XLM Warning: MACD Death Cross & Bearish Sentiment Signal Potential Crash Ahead

Stellar's native token flashes its first major sell signal since 2023 as technicals and sentiment align against bulls.

Technical Breakdown:

The moving average convergence divergence indicator just printed its first death cross in 18 months—a classic bearish reversal pattern that historically precedes 20%+ drops. Meanwhile, weighted social sentiment scores plunged to -0.89 this week, matching levels seen during May's 34% correction.

Market Psychology:

Traders are rotating out of altcoins as Bitcoin dominance climbs, and XLM's weak correlation with ETH isn't helping. The 'Stellar for payments' narrative keeps getting undermined by—surprise—actual payment networks doing their job better.

Bottom Line:

Until XLM recaptures the $0.12 support level, this looks like another 'buy the rumor, sell the news' scenario for crypto's perennial bridesmaid. Maybe try buying when VCs aren't dumping their 47th airdrop onto retail?

XLM Bears Take Control: Technical and Social Metrics Align for Further Losses

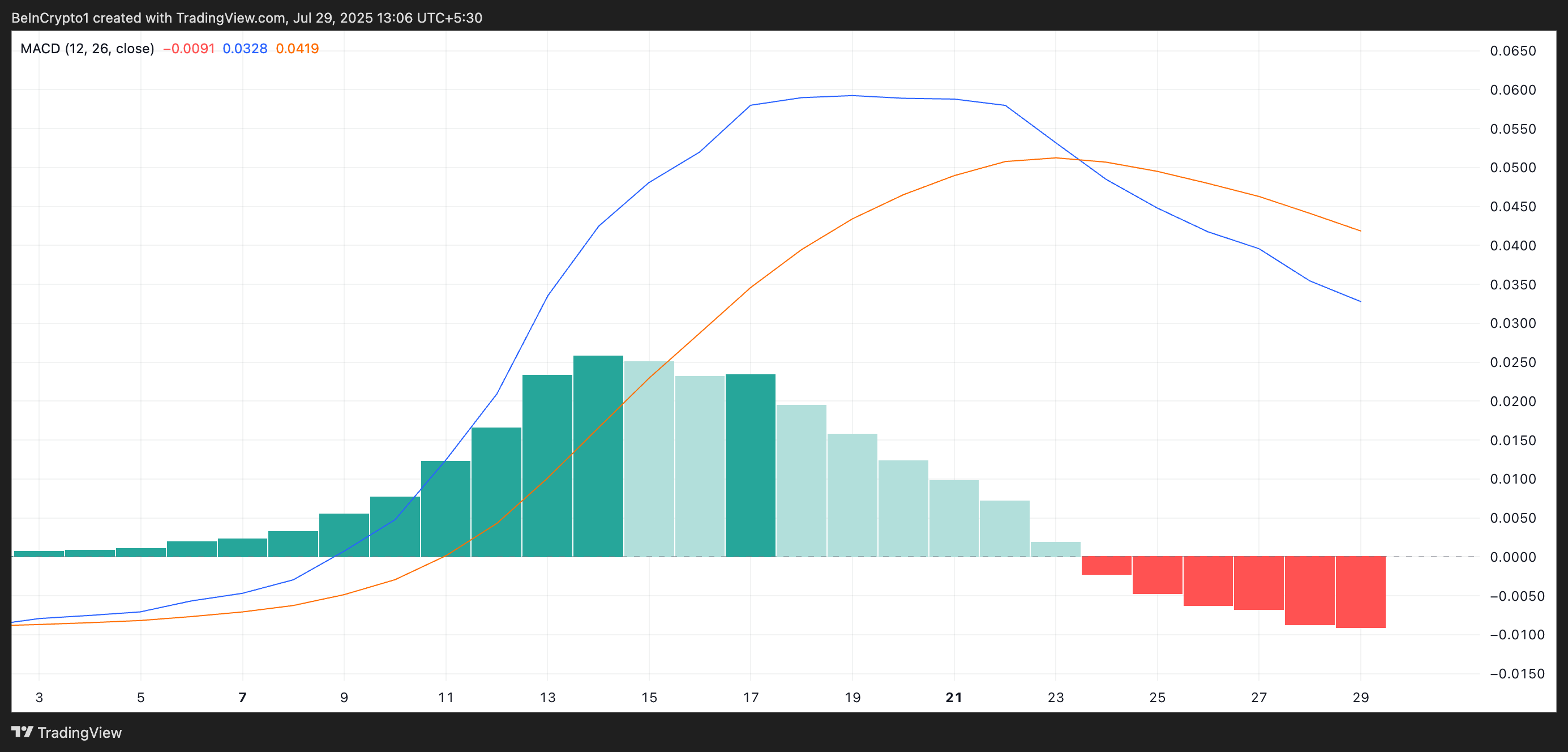

An assessment of the XLM/USD one-day chart reveals that the Moving Average Convergence Divergence (MACD) indicator formed a bearish crossover on July 24.

This occurs when an asset’s MACD line (blue) breaks below the signal line (orange). It happens when short-term momentum weakens and dips below the longer-term trend. It often marks the beginning of a downtrend or a period of sideways consolidation.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

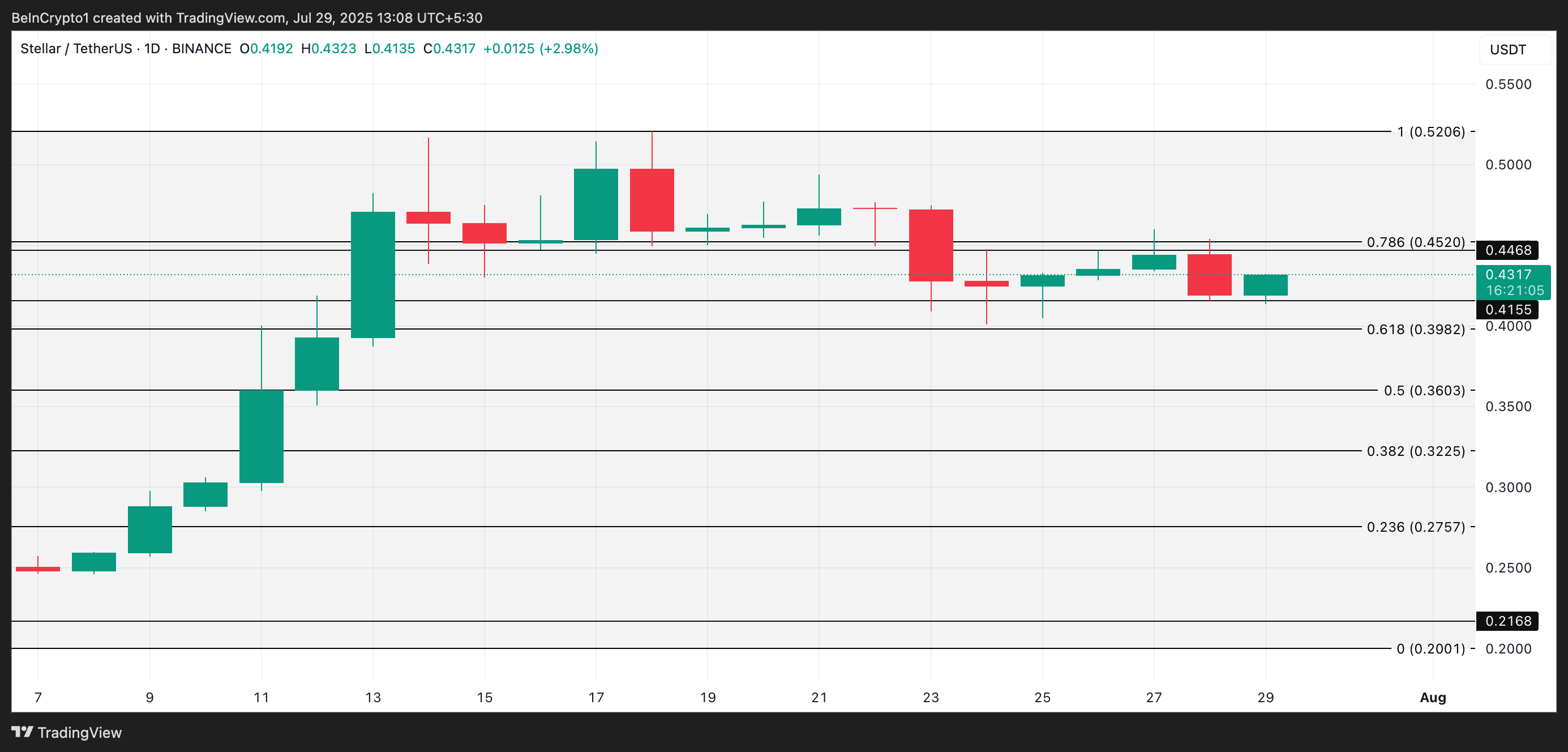

Since the crossover emerged, XLM has mostly traded within a narrow range, facing persistent resistance around $0.44 while finding support at $0.41. This price action reflects a clear loss of bullish momentum and confirms the current period of low trading activity and indecision among market participants.

The lack of strong directional movement reinforces the bearish outlook for the altcoin, especially if support at $0.40 begins to weaken.

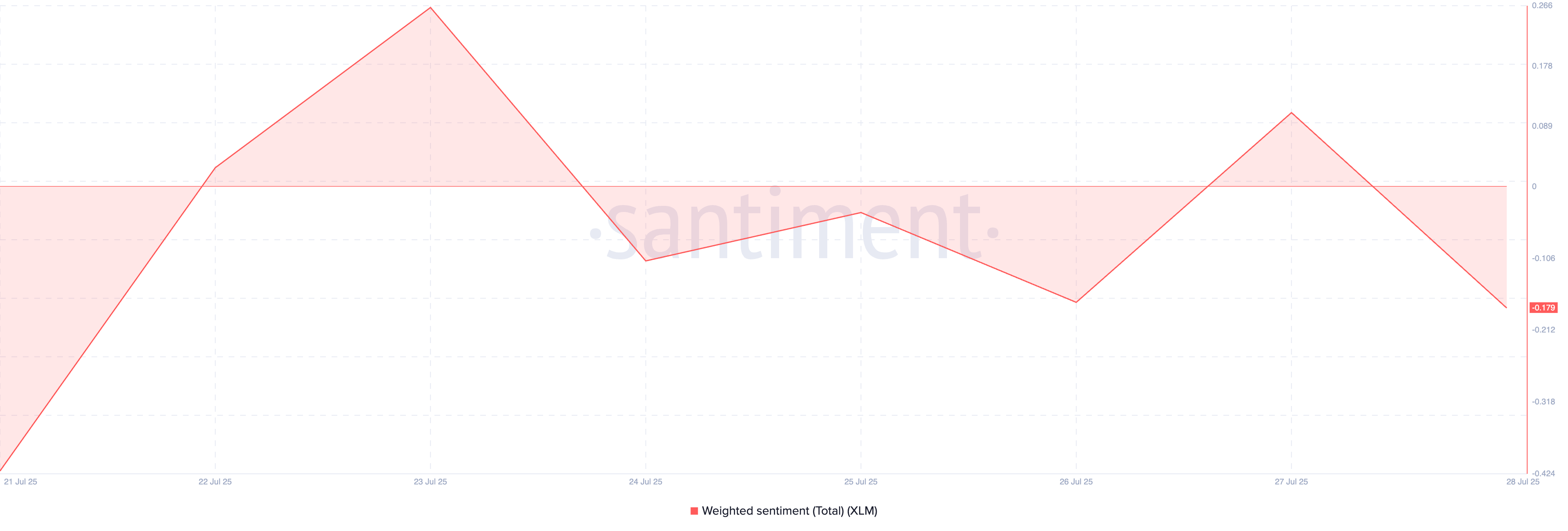

Furthermore, on-chain sentiment around XLM has also turned notably negative, amplifying the likelihood of a continued price slide. According to Santiment, the token’s weighted sentiment stands at -0.179, adding to the bearish pressures on its price.

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions.

When it is negative, it is a bearish signal, as investors are increasingly skeptical about the token’s near-term outlook. This prompts them to trade less, exacerbating the price decline.

One Push Could Send It to $0.39 or Trigger a Rebound

XLM trades at $0.43 at press time, down 2% amid the broader market pullback. If negative sentiment strengthens and new demand remains absent, the altcoin could break out of its narrow range and fall to $0.39.

Conversely, a resurgence in bullish sentiment could prevent this from happening. If buying activity resumes, XLM could reverse its current course, break resistance at $0.44, and rally toward $0.45.