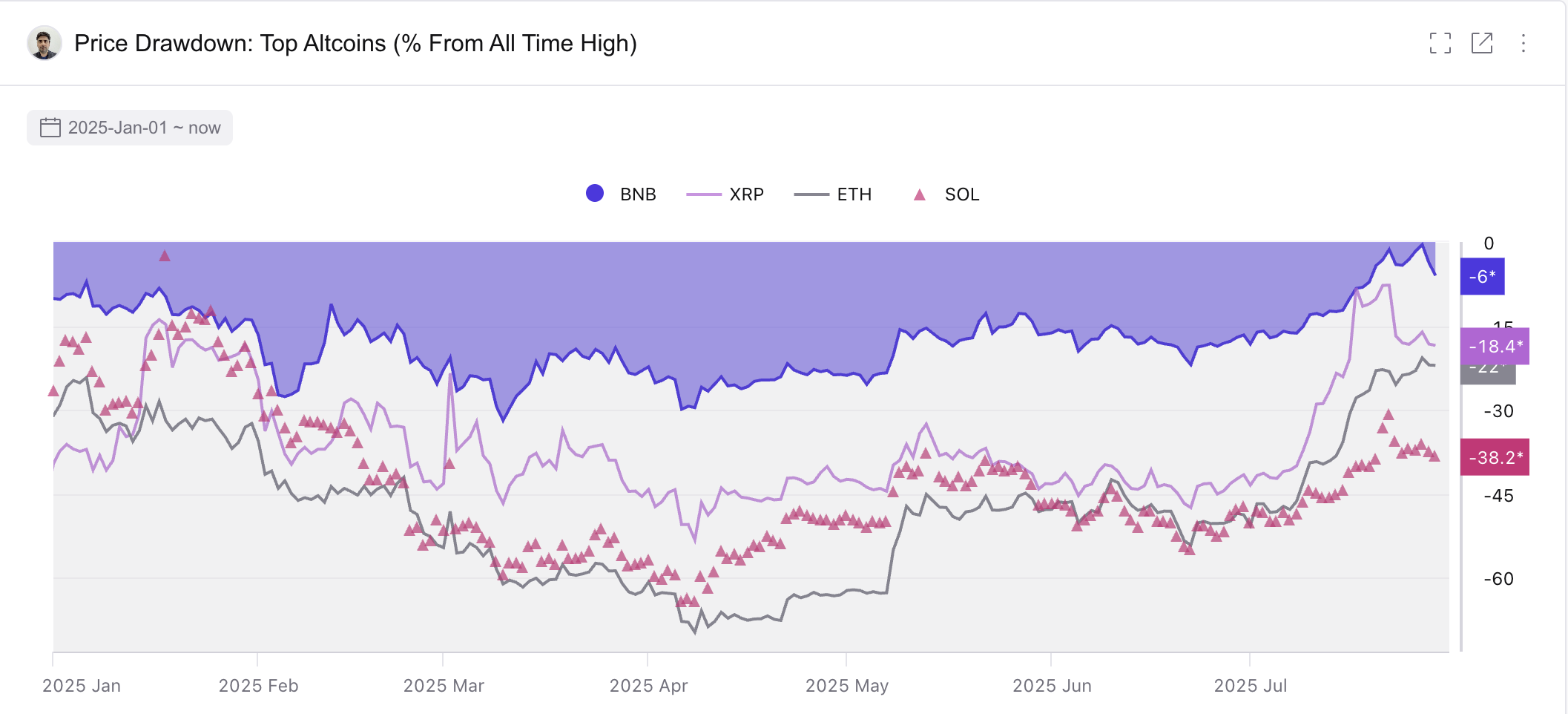

Among top market cap altcoins, BNB currently shows one of the strongest technical positioning. It now sits just 12.3% below its all-time high.

What sets BNB apart is its minimal drawdown trend throughout 2025. It has never dropped more than 30% below its all-time high, according to year-to-date drawdown data. This consistent resilience is a rare feat in a market known for volatility.

Investor confidence has been buoyed by real utility across the Binance ecosystem, and recent 11% month-on-month growth in DeFi activity on BNB Chain reinforces its on-chain momentum.

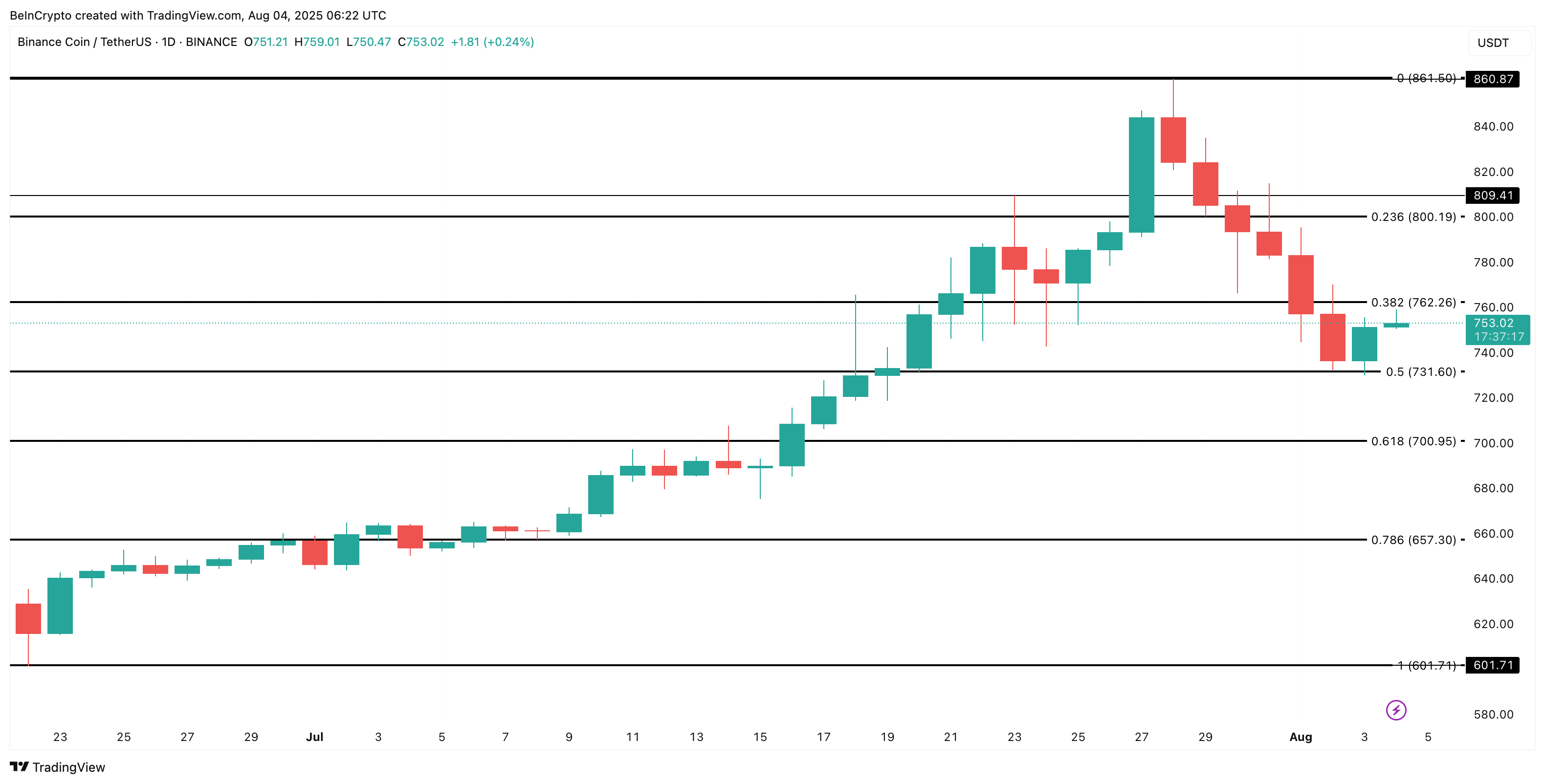

BNB is currently trading around $753, holding just above $731, a key support zone derived from the Fibonacci retracement between the June swing low of $601 and the recent peak near $809.

- If $731 holds, the next key resistance is at $762, where BNB previously consolidated before its last breakout.

- A clean move past $762 opens the door for a retest of the $800–809 zone.

Note: There isn’t any strong technical resistance level between $800 and $861, strengthening BNB’s case for a new all-time high if $800 is re-breached.

With strong structural support, limited historical downside, and steadily growing DeFi usage, BNB is one of the top altcoins for a fresh all-time high this month, provided broader market stability continues.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

HYPE (Hyperliquid)

Hyperliquid is quickly emerging as a serious contender in the DeFi derivatives space. With a total value locked (TVL) of over $2.06 billion, it’s currently ahead of major platforms like dYdX, which holds around $263 million. The protocol has also climbed into the top 10 DeFi ecosystems by TVL.

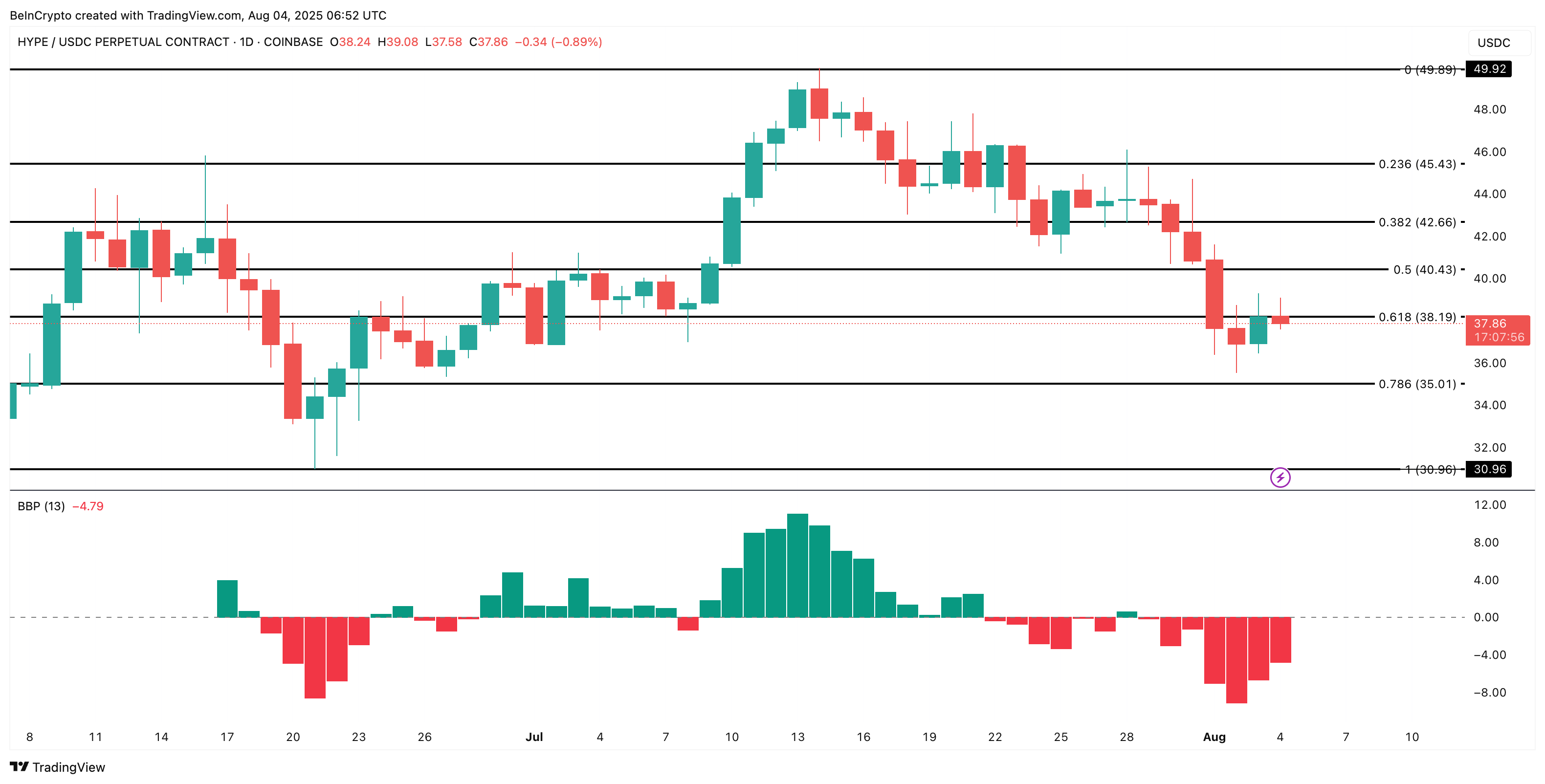

In terms of recent performance, HYPE is down just over 24% from its all-time high of $49.92, which was made a few weeks back. However, its three-month gain still stands at a massive 86.8%, showing that the broader uptrend is still intact despite a 15.3% drop in the last seven days.

One of the key technical validations towards a new all-time high comes from the Bull Bear Power (BBP) indicator. At the time of writing, BBP is showing the same pattern right before the price rallied by over 60% from around $30 to nearly $50. The current pattern mimics that behavior, with BBP showing similar bear exhaustion. If that setup repeats, a strong reversal is not off the table.

At the price level, HYPE is consolidating just below the 0.618 Fibonacci retracement level, marked at $38. This zone is being closely watched, as a flip of this resistance could open the way toward $42 and potentially back to the highs. Notably, the $35 region also acts as a strong psychological and structural support. Do note that it was the base for the last breakout.

TRX (Tron)

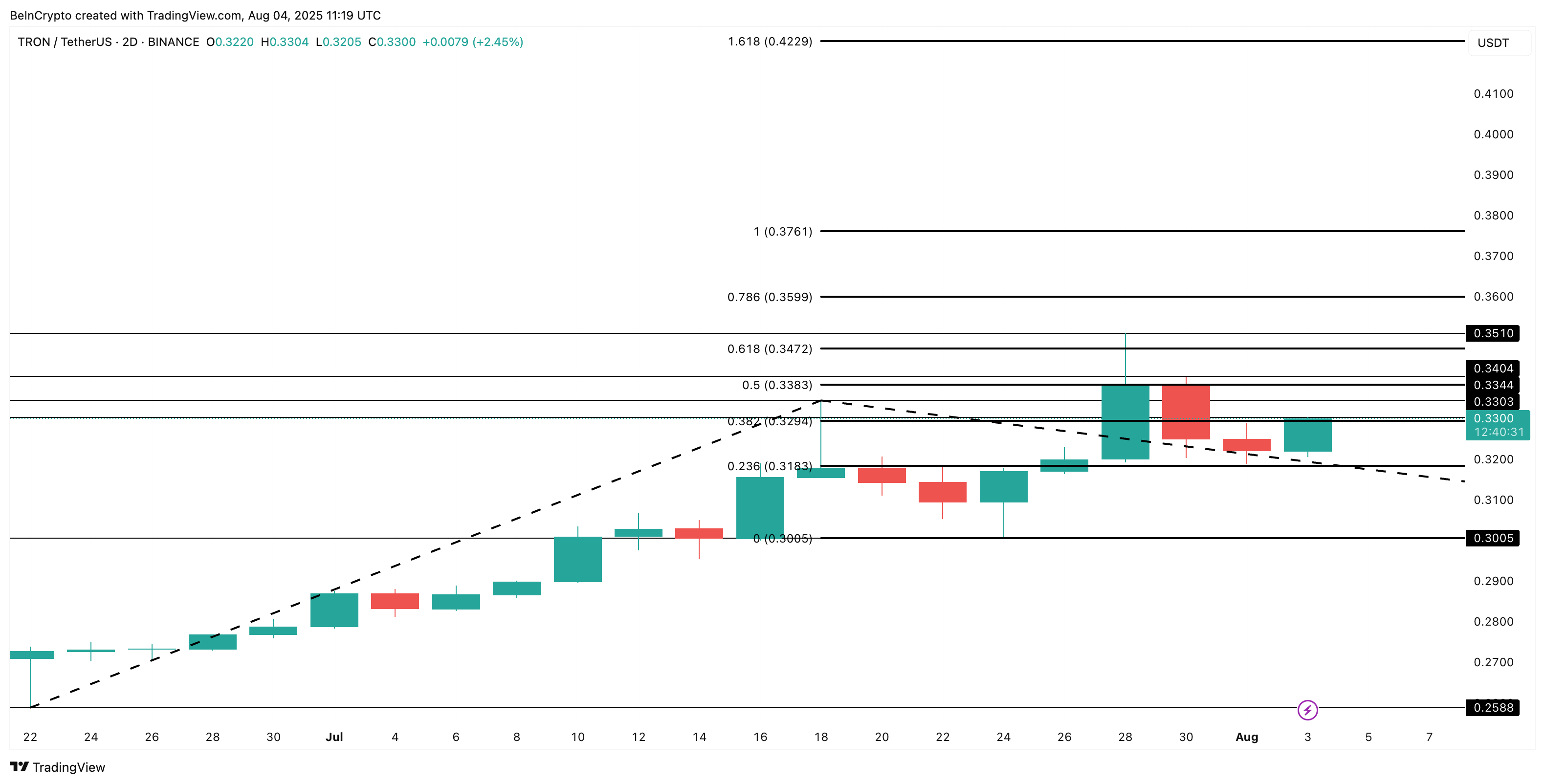

Tron has remained one of the few altcoins showing resilience through the recent market volatility. It has clocked a steady 2.4% gain in the past week when most large caps bled out. On a broader trend, it has climbed over 17% in the last month. It now sits just 23.82% below its all-time high of $0.43, last hit 8 months ago.

What strengthens TRX’s bullish thesis is a striking fractal from later 2024. It closely mirrors the one that formed before its previous major rally, a set of higher highs in price. The price doubled from the top of the 2024 fractal, peaking above $0.40. Today, a similar fractal is forming again.

Even in the latest leg, the rally from $0.25 to $0.33 was followed by a healthy retracement to $0.30. Using a trend-based Fibonacci extension on the 2-day chart, this correction appears textbook, and the ongoing structure puts $0.34 as a key resistance level.

A clean breakout above this threshold could set the stage for a rally toward $0.42 (1.618 extension), potentially testing or even breaking the previous all-time high.

Should the fractal fully play out, a 100% MOVE wouldn’t be off the table, placing TRX near the $0.70 mark. What reinforces this possibility is a hidden bullish divergence on the daily chart, with price making higher lows while the RSI trends lower; a continuation signal that supports the uptrend’s persistence.

Finally, the sentiment around TRON benefited from a highly visible moment earlier this month, when Justin Sun completed his commercial spaceflight aboard Blue Origin’s NS-34 mission.