🚀 Altcoin/ETH Pairs Poised for Explosive Capital Influx—Analysts See 2025 as the Tipping Point

Ethereum's dominance as the altcoin gateway is facing its biggest test yet. Traders are rotating out of stablecoin pairs at a pace not seen since the 2021 bull run—and this time, the smart money's betting on ETH as the base currency.

Why the shift? Three words: gas fee arbitrage. With Layer 2 solutions finally delivering sub-penny transactions, altcoin projects are abandoning their USDT pegs faster than a DeFi founder abandons a project post-ICO.

The real action? Watch the mid-cap alts. While blue-chips like SOL and ADA already trade heavily against ETH, the next 180 days could see obscure tokens achieve 300%+ volume spikes against Wrapped Ethereum—assuming the SEC doesn't try to classify ETH pairs as unregistered securities by Thursday.

One hedge fund MD put it bluntly: 'We're not betting on altcoins here—we're betting against Tether's ability to maintain its peg during the next liquidity crisis.' Ouch.

Signs That Capital May Soon Flow into Altcoins

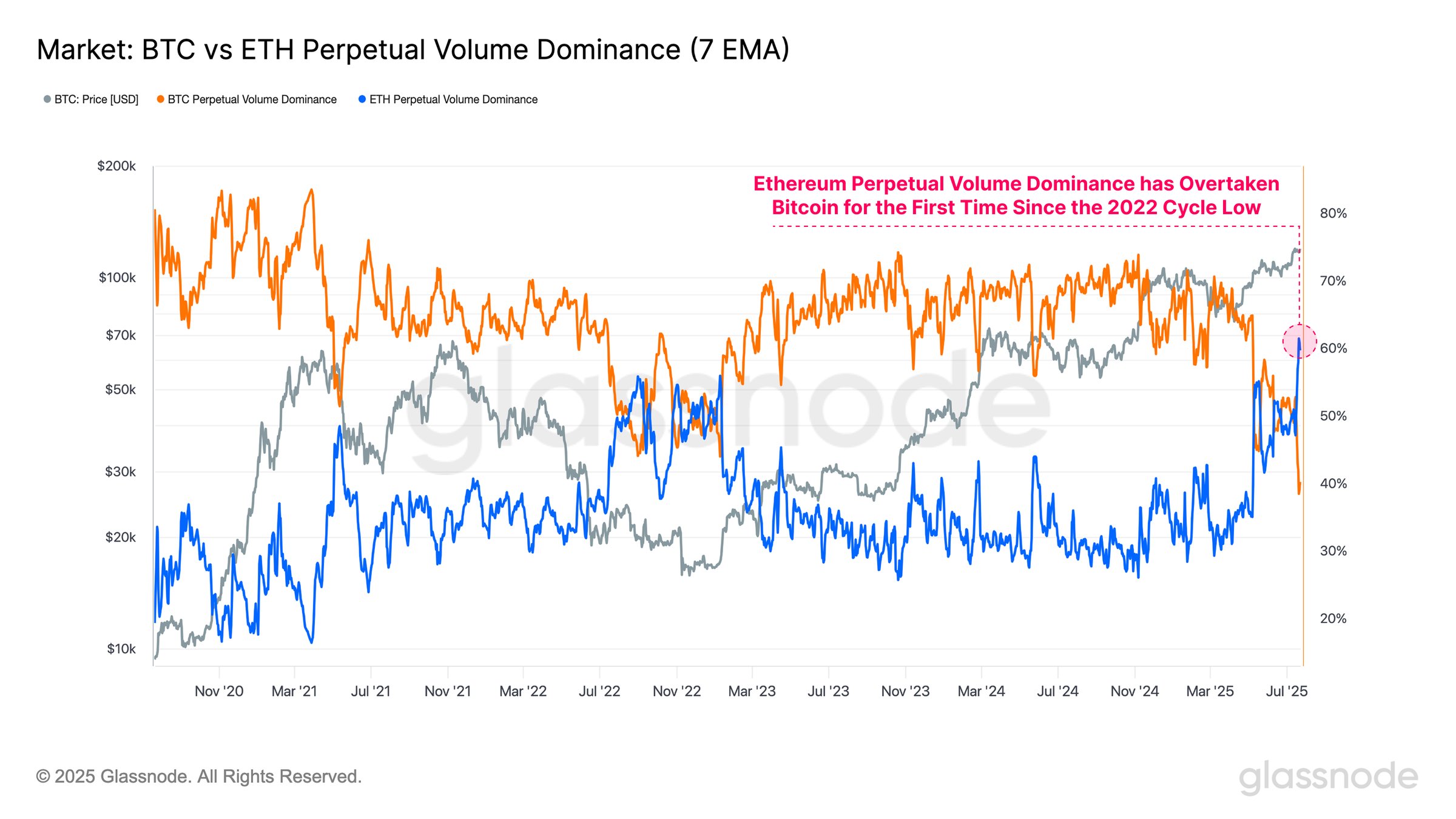

Ethereum’s perpetual volume dominance recently surpassed Bitcoin’s for the first time since the cycle low in 2022. This marks the largest recorded volume skew in favor of ETH.

ETH accounted for more than 60% of perpetual volume by the end of July. This indicates that traders are now trading ETH more actively than BTC.

According to Glassnode, this shift also points to a growing speculative interest in the altcoin sector.

“This shift confirms a meaningful rotation of speculative interest toward the altcoin sector,” Glassnode reported.

Glassnode’s view aligns with the recent opinions of several market analysts. They believe the market is currently in Phase 2 (capital flowing into ETH) and is preparing to enter Phase 3 (capital moving into other altcoins).

When Should Investors Pay Attention to Altcoin/ETH?

When investors buy ETH and wait for profits, they look for opportunities in underperforming Altcoin/ETH pairs instead of simply holding ETH.

The main concern is that these pairs come with double risk. The first is a drop in ETH’s price. The second is a sell-off in the altcoin/ETH pair, which can lead to double losses. However, with proper timing, investors can earn double gains from both sides.

By observing the performance of altcoin market cap (TOTAL3 – excluding BTC and ETH) relative to ETH, well-known market analyst Benjamin Cowen noted that Altcoin/ETH pairs have dropped an average of 40% since the 2025 peak.

He predicted further declines as long as ETH’s rally continues.

Analyst Colin Talks crypto shared a similar view but believes that a reversal will come eventually.

“It’s ETH Season. ETH may outperform lower ALTS for a while yet. If I were to take a guess, I’d say the path will go something like this, down to the lower trend line. When this line drops it means ALTs lose value relatively to ETH. Only in the very final stage of the bull run do ALTs perform better than both ETH and BTC,” Colin Talks Crypto predicted.

This analysis suggests that the golden time to trade Altcoin/ETH pairs could fall in the year’s final quarter. However, along the way, there may be short-term recoveries in these pairs. Several other analysts agree with this view.

Analyst Rekt Fencer also relied on the above chart and offered a more specific scenario: when ETH reaches $7,000–$8,000, rotate into Altcoin/ETH pairs to maximize returns.

Everyone is obsessed with ALTS/BTC.

The chart you should ACTUALLY be watching is ALTS/ETH.

It's at a make or break level right now.

Alts don't run unless ETH leads the way.

So for now the best play is to hold $ETH itself.

And when it gets to $7-8k, rotate into alts. pic.twitter.com/pFl6Qbita9

However, by monitoring the ratio of the OTHERS market cap (excluding the top 10) to ETH, one might spot earlier signs.

This ratio has risen from 0.21 to 0.27 over the past month, indicating that altcoins outside the top 10 are beginning to outperform ETH. This reflects investor sentiment shifting toward mid-cap and low-cap opportunities.