Lido’s Dominance Cracks: Ethereum Staking Giant Hits 3-Year Market Share Low—What’s Next?

Lido’s grip on Ethereum staking is slipping—fast. The once-unshakable titan now holds its smallest market share in three years. Is this a blip or the start of a staking shake-up?

Subheader: The Unraveling of a Staking Juggernaut

Lido built an empire on lazy capital—locking up ETH for yields while investors kicked back. But rivals are circling, and the staking giant’s armor shows cracks. Even decentralized finance’s golden child isn’t immune to competition.

Subheader: The Numbers Don’t Lie

Three years. That’s how long it’s been since Lido’s market share looked this thin. The drop begs the question: are stakers finally waking up to centralized risks—or just chasing higher APYs elsewhere?

Subheader: A Cynic’s Take

Wall Street would call this ‘healthy competition.’ Crypto natives know better—it’s a bloodsport where yesterday’s darling becomes tomorrow’s cautionary tale. Lido isn’t dead, but the invincibility aura? Gone.

Lido’s ETH Staking Market Share Hits a Three-Year Low

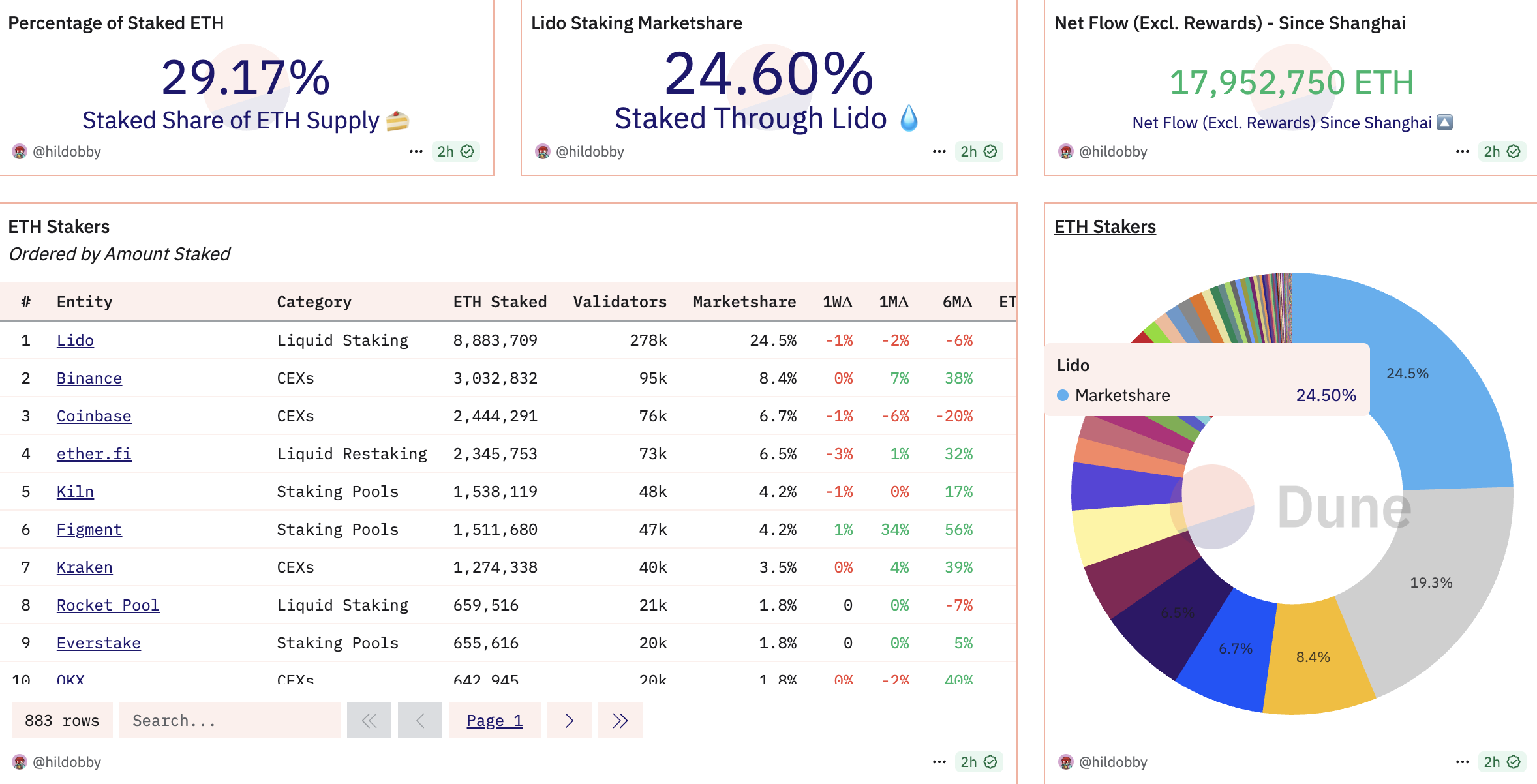

Lido, Ethereum’s largest decentralized staking platform, has recently shown several concerning signals. According to data from Dune, Lido’s share of ETH staking has dropped to just 24.6%, the lowest point in the past three years. This represents a significant shift, particularly for a protocol that once was dominant in Ethereum’s liquid staking landscape.

This decline could stem from multiple factors, including growing competition from rivals like Rocket Pool or staking solutions integrated directly by major exchanges like Coinbase. The Ethereum community actively prioritizes decentralization. This raises questions about whether a protocol controlling numerous validators aligns with Ethereum’s long-term vision.

Beyond its shrinking market share, Lido recently disclosed a vulnerability in the RageQuit mechanism of its “Dual Governance” (DG) system. While the project team confirmed that no user funds were affected and mitigation steps have already been taken, this serves as a reminder that even major protocols are not immune to technical issues that may arise during operations.

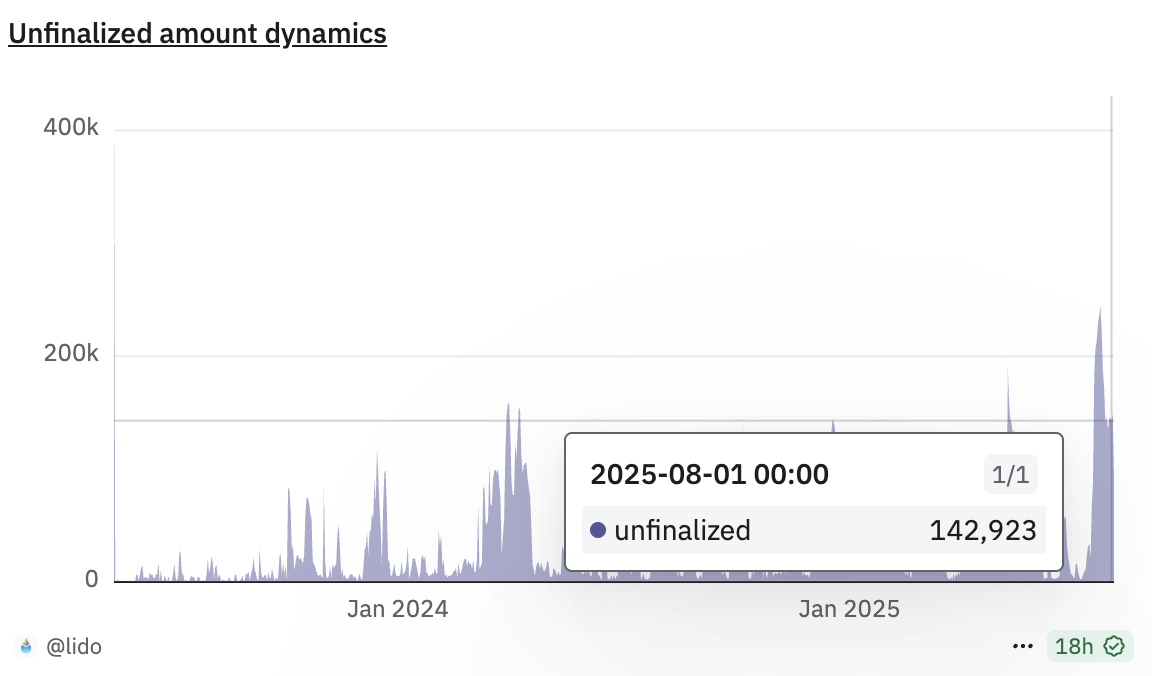

In addition, the ETH withdrawal queue on Lido has reached its highest level since withdrawals were first enabled. Data from Dune shows that ETH pending withdrawal is nearly 143,000. Although this number has decreased from its all-time high at the end of July, it still reflects a shift in confidence among some users, especially as more flexible or secure staking alternatives emerge.

In this context, Lido has officially confirmed that it will reduce its contributor team by approximately 15%. According to a public statement by co-founder Vasiliy Shapovalov on platform X (formerly Twitter), this decision was made to ensure the organization can operate more efficiently and adapt to the changing market trends.

“This decision was about costs — not performance. It affects incredibly talented people who helped shape the protocol and community.” Vasiliy Shapovalov shared on X.

Downsizing the team does not necessarily signal a crisis. However, it indicates that leadership is reassessing its human capital strategy, particularly as key performance metrics struggle to sustain prior growth trends. The protocol is entering a pivotal proving ground amid fast-moving technological and cultural shifts.