Bitcoin Sellers Remain Silent—So When Will the Explosive Rally Finally Ignite?

The crypto market holds its breath as Bitcoin sellers stay sidelined—yet prices refuse to skyrocket. What’s holding back the inevitable surge?

The Quiet Before the Storm?

On-chain data shows minimal sell pressure, with long-term holders clinging to their coins like Wall Street clings to outdated fee structures. But without fresh catalysts, even diamond hands get restless.

Liquidity vs. Greed

Exchanges report thinning order books—a classic setup for volatility. Yet institutional players keep waiting for ‘the perfect entry’ like it’s 2021 all over again.

When this dam breaks, it won’t be a rally. It’ll be a reckoning.

Taker Sell Volume Collapse Shows Bears Have Stepped Away

One of the cleanest signs that sellers are backing off is the steep drop in taker sell volume. On July 25, Taker sell volume hit a local peak of almost $17.8 billion. Since then, it has dropped by nearly 93%, sitting at $1.2 billion at the time of writing.

That kind of collapse in sell-side aggression suggests bears are no longer driving the market.

Normally, when sellers vanish like this and price holds firm, it sets the stage for upside. But in Bitcoin’s case, the price has gone nowhere. That doesn’t weaken the bullish thesis; it just means the rally is paused, not invalidated. What’s missing is a trigger.

Taker sell volume tracks the value of trades where sellers are the aggressors: that is, when people are market-selling into the bid. A drop in this metric shows that fewer traders are trying to dump coins quickly, which usually reflects reduced fear or exhaustion from the sell side.

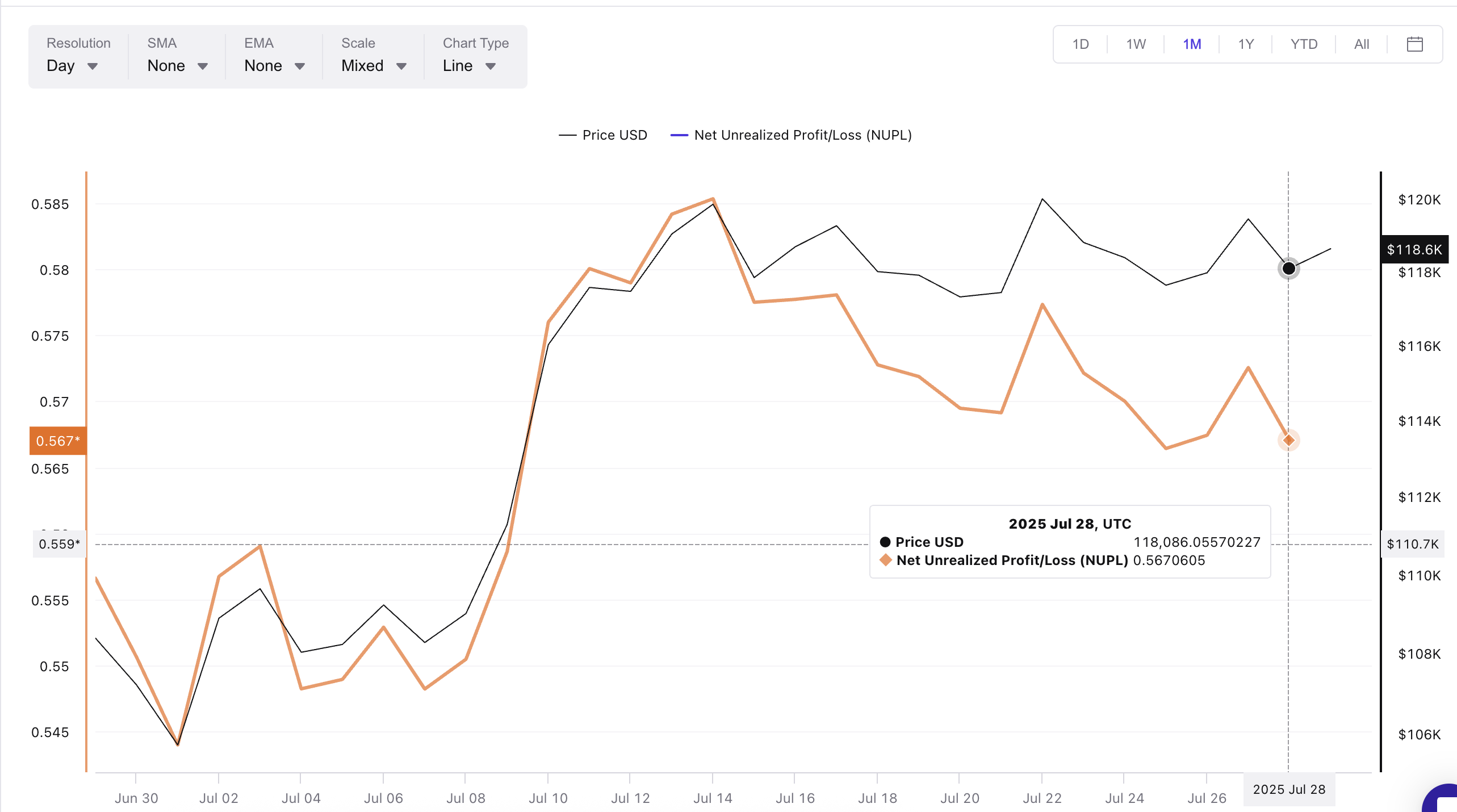

NUPL Peaks Continue to Trigger Profit-Taking

The missing trigger may be psychological, and Net Unrealized Profit/Loss (NUPL) helps explain why. NUPL measures the amount of unrealized profit in the system, giving a rough sense of when holders might feel tempted to sell.

Over the past two weeks, Bitcoin has repeatedly tested the $119,000–$120,000 level, occurring on July 14, July 17, July 22, and even July 27. Each time, NUPL peaked between 0.57 and 0.58, and each time, the BTC price failed to break higher and pulled back.

That’s not a coincidence. It’s the market signaling that $119,000-$120,000 has become a key profit-taking zone.

Since the last rejection, NUPL has declined modestly while the price has held steady. This suggests that some profit-taking has already played out. Traders locked in gains around $120,000, and the market is now digesting that MOVE without new waves of sellers.

NUPL stands for Net Unrealized Profit/Loss. It compares Bitcoin’s market cap to its realized cap, essentially telling us how much profit holders are sitting on without selling. When NUPL is high, there’s more incentive to take profit. When it drops while price holds, it means some profit-taking has already happened, which can reset the market for another leg up.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

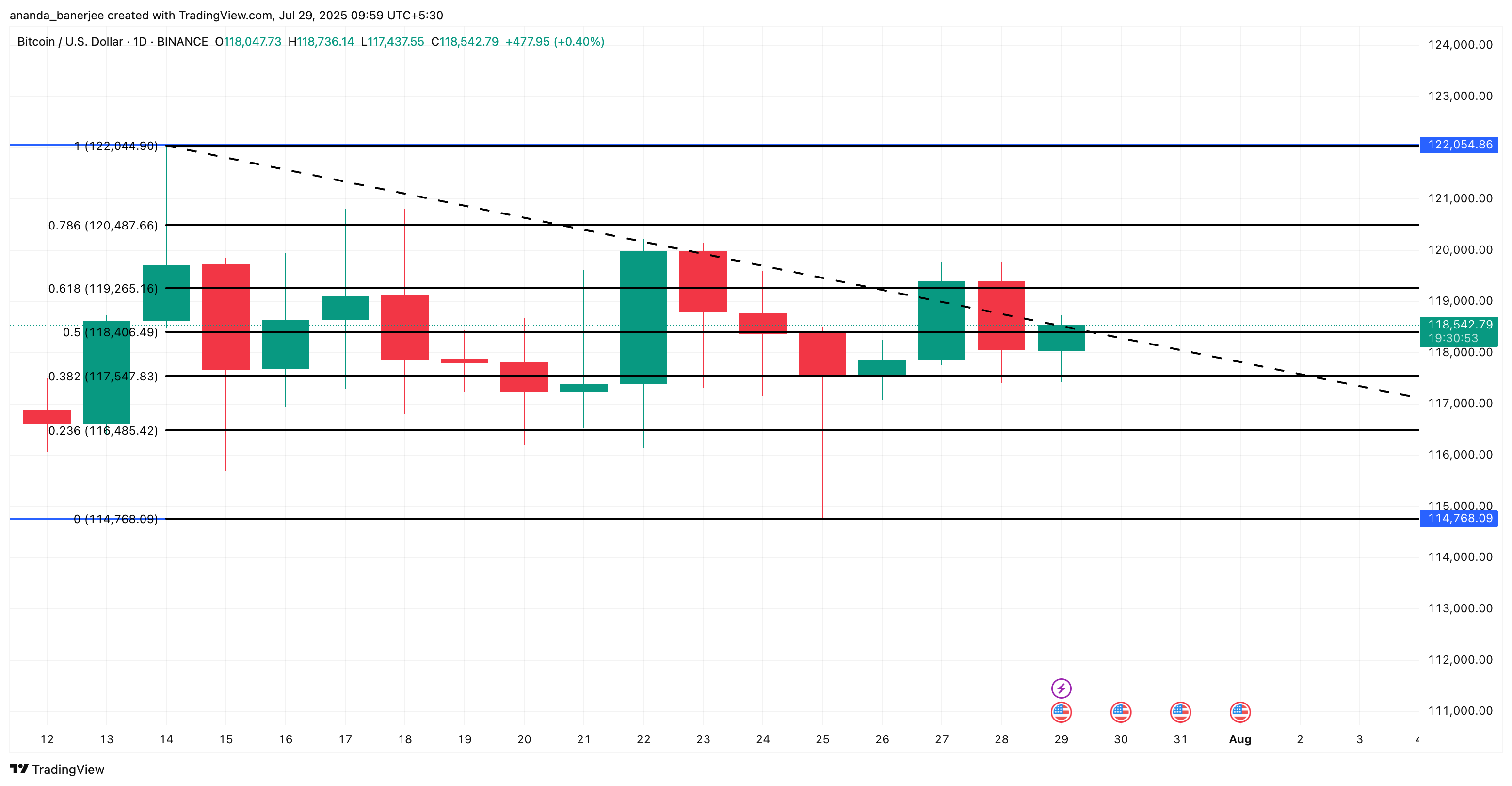

Bitcoin Price is Holding Up, But Needs a Clean Break Above This Level…

Despite several failed breakout attempts above $119,000, the BTC price is still above key support levels of $117,000 and $118,000. That zone is backed by the 0.382 and 0.5 Fibonacci retracement levels, both of which have held through multiple tests.

Sellers have stepped away, but buyers haven’t been able to flip the range.

What’s holding bitcoin back is resistance, both technical and behavioral, right at $120,000. That’s where the 0.786 Fib level sits, and it’s also where NUPL peaked most recently. Until BTC clears this zone with conviction, the Bitcoin rally remains stalled.

But if $120,000 breaks, the structure opens fast. BTC could move toward $122,000 and possibly beyond. With sell pressure gone, profits already taken, and support intact, the conditions for the next Bitcoin rally are still alive; they just need a push.

Yet, the bullish hypothesis fails in the short term if the Bitcoin price dips under $117,000, which then opens the doors to $114,000, flipping the entire structure bearish.