Fed Holds Rates Steady as Economic Storm Clouds Gather – What It Means for Your Crypto Portfolio

Markets hold their breath as Powell plays wait-and-see

The Federal Reserve just hit pause on rate hikes—again. With inflation still sticky and recession fears looming, Jerome Powell's crew is sticking to their "higher for longer" script. But crypto traders aren't waiting around for permission to move.

Why this matters for digital assets

When traditional finance freezes up, decentralized markets keep churning. Bitcoin's proving its worth as the ultimate macro hedge—again. Meanwhile, altcoins are primed to explode at the first whiff of dovishness from the Fed.

The cynical take

Wall Street's still trying to decode Powell's "carefully calibrated" messaging—code for "we're making this up as we go." Meanwhile, Bitcoin's blockchain doesn't need emergency FOMC meetings to process transactions.

Bottom line: The Fed's stuck in neutral while crypto's building the next financial system. Your move, traditional finance.

No Rate Cut in Sight from the Feds?

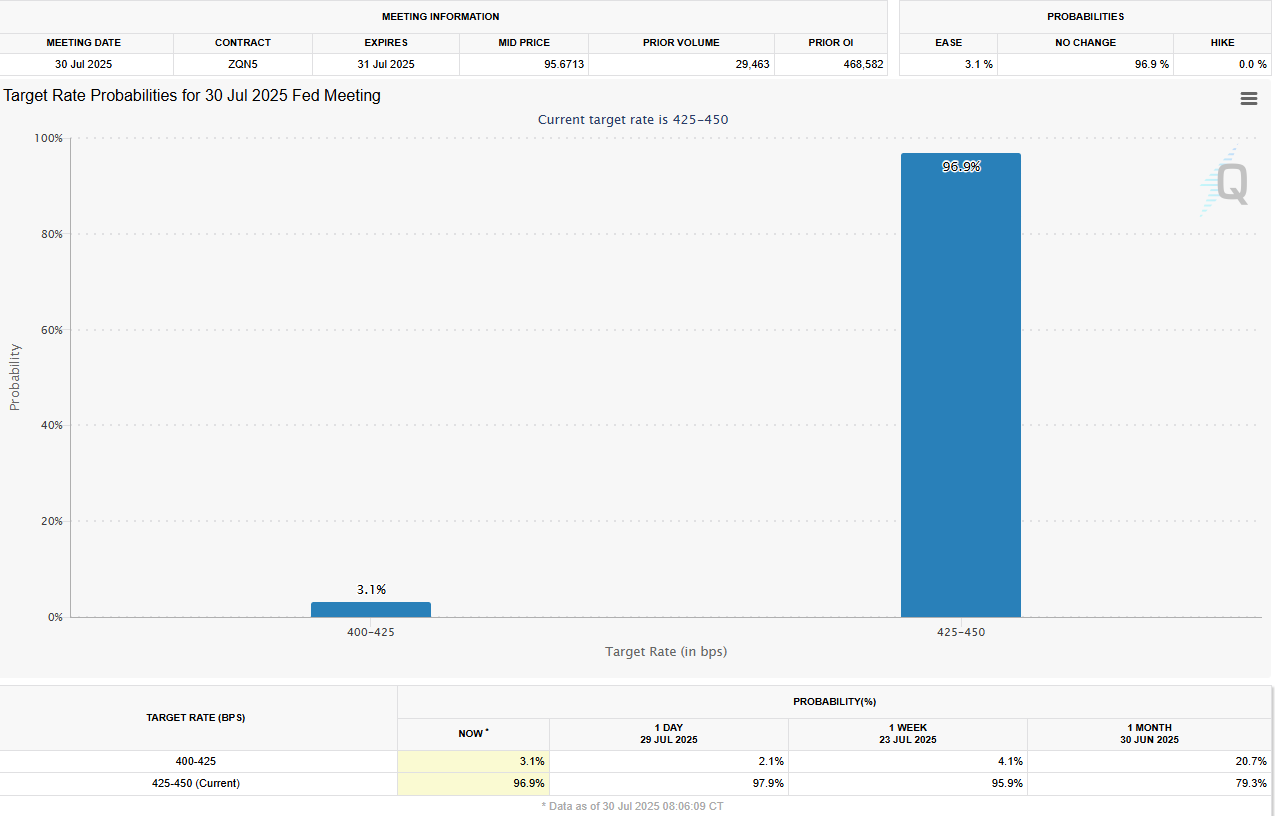

The CME FedWatch Tool shows that investors virtually see no chance of a rate cut in July, while pricing in about a 64% probability of a 25 bps reduction in September. This market positioning suggests that the US Dollar faces a two-way risk heading into the event.

The revised Summary of Economic Projections (SEP), published in June, showed that policymakers’ projections implied 50 bps of rate cuts in 2025, followed by a 25 bps reduction in both 2026 and 2027.

Seven of 19 Fed officials pencilled in no cuts in 2025, two saw one cut, eight projected two, and two forecast three cuts this year.

Following the June meeting, Fed Governor Christopher Waller voiced his support for a July rate cut in his public appearances, arguing that they should not wait until the labor market is in trouble before easing the policy.

Similarly, Fed Governor Michelle Bowman said that she is open to cutting rates as soon as July since inflation pressures remain contained.

Meanwhile, President Donald TRUMP extended his attempts to pressure the US central bank into cutting interest rates in July.

While addressing reporters alongside British Prime Minister Keir Starmer on Monday, Trump reiterated that the US economy could be doing better if the Fed were to cut rates.

“The FOMC is again widely expected to keep its policy stance unchanged next week, with the Committee maintaining rates at 4.25%-4.50%,” noted analysts at TD Securities. “We expect Powell to repeat his patient, data-dependent policy stance while maintaining flexibility around the Committee’s next MOVE in September. We believe two dissents, from Governors Bowman and Waller, are likely at this meeting.”

When will the Fed announce its interest rate decision and how could it affect EUR/USD?

The Fed is scheduled to announce its interest rate decision and publish the monetary policy statement on Wednesday at 18:00 GMT. This will be followed by Fed Chair Jerome Powell’s press conference starting at 18:30 GMT.

In case Powell leaves the door open for a rate cut in September, citing alleviated uncertainty after the US reached trade deals with some major partners, such as the European Union and Japan, the USD could come under renewed selling pressure with the immediate reaction.

Eren Sengezer, European Session Lead Analyst at FXStreet, provides a short-term technical outlook for EUR/USD.

“The near-term technical outlook points to a buildup of bearish momentum. The Relative Strength Index (RSI) indicator on the daily chart stays below 50 and EUR/USD trades below the 50-day Simple Moving Average (SMA) for the first time since late February.”

Conversely, the USD could gather strength against its rivals if Powell repeats the need for a patient approach to policy-easing, highlighting sticky June inflation readings and relatively healthy labor market conditions.

In this scenario, investors could refrain from pricing in a rate cut in September and wait for new inflation and employment data.

“On the downside, 1.1440 (Fibonacci 23.6% retracement level of the February-July uptrend) aligns as the next support level ahead of 1.1340 (100-day SMA) and 1.1200 (Fibonacci 38.2% retracement). Looking north, resistance levels could be spotted at 1.1700 (20-day SMA), 1.1830 (end-point of the uptrend) and 1.1900 (static level, round level),” said Sengezer.