Kraken & Robinhood Defy Crypto Slump: Stellar YoY Growth Amid Q2 Slowdown

Crypto giants Kraken and Robinhood just flexed their resilience—posting double-digit YoY gains while the rest of the market napped through Q2. Who needs a bull run when you’ve got diamond-handed users and fee machines?

Subheader: Exchange Titans Buck the Trend

While retail traders panic-sold into the summer lull, these platforms kept printing revenue. Kraken’s OTC desk reportedly cleaned up on institutional deals, while Robinhood’s ‘zero-fee’ model (spoiler: they got you elsewhere) kept the plebs stacking sats.

Subheader: The Quiet Quarter That Could

Q2’s trading volume dip? Barely a speed bump. Both firms leveraged sticky user bases and—let’s be real—the eternal hope of degens chasing the next meme coin pump. Bonus cynical jab: Wall Street analysts still can’t decide if crypto is ‘digital gold’ or a casino, but the house always wins.

Kraken’s Q2 Performance: Earnings Dip Amid Market Turbulence

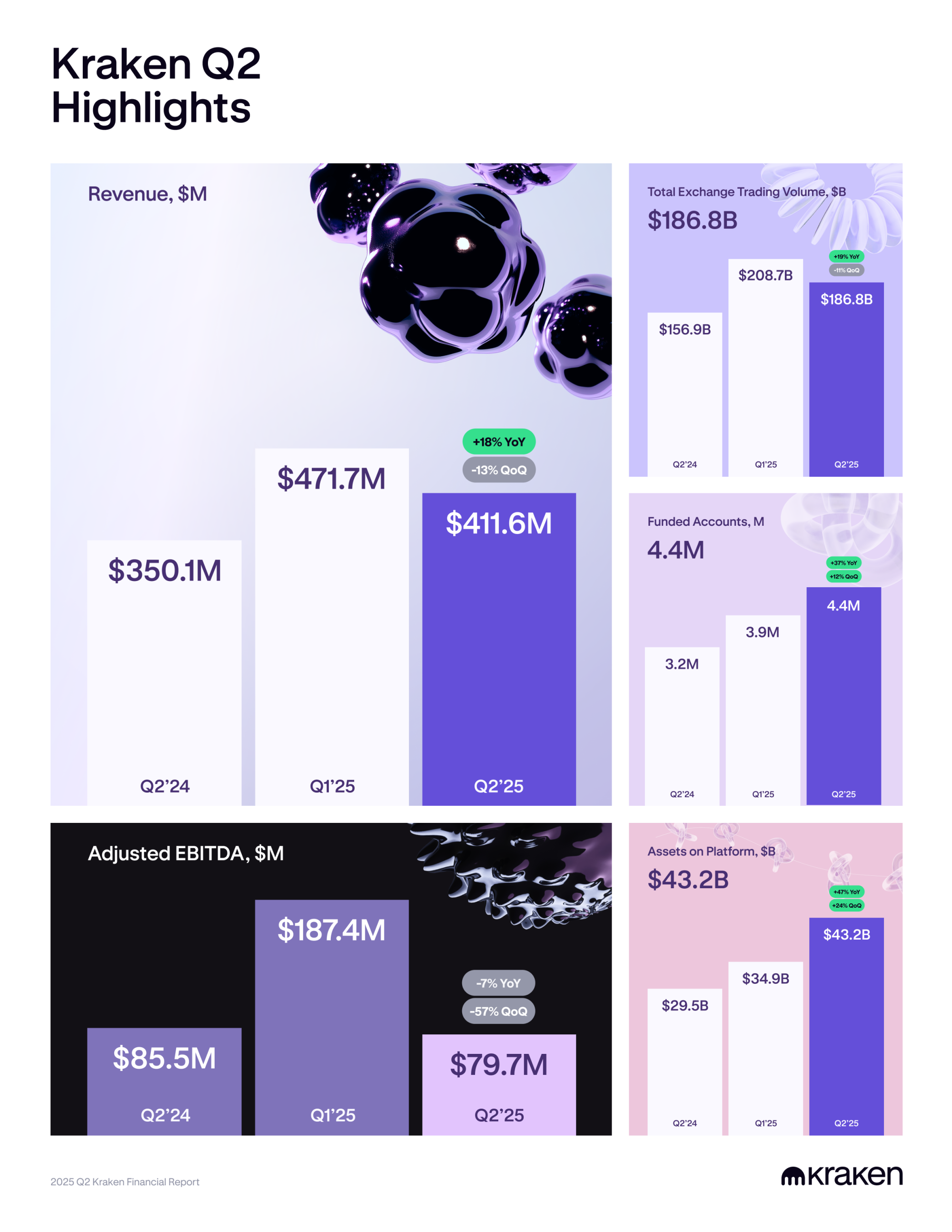

Kraken, a leading cryptocurrency exchange, released its Q2 2025 financial report on July 30. The exchange reported a revenue of $411.6 million in the second quarter.

This reflected an 18% YoY uptick but a 13% decline from Q1 2025. Similarly, its total exchange volume saw a 19% increase over the past year. It reached $186.8 billion, an 11% drop from Q1.

Furthermore, the exchange’s Adjusted EBITDA fell 7% YoY to $79.7 million and 57% compared to the previous quarter.

“After a strong Q1, there was market turbulence related to U.S. tariffs and broader macro uncertainties. Q2 volumes decelerated quarter-over-quarter, as Q2 tends to be a seasonally lower quarter for trading activity across the industry,” the report read.

Despite the challenges, Kraken demonstrated strong performance in several key areas. By the end of Q2, the platform’s assets grew to $43.2 billion, reflecting a 47% growth YoY and a 24% rise from the previous quarter.

Additionally, the number of funded accounts ROSE by 37% compared to the previous year, reaching 4.4 million. The exchange also strengthened its position in the stablecoin market, with its share of stable-fiat spot volumes increasing from 43% to 68%.

“As the TradFi and crypto markets converge, we are strategically investing in innovation and expanding our product suite to accelerate growth. In Q2, we supported faster product delivery and platform enhancements, alongside targeted marketing efforts that demonstrated strong, efficient ROI,” Kraken added.

The report comes amid heightened reports of Kraken’s plans to go public. BeInCrypto highlighted that the company reportedly aims to raise $500 million at a $15 billion valuation, with a potential public offering in early 2026.

Robinhood’s Q2: Crypto Revenue Jumps 98%

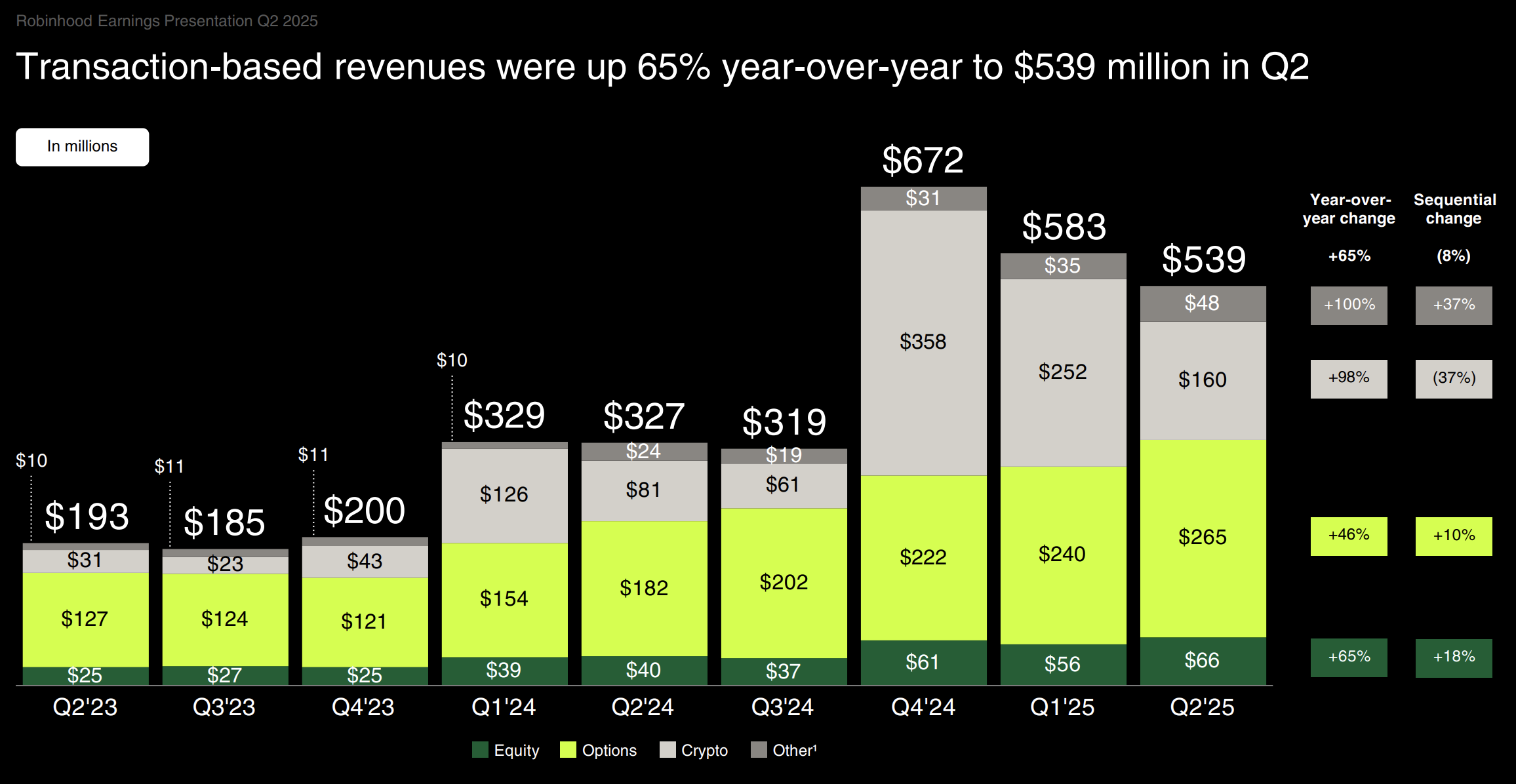

Meanwhile, Robinhood also delivered a notable performance, surpassing Wall Street’s earnings expectations. The trading platform reported a 98% yearly appreciation in cryptocurrency revenue.

It reached $160 million, up from $81 million in Q2 2024. However, as seen with Kraken, the revenue dipped 37% compared to Q1 2025.

Robinhood’s crypto trading volume grew 32% to $28.3 billion, but it again declined 39% quarter over quarter (QOQ). Besides this, the platform recorded a total net revenue of $989 million, a 45% yearly and 7% quarterly rise. Net income more than doubled, increasing 105% YOY to $386 million.

“We delivered strong business results in Q2 driven by relentless product velocity, and we launched tokenization—which I believe is the biggest innovation our industry has seen in the past decade,” Chairman and CEO of Robinhood, Vlad Tenev, said.

Moreover, Jason Warnick, Chief Financial Officer of Robinhood, highlighted that Q3 has already begun on a strong note. He added that customers accelerated their net deposits to around $6 billion and showed strong trading activity across various categories.

Thus, both Kraken and Robinhood demonstrated resilience with significant YoY growth despite quarterly setbacks. Kraken’s focus on product innovation and market expansion, alongside Robinhood’s advancements in tokenization, signal strategic efforts to navigate the market and drive future growth.