XRP Alert: 2 Critical Factors That Might Trigger a Steep Price Plunge

Brace for impact—XRP's chart is flashing warning signs that could send bulls scrambling.

### Liquidity crunch meets regulatory overhang

Market makers are pulling bids just as SEC lawyers sharpen their knives. The perfect storm for a cascade.

### The 'whale wallet' domino effect

Three dormant wallets holding 9-digit positions just activated. Guess what comes next when OGs start dumping?

Of course, this all assumes crypto markets still follow logic—a bold bet after 2024's 'stablecoin spring' debacle.

XRP Traders Are Tapping Out: $222 Million Exit Signals Fear

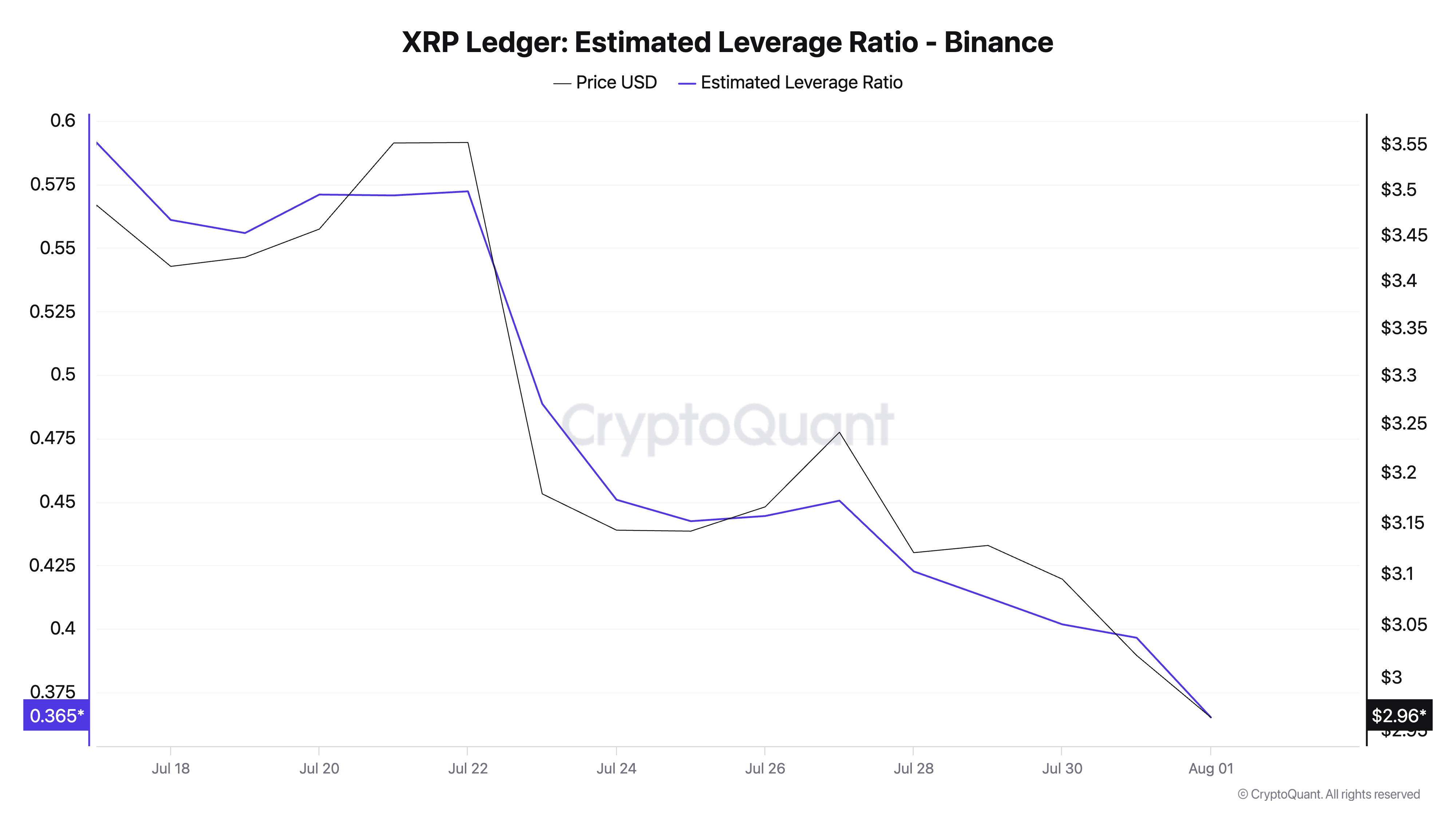

XRP’s falling Estimated Leverage Ratio (ELR) on leading exchange Binance confirms falling investor confidence and a declining appetite for risk. According to CryptoQuant, the ELR currently sits at 0.36 — its lowest weekly close in the past month.

An asset’s ELR measures the average amount of leverage its traders use to execute trades on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

XRP’s declining ELR indicates a reduced risk appetite among traders. It suggests that investors are growing cautious about the token’s short-term prospects and are avoiding high-leverage positions that could amplify potential losses.

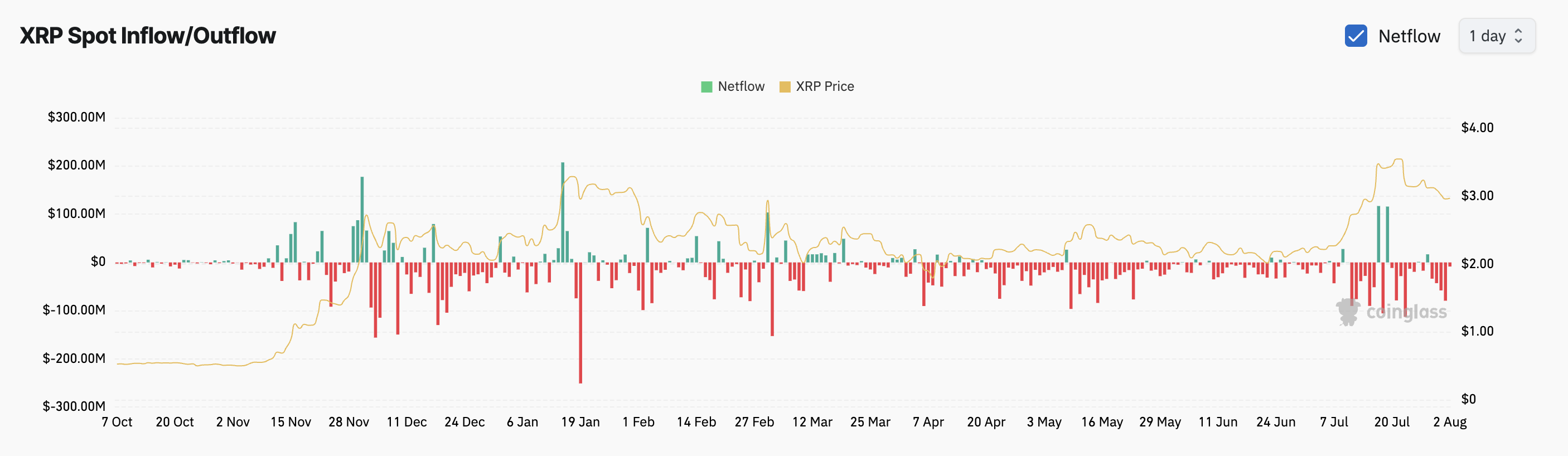

The trend is no different among spot market participants. According to Coinglass data, XRP has recorded negative netflows exceeding $222 million since July 29, signaling persistent sell-side dominance and weak buy-side pressure.

When an asset records negative spot netflows, traders are selling their holdings and taking profits, while fewer buyers are stepping in to replace them.

This trend could worsen XRP’s current downtrend, as the demand for the asset decreases while its supply builds up.

XRP Bears Close In on $2.71—But a $3.39 Breakout Is Still in Sight

As sell-side pressure gains, XRP risks plunging to $2.71. If this support floor fails to hold, the altcoin could witness a steeper fall to $2.50.

On the other hand, a breakout above the $3 price level remains possible if buying momentum strengthens. A successful MOVE past this threshold could pave the way for a rally toward $3.39.