Hyperliquid Vows to Compensate Traders After API Meltdown—Will It Restore Trust?

Hyperliquid's infrastructure hiccup just turned into a costly mea culpa. The perpetual swaps platform—known for its low-latency promises—is cutting refund checks after its API crapped out mid-trade. No more radio silence: affected users get made whole. Finally, a crypto firm putting skin in the game instead of hiding behind 'act of God' clauses.

When APIs attack: The silent killers of crypto profits

That 'uninterrupted trading experience' sales pitch? Shattered like a memecoin's liquidity during a 10x leverage unwind. Hyperliquid's outage proves even the slickest platforms still rely on infrastructure held together by GitHub spaghetti and VC prayers.

Refund or revolt: The new calculus for decentralized finance

One cynical truth emerges—exchanges only compensate users when the PR disaster outweighs the cost of reimbursement. At least Hyperliquid's playing ball... unlike certain *cough* centralized *cough* rivals who'd rather send 'thoughts and prayers' than open their treasuries.

Hyperliquid to Refund Users

Hyperliquid, a prominent DEX, suffered a brief outage yesterday with an unexplained cause. Users speculated that an API bug might be involved, as the glitch only impacted user-end operations.

Although this outage was brief, some users reported unfavorable position closings and other issues. Today, Hyperliquid has promised to refund all these users:

An update on the API congestion yesterday:

+ Improvements will be made to prevent this from occurring again.

+ A refund methodology will be created to refund affected users. This will be an automated process; no tickets need to be opened.

Hyperliquid pic.twitter.com/6O31uuzgxB

Apparently, the theory that growing pains at the popular exchange proved correct. There wasn’t any hack or deliberate attempt to breach the API. It just struggled under surging user activity and protocol revenue.

Nonetheless, Hyperliquid took an active approach to retaining loyal customers, promising an automated refund in the coming days.

Naturally, Hyperliquid’s promised refund attracted a lot of goodwill from the community. Whereas some exchanges are sluggish in reimbursing users and addressing their concerns, Hyperliquid has prioritized good communication.

The platform needs to establish clear criteria for an impacted user, and then it’ll disperse funds accordingly.

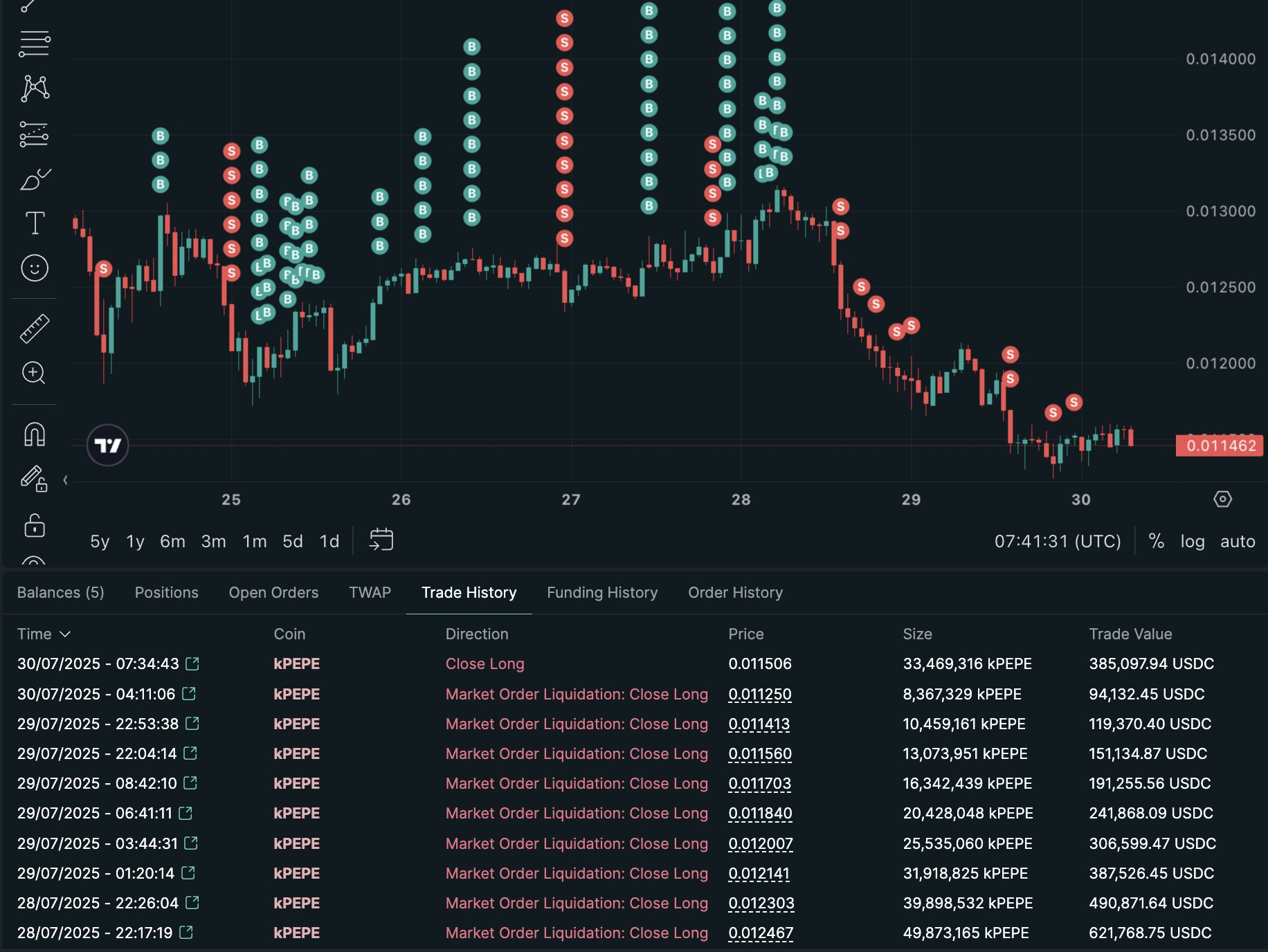

Meanwhile, James Wynn, a prominent Hyperliquid whale, saw a $2.99 million position liquidated last night. This happened only a few days after he bagged his first major profits in two months, making this extra painful. Currently, his active holdings are under $4,000.

It doesn’t seem that this loss lined up with the outage window, but it’s best to be certain. User-end issues can cause many lingering difficulties, and any number of potentially ambiguous cases like this could create unhappy clients.

Overall, Hyperliquid has positively addressed this issue and satisfied user complaints. While network outages are not rare in crypto, they can have a major impact on user trust, especially in decentralized platforms like Hyperliquid.

Hopefully, developers have adequately repaired the faulty infrastructure to prevent future issues.