Ethereum (ETH) Teeters at $4,000 – Is This the Peak or Just the Start?

Ethereum flirts with a make-or-break moment as it dances near the $4,000 threshold. Traders are sweating—will this rally hold, or is a profit-taking nosedive imminent?

Bullish momentum meets brutal reality

The crypto crowd’s split: true believers see $4K as a springboard, while skeptics whisper ‘market top’ every time ETH twitches. Liquidity’s thin at these altitudes—one whale sell-off could trigger a cascade.

Greed index flashing orange

Open interest screams leverage, derivatives markets pile in, and your Uber driver just asked about staking yields. Classic signs of a overheated market—or just crypto doing what crypto does?

Wall Street’s watching (and probably overcomplicating it)

Institutional analysts dust off their ‘this time it’s different’ PowerPoints while retail traders YOLO into call options. Meanwhile, Ethereum’s actual utility—DeFi, NFTs, smart contracts—keeps building beneath the price chaos.

Close: Whether this is 2017-redux or a genuine paradigm shift depends who you ask. Just remember: in crypto, ‘fundamentals’ are what traders cite while ignoring the chart screaming ‘SELL’.

Ethereum is Noting A Market Top

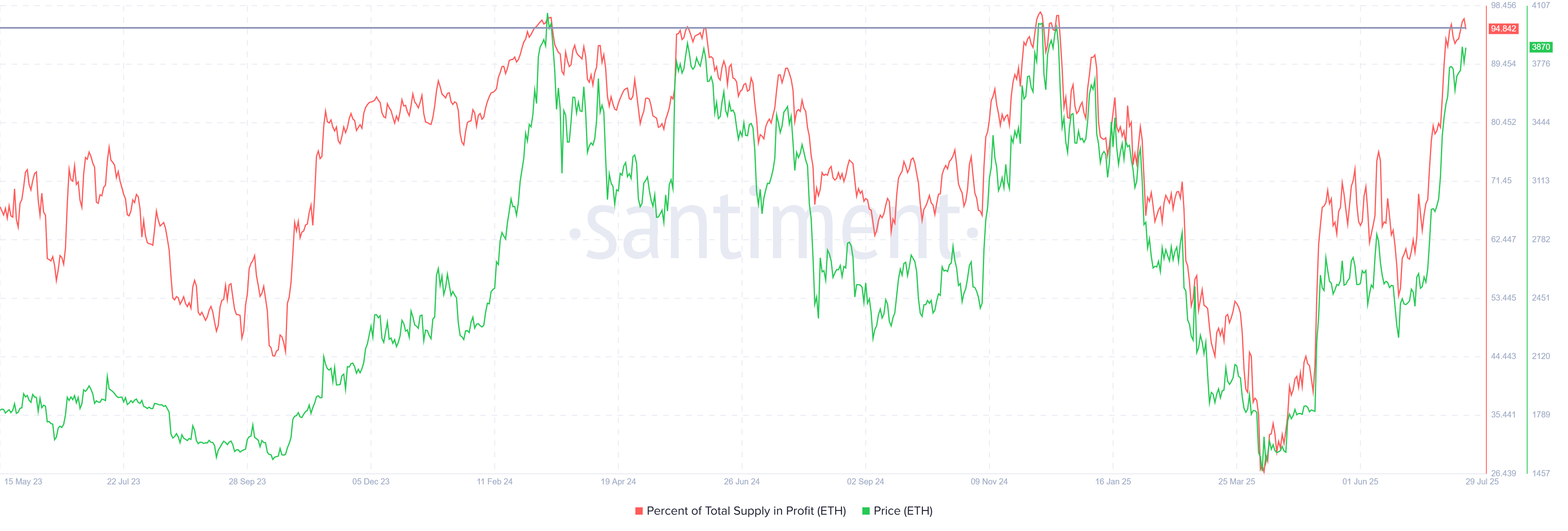

Currently, 94% of Ethereum’s total supply is in profit. Historically, when the profitable supply surpasses 95%, it signals a market top. This has been followed by price corrections as investors begin to secure profits. As a result, Ethereum’s price could face a pullback if the trend continues, potentially reversing recent gains.

Market tops often indicate that bullish momentum has saturated, and many investors begin to sell their holdings. This shift could slow Ethereum’s upward movement, as the market reacts to potential saturation.

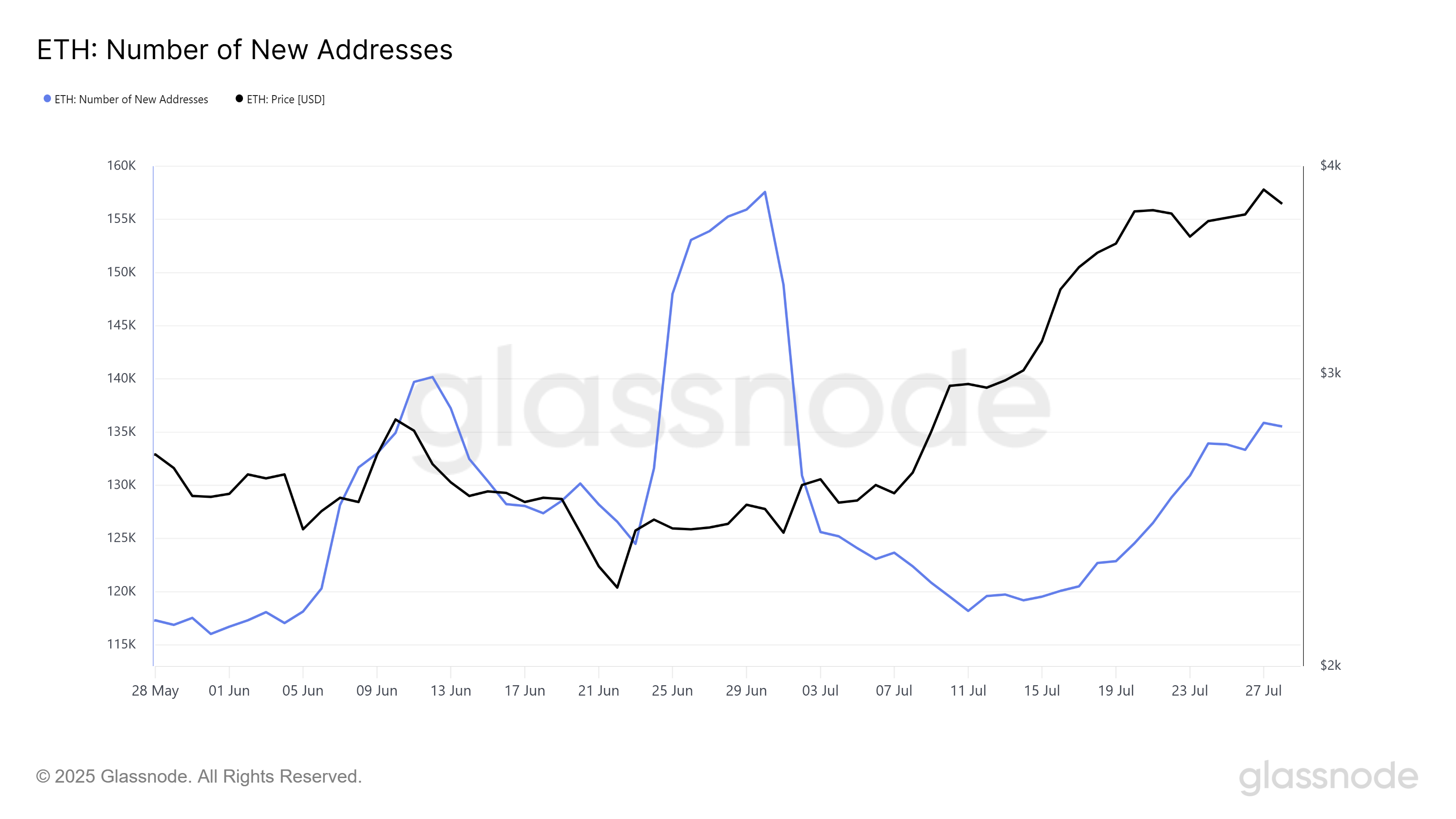

Ethereum’s macro momentum has seen a mixed trend, with new address activity being a focal point. Earlier this month, the number of new addresses spiked but then sharply declined. However, recent data shows a 13% increase in new addresses over the last 10 days, rising from 119,184 to 135,532.

If this growth in new addresses continues, it could counter the impact of the market top, providing ethereum with support to sustain its price gains. New investors could help strengthen the demand for Ethereum, reducing the risk of a market pullback.

ETH Price Needs A Push

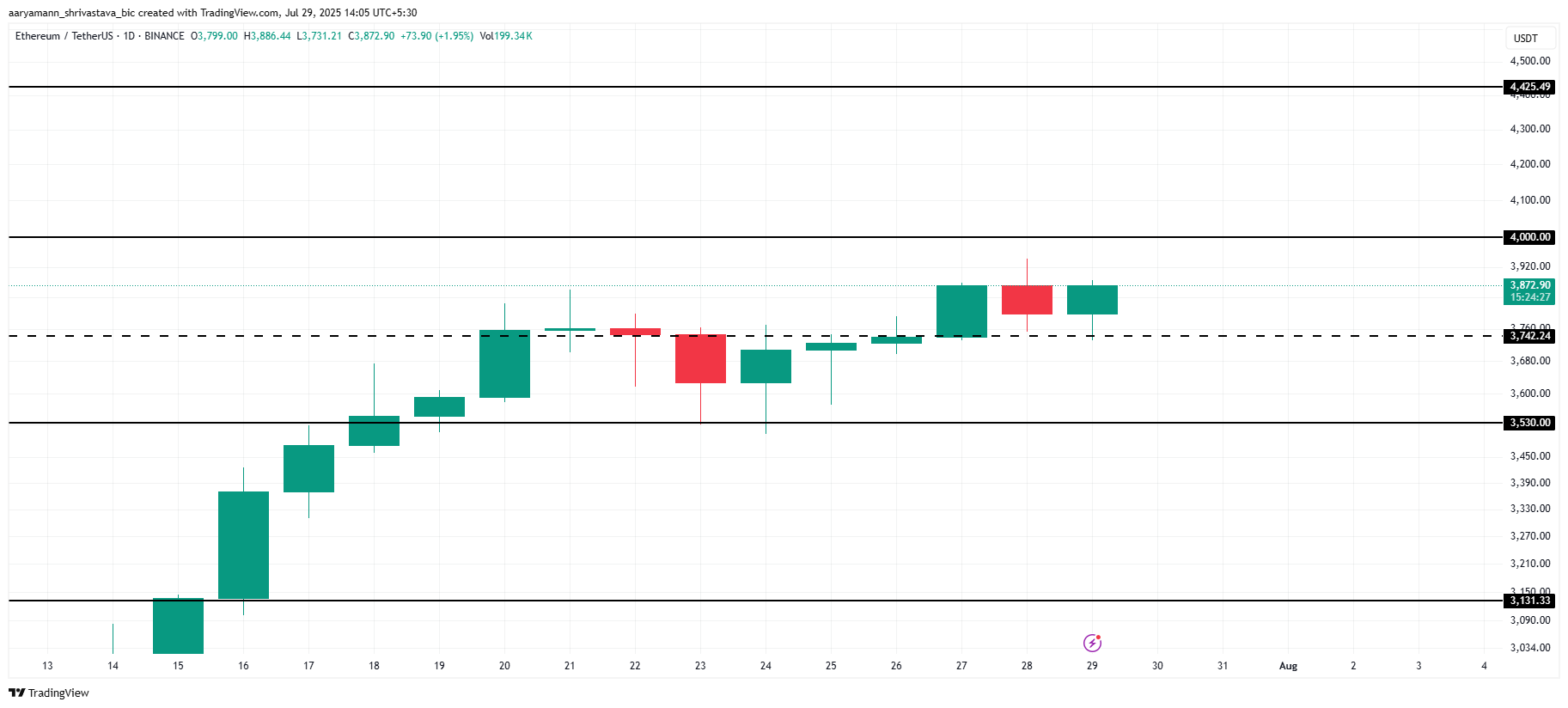

Ethereum’s current price stands at $3,872, holding above its local support level of $3,742. While ETH is approaching the $4,000 mark, it has not yet managed to breach it. This resistance could continue to hold, limiting Ethereum’s immediate potential for further gains.

If the market top signals a reversal, Ethereum’s price could drop to $3,530 or lower. A sharp decline to $3,131 is also a possibility, erasing much of the recent gains made in the past month. Such a move WOULD invalidate the bullish sentiment that has driven Ethereum’s growth.

On the other hand, if the influx of new addresses continues and strengthens, Ethereum may finally break through the $4,000 resistance. Should this happen, ETH could rise towards $4,425, with a renewed surge in price. This would invalidate the bearish thesis and push Ethereum into a new bullish phase.