Ethereum’s $4,000 Dream Hits a Wall: Whales & Institutions Bail as Rally Stalls

Ethereum’s march toward $4,000 just got messy. Big money players—whales and institutions—are tapping the brakes, leaving retail traders to wonder if this is a pause or a full-blown retreat.

Whales ditch, retail twitches

The smart money’s pulling back, and the charts show it. That $4,000 target? Suddenly feels like a mirage. No fancy footwork here—just cold, hard profit-taking from the players who move markets.

Institutions play it safe (shocking)

Hedge funds and crypto ETFs are suddenly acting like they’ve discovered risk management. Who knew a 20% monthly gain could spook the so-called ‘visionaries’? Meanwhile, the rest of us get to enjoy yet another volatility rollercoaster—because what’s crypto without a little existential dread?

Here’s the kicker: this pullback might just be Wall Street’s way of shaking out weak hands before the next leg up. Or it’s the start of a classic ‘buy the rumor, sell the news’ dump. Either way, grab some popcorn—the show’s just getting started.

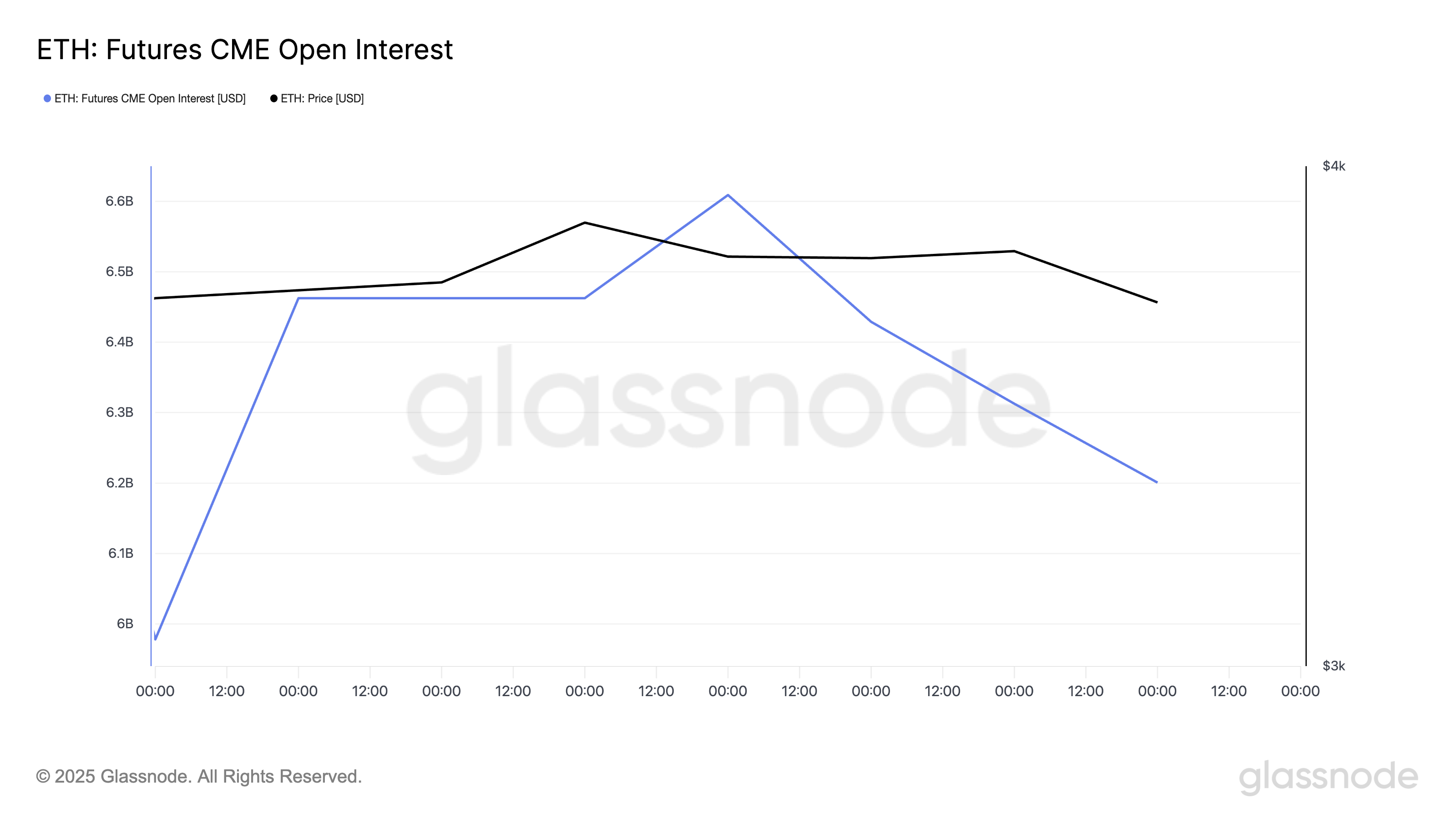

ETH Futures Sink to $6.2 Billion: Institutional Confidence Losing Steam?

On-chain and derivatives data show a recent trend of decline in activity among the market’s biggest players. For example, open interest in ETH futures contracts on the Chicago Mercantile Exchange (CME) has fallen sharply, closing yesterday at a five-day low of $6.2 billion.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This drop is notable, as CME’s ETH futures market is primarily used by institutional players seeking regulated exposure to the asset. Therefore, lower open interest signals these investors may be scaling back their ETH positions.

Without continued institutional engagement, the upward pressure on ETH’s price may weaken, increasing the likelihood of short-term corrections.

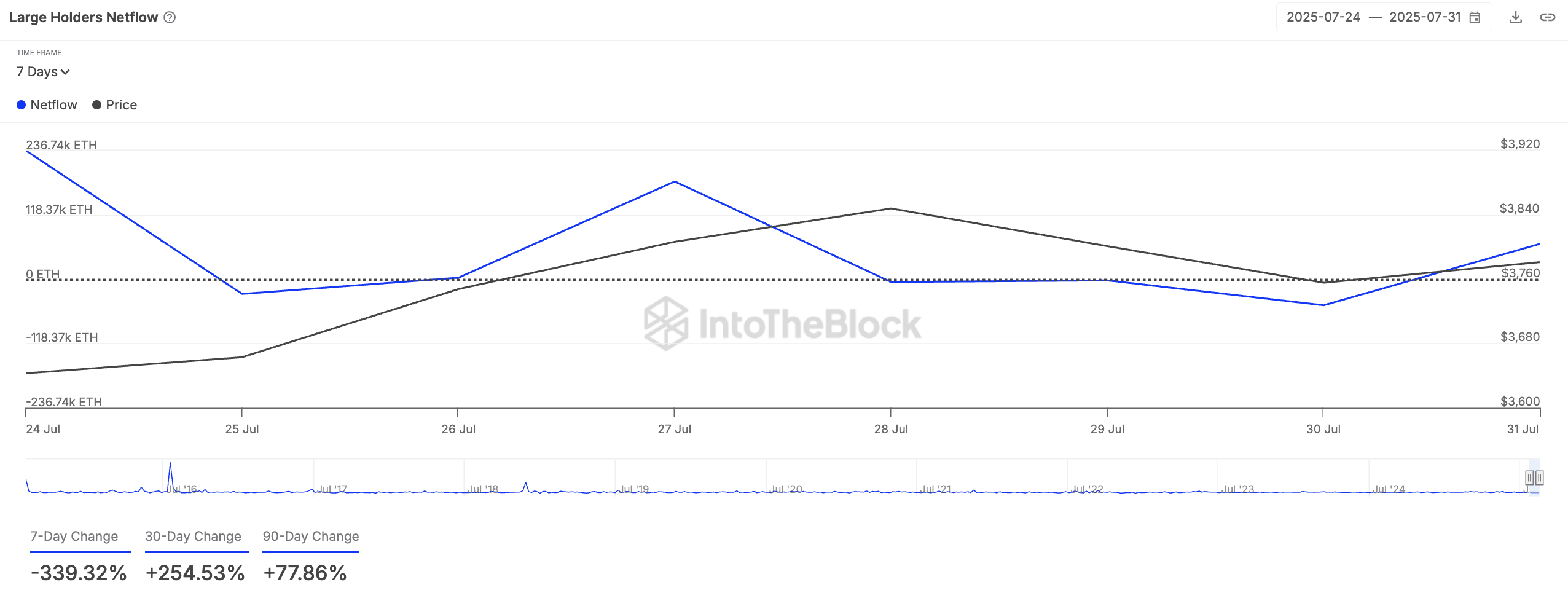

In addition, whale activity is also tapering off. A review of the coin’s on-chain activity reveals a 339% dip in its large holders’ netflow over the past seven days.

Large holders are whale addresses that hold more than 1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow increases, more tokens or coins FLOW into major investors’ wallets than are flowing out. This trend indicates that these holders are accumulating the asset, signaling confidence in its future value.

Conversely, when it plunges, it marks a cooling in high-conviction accumulation, weakening short-term price support.

Ethereum Tanks 10% as Selling Pressure Surges—Is $3,314 Next?

At press time, ETH trades at $3,620, down nearly 10% over the past day. During that period, its trading volume rocketed by 17%, creating a negative divergence. This divergence emerges when rising trading activity coincides with falling prices, signaling intensified selling pressure.

If this continues, ETH’s price could fall to $3,524. A breach below this key support floor could lead to a deeper decline to $3,314.

However, if demand resumes, ETH could regain and climb to $3,859.