Bitcoin’s Profit Crunch: Supply in Profit Hits 2-Month Low—Will BTC Plunge to $110K?

Bitcoin’s looking shaky. The percentage of supply in profit just nosedived to levels not seen since June—now traders are sweating over whether $110,000 becomes the next stop.

### The Profitability Plunge

When BTC’s supply in profit shrinks, it usually means one thing: weak hands are cashing out. This time? The metric’s scraping lows unseen for 60 days. Not catastrophic—but enough to make leverage traders nervous.

### The $110,000 Question

If history’s any guide, these dips often precede bigger corrections. But let’s be real—since when does Bitcoin follow a script? The ‘number go up’ brigade will call this FUD. The bears are already drafting their ‘told you so’ tweets.

### Wall Street’s Cynical Take

Meanwhile, traditional finance bros are smugly sipping lattes—‘See? Even crypto’s ‘store of value’ can’t escape profit-taking.’ Never mind that BTC’s still up 300% since their last ‘bubble’ prediction.

Buckle up. Volatility’s back on the menu.

Bitcoin’s Profitability Falls to 41-Day Low

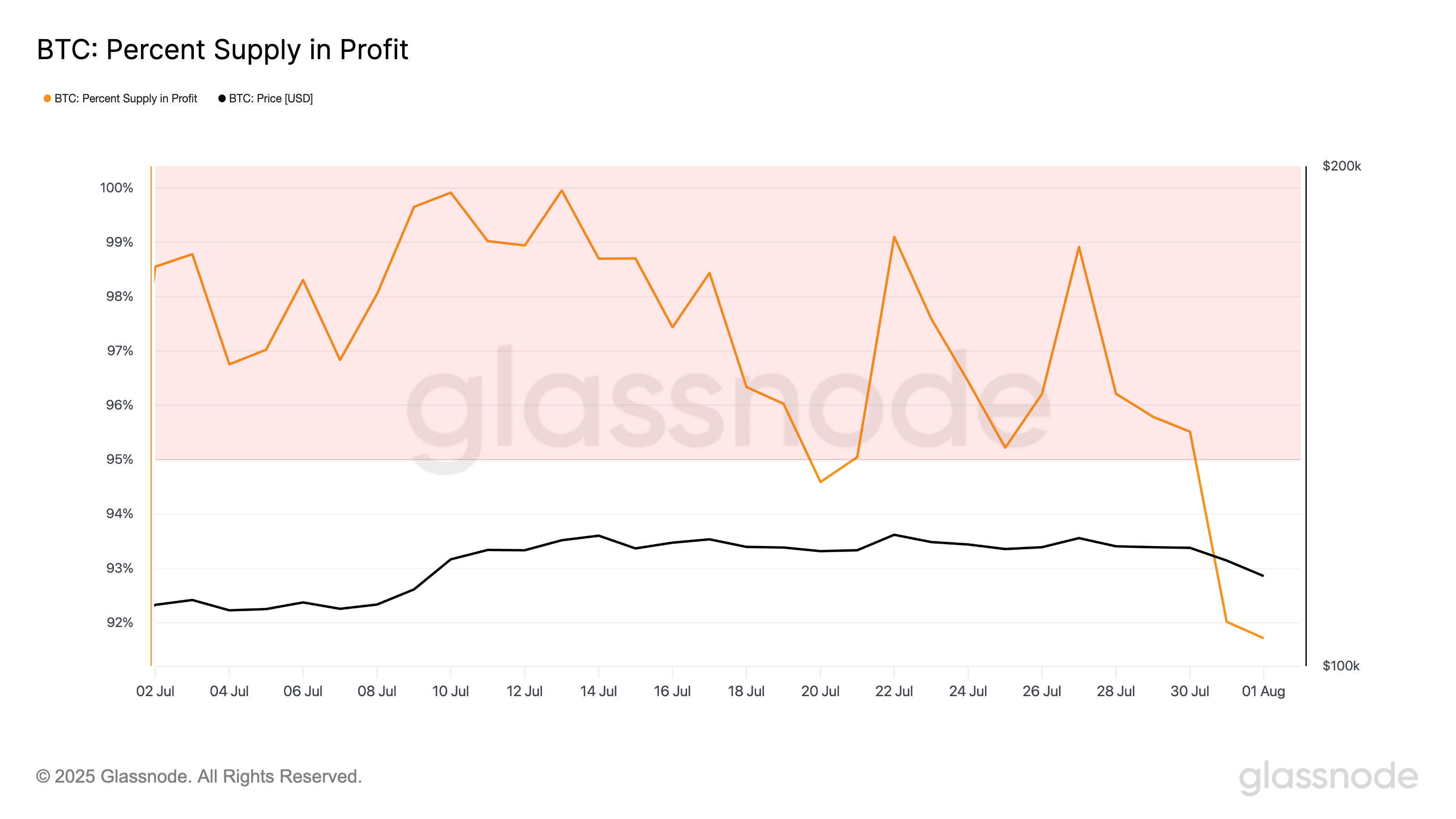

According to Glassnode, BTC’s Percent Supply in Profit fell to a 41-day low of 91.71% on August 1. This metric measures the percentage of BTC’s circulating supply currently held at a profit. It measures market sentiment, often peaking during euphoric rallies and falling as investor confidence wanes.

When this metric falls, a growing portion of holders is either breaking even or recording losses. These market conditions historically coincide with periods of market consolidation or potential price corrections.

The recent decline to 91.71% suggests that the broader market is cooling off after weeks of upward price action. It reflects a shift in sentiment, as fewer holders remain comfortably in profit.

This could dampen short-term buying pressure and leave BTC at risk of a further dip over the next few trading sessions.

Bitcoin Faces Key Test as Futures Traders Flip Bearish

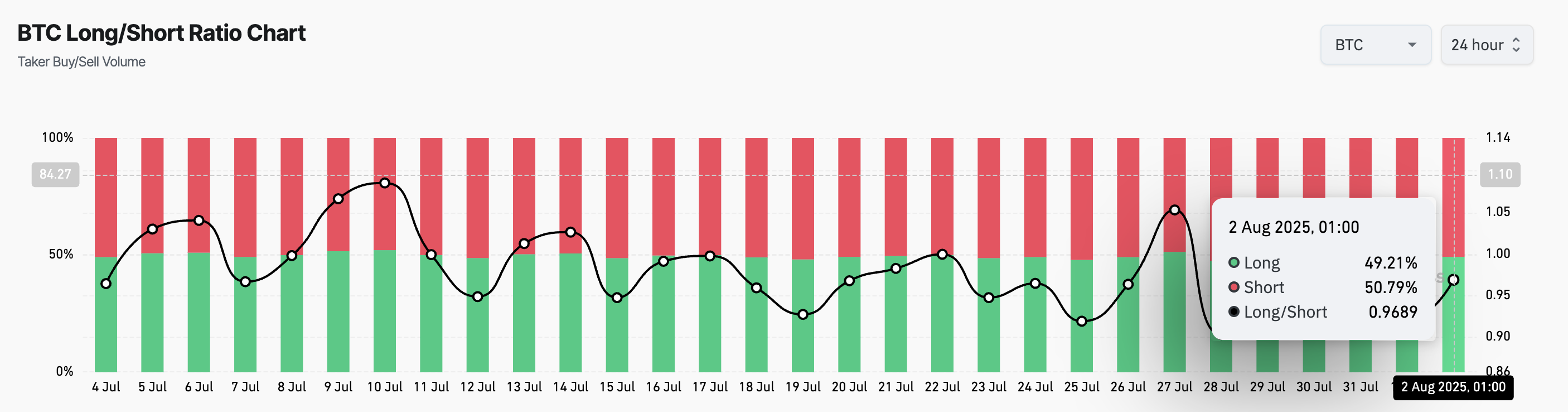

BTC’s long/short ratio has tilted toward bearish territory, confirming that the bullish conviction among Leveraged traders might also be fading. At press time, this stands below one at 0.96.

The long/short metric measures the proportion of long bets to short ones in an asset’s futures market. A ratio above one signals more long positions than short ones. This indicates a bullish sentiment, as most traders expect the asset’s value to rise.

On the other hand, a long/short ratio below 1 means that more traders are betting on the asset’s price to decline than those expecting it to rise.

With fewer traders willing to bet aggressively on continued upside, BTC may find it difficult to regain momentum unless fresh catalysts emerge.

Bitcoin’s Next Move: Breakdown to $111,855 or Breakout Above $120,000?

Bitcoin’s daily trading volume has dropped from its July peaks, signaling reduced market participation. If profit-taking strengthens, the king coin could potentially decline toward $111,855.

However, if new demand enters the market, the coin’s price could regain strength and climb toward $116,952. A breach of this resistance is key before the coin can rally back above $120,000.