🚀 HYPE’d Up? Paradigm’s $765M Hyperliquid Token Stash Sparks Market Frenzy

Paradigm just flexed its crypto muscles—analysts spot a jaw-dropping $765 million Hyperliquid token position. Is this the next market mover or just another whale playing with monopoly money?

### The Whale Watch Begins

On-chain sleuths caught Paradigm red-handed with a nine-figure bag of Hyperliquid tokens. The crypto VC giant’s vault now holds enough firepower to sway entire liquidity pools—assuming they don’t rug-pull the market first.

### Hyperliquid’s Make-or-Break Moment

With Paradigm’s war chest now public, traders are scrambling to front-run the inevitable pump. But remember kids: in crypto, ‘strategic investment’ often translates to ‘exit liquidity prep’.

### The Cynic’s Corner

Another day, another nine-digit ‘investment’ that’ll either moon or evaporate faster than a DeFi founder’s accountability. Place your bets—the house always wins.

Paradigm’s Involvement with Hyperliquid

According to MLM, Paradigm holds approximately $765 million in HYPE (Hyperliquid‘s native token). While the fund has not officially confirmed this figure, Paradigm controls roughly 6% of HYPE’s circulating supply if accurate. Such a significant holding by a major investment fund is typically interpreted in two ways: either a strong belief in the project’s potential or a latent risk of a sell-off if market conditions shift unfavorably.

“We can’t know the exact average entry, but using timestamps from when HYPE was received from Wintermute or Gate, the estimated average entry is $16.46, meaning a total cost basis of ~$315M. Unrealized gain: ~$450M at $40/HYPE” MLM commented on X

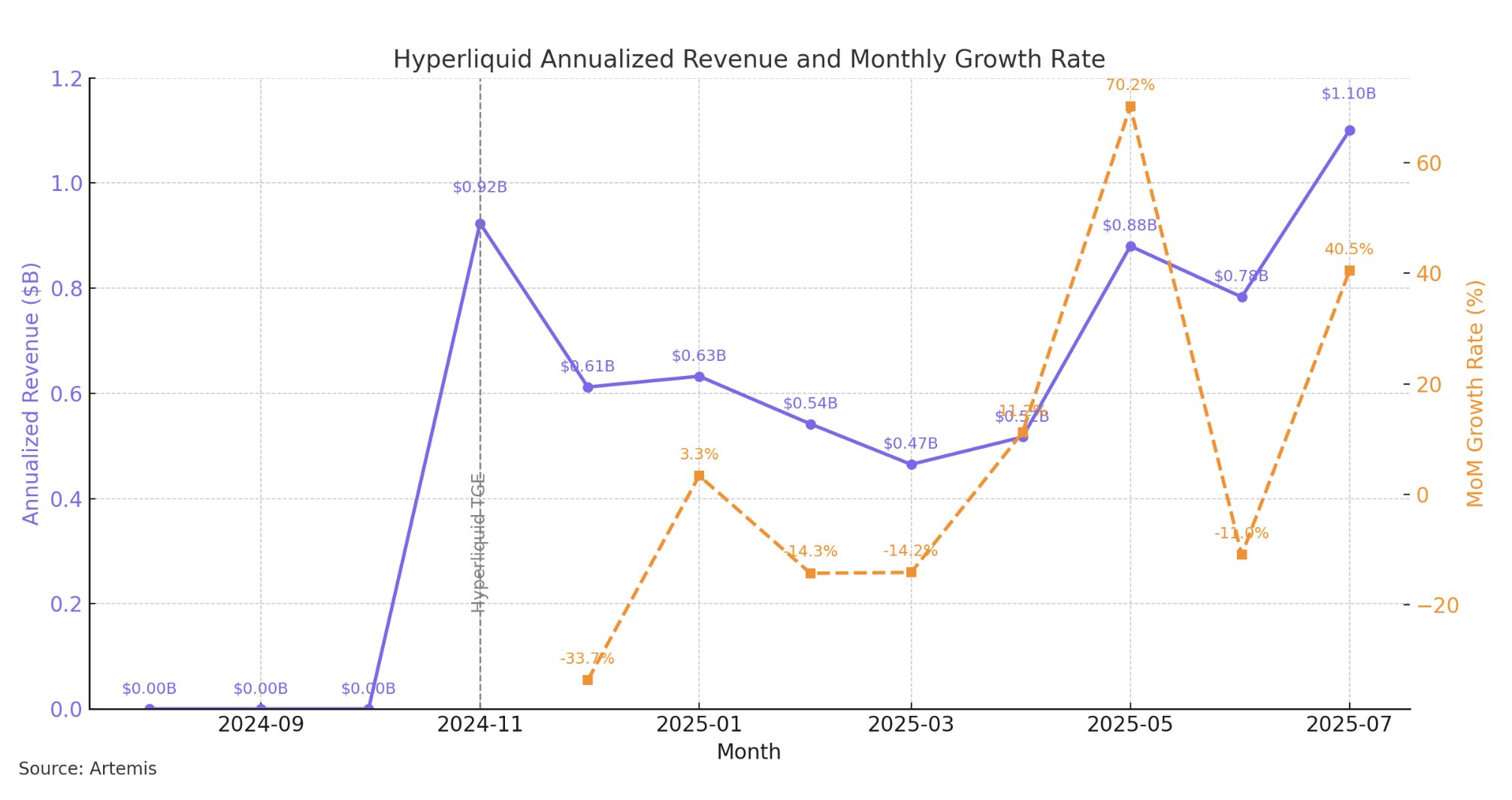

Jon Ma shared on X that Hyperliquid’s 40% month-on-month growth has propelled its annualized revenue to $1.1 billion. This highlights the remarkable performance of the young DeFi platform.

This success is attributed to its optimized DEX model, which leverages off-chain order book technology with near-instantaneous order matching. Hyperliquid’s $231 billion monthly volume surpassed Robinhood’s, signaling a major shift in how DEXs compete with CEX giants. However, short-term growth does not guarantee long-term sustainability, which still requires validation across multiple market cycles.

Paradigm may be betting on Hyperliquid as a next-generation DEX capable of competing directly with traditional CEXs. However, the concentration of token ownership and unclear technical signals make HYPE’s current trajectory unpredictable.

Additionally, the rapid growth caused Hyperliquid to experience a brief outage on its user interface, leaving users unable to place, close, or withdraw orders. The good news is that the platform later announced refunds for affected users.

At the time of writing, HYPE is trading at $38.40, 23% below its ATH in July.

BeInCrypto has reached out to Paradigm for their statement, but we are yet to hear back.