10 Revolutionary Ways Ethereum Reshaped Crypto in Just 10 Years

Ethereum didn't just enter the crypto scene—it rewrote the rules. From smart contracts to DeFi explosions, here's how Vitalik's brainchild bulldozed the status quo.

1. Smart Contracts Went From Sci-Fi to Standard

No more waiting for lawyers—code became law overnight. The ripple effect? A $500B+ DeFi ecosystem that traditional banks still pretend to understand.

2. Gas Fees Made Miners Rich—And Users Furious

That $100 latte you bought? Cute. Try paying that much just to send $20 in ETH during peak hours. Layer 2 solutions arrived fashionably late to the party.

3. ICO Mania (And Subsequent Implosion)

2017's 'throw money at whitepapers' frenzy birthed both unicorns and dumpster fires. Regulators are still finding token-shaped shrapnel.

4. NFTs: From CryptoKitties to Sotheby's

What started as cartoon cats evolved into a $41B market where JPEGs outprice Rembrandts. Art critics remain unamused.

5. The DAO Hack That Changed Everything

A $60M heist forced Ethereum's first existential crisis—and birthed the 'code is law' vs 'human intervention' debate that still rages today.

6. DeFi Summer Melted Traditional Finance's Ice Age

Yield farming protocols offered APYs that made savings accounts look like insult. Banks responded by... raising overdraft fees.

7. Ethereum Killers Rose—And Mostly Flatlined

Competitors promised cheaper, faster chains. Most delivered—except for the 'actually replacing Ethereum' part.

8. The Merge: From Energy Guzzler to Green Poster Child

Cutting energy use by 99.95% was impressive. Watching crypto-skeptics suddenly care about carbon footprints? Priceless.

9. Institutional Adoption Went From 'Never' to 'How Fast?'

BlackRock's ETH ETF approval proved Wall Street always adopts disruptive tech—right after calling it a scam for 8 years.

10. Web3 Went From Buzzword to Battleground

The dream of a decentralized internet lives—even if current implementations involve more VC money than Satoshi would've liked.

Ten years in, Ethereum remains crypto's most fascinating contradiction: simultaneously the establishment it sought to overthrow, and the innovation engine the space can't quit. TradFi suits still don't get it—which probably means it's working.

Ten Years of Ethereum

Since Vitalik Buterin first launched ethereum ten years ago, smart contracts have been a key feature of its blockchain. Bitcoin, the first cryptocurrency, allows smart contracts, but Satoshi Nakamoto mainly focused on its trustless and decentralized structure.

Ethereum, on the other hand, introduced Solidity, a programming language specifically tailored to smart contracts.

Ten years later, it’s difficult to quantify how influential Ethereum’s smart contracts have been. They’re still one of the blockchain’s strongest features, and other protocols have heavily diversified the field.

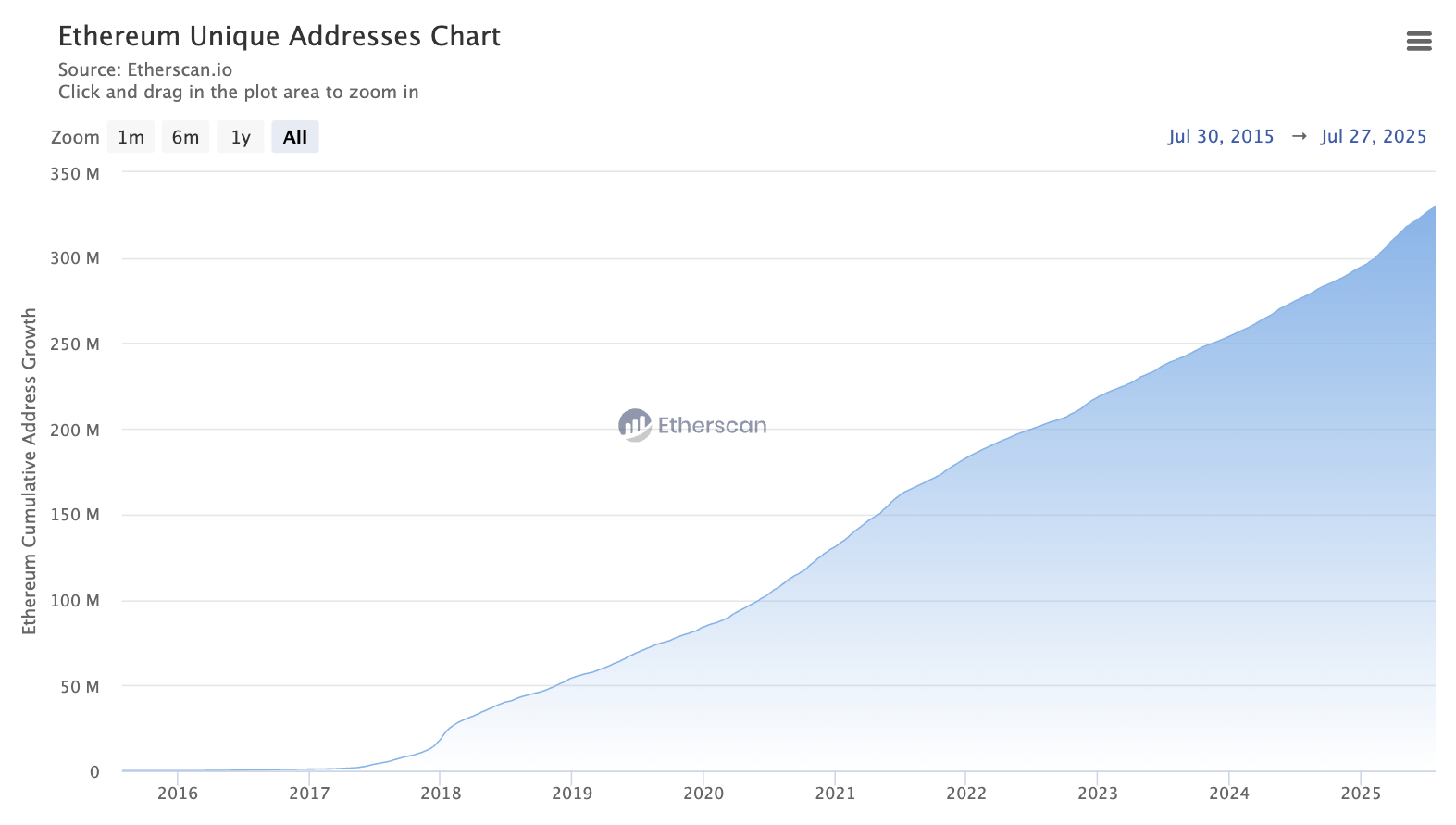

Although we can’t tell how many ETH smart contracts currently exist, the explosive growth in unique addresses should speak for itself.

The EVM (Ethereum VIRTUAL Machine) Standard further empowered the rise of smart contracts. EVM governs how these protocols work, processes transactions, monitors the global ETH ecosystem, and more.

This standard helps power Ethereum for users around the world, opening new possibilities for decentralized finance.

Ethereum Revolutionizes Token Minting and Blockchain Use

The ERC-20 Standard is another one of Ethereum’s critical contributions over the last ten years. Before ERC-20, creating tokens on a blockchain was a highly fragmented and inconsistent process.

By standardizing new rules between tokens, Ethereum opened a way to make over a million assets uniform, fungible, and interoperable amongst themselves.

Because of ERC-20, Ethereum is Tether’s preferred blockchain for minting USDT tokens. USDT is the world’s most popular stablecoin, so this is particularly impressive.

Academic papers have attempted to quantify this standard’s impact on the crypto industry, but it’s been unequivocally positive.

Furthermore, Ethereum’s ability to host Layer-2 protocols has revolutionized the industry over ten years. These protocols can build solutions to many issues, especially the scalability problem, within the framework of classical blockchains.

Today, even Bitcoin has a host of L2 protocols, but Ethereum specialized in them first.

ICO Boom and the Birthplace of DeFi

One particular benefit of ERC-20 is the ICO Boom of the late 2010s. With this new standard, protocols like chainlink and Basic Attention Token used it to launch their LINK and BAT tokens, respectively.

Today, some of these protocols have surpassed Ethereum in developer activity, highlighting their relevance over the past ten years.

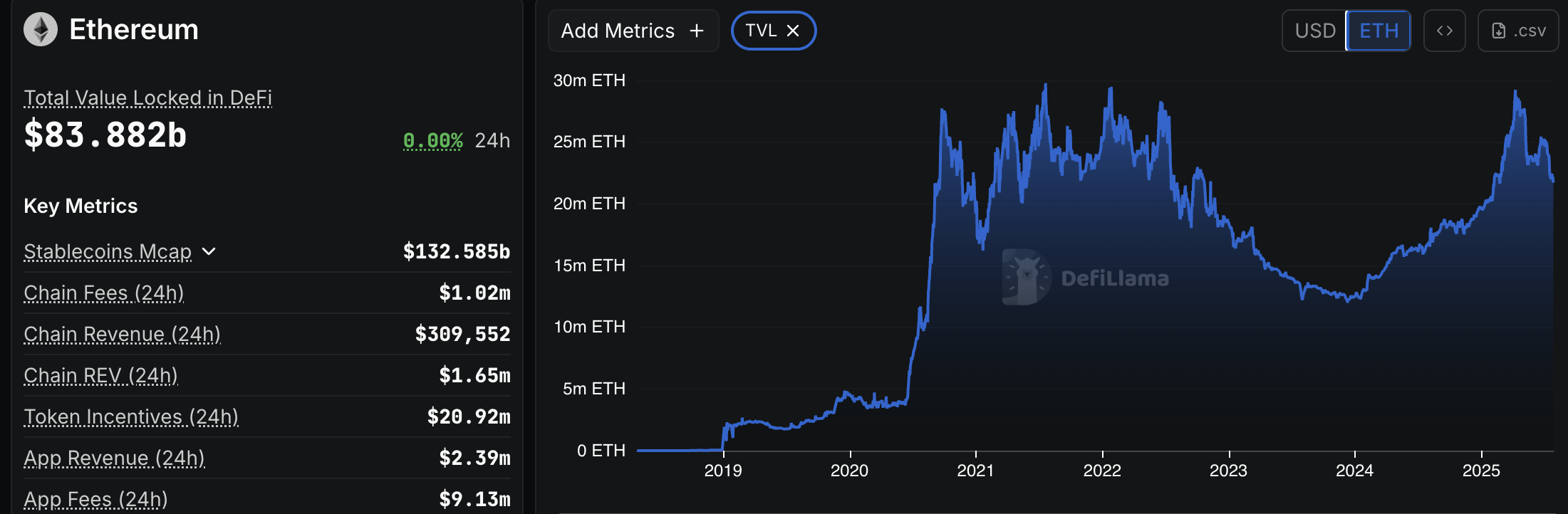

Between these technological improvements, the active community, and its ability to host decentralized exchanges, Ethereum is arguably the birthplace of DeFi.

Its tools and infrastructure have enabled a community to develop a trustless economic infrastructure in practice. Its DAO governance model has further enabled financial democracy on an unprecedented scale.

Hart Lambur, Co-founder of Risk Labs, shared some thoughts on Ethereum’s influence over DeFi in an exclusive comment to BeInCrypto:

“The real endgame is straightforward: A giant payments and exchange network that connects every blockchain. If most assets become tokenized – money, equities, bonds, real-world assets – Ethereum becomes the settlement and payment LAYER for all things of value on the internet,” Lambur claimed.

The total value locked on Ethereum’s blockchain has risen dramatically over the last ten years:

NFTs, Memes, ETFs, and More

These factors came together to make Ethereum the unquestionable home of NFTs, which were totally unprecedented ten years ago.

By combining self-executing smart contracts, a DeFi-oriented community, and a few new token standards, ETH became the heart of 2021’s NFT boom. These products are still relevant today, further showing Ethereum’s influence.

Although Dogecoin was the first meme coin, launched over ten years ago, Ethereum’s shiba inu invigorated the sector. The two coins were superficially similar, but Ethereum’s DeFi infrastructure and community launched a wave.

Ethereum developers didn’t directly create meme coins, yet their work was instrumental to the meme-filled sector we know and love today.

Finally, Ethereum was an important second place in another key area. bitcoin had the first US-approved spot ETF, but ETH followed a few months later.

This approval showed that the SEC under Gary Gensler WOULD permit additional altcoin products, and a wave of active applications is now sweeping through. Further, ETH ETFs are surpassing BTC ones right now.

In summary, Ethereum has done a lot for crypto in the last ten years. It proved to be a radical departure from Bitcoin, with a whole host of features that enabled a new world.

Ethereum has influenced every aspect of the crypto community, both present and past. Given its current adoption, blockchain’s contribution to the crypto economy will likely remain vital for years or decades to come.