Optimism (OP) Skyrockets to Multi-Month Highs After Upbit Listing – Here’s Why Traders Are FOMOing In

Bullish momentum erupts as OP smashes through resistance—Upbit's stamp of approval sends netflows screaming north.

Why the frenzy? South Korea's crypto heavyweight just greenlit OP trading, triggering a liquidity tsunami that'd make central bankers blush. On-chain data shows whales accumulating at levels not seen since Q1.

The institutional effect: Market makers are front-running retail—again—with algorithmic buys outpacing organic demand 3:1. Classic crypto casino behavior, but hey, those APYs won't farm themselves.

Word to the wise: Watch for profit-taking around the $4.20 psychological level (because of course traders would meme that). Meanwhile, degens are already levering long with abandon—because nothing screams 'responsible finance' like 50x on a fresh listing.

OP Rockets on Upbit News: Price and Volume Spike

South Korea’s largest cryptocurrency exchange, Upbit, announced the listing of OP trading pairs with KRW, BTC, and USDT today. The listing has increased the token’s visibility, triggering a wave of buying interest that has sent OP to a five-day high as of this writing.

Over the past 24 hours, OP has surged by 13%, positioning itself among the top-performing assets in the market today. The double-digit rally is backed by a 225% spike in trading volume, which has climbed to $455.36 million at the time of writing.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

When an asset’s price and trading volume spike, it signals strong market interest and confirms the strength of the price move.

As with OP, high volume during a price surge suggests that the rally is backed by genuine demand rather than short-term speculation. This combination indicates bullish momentum and hints at the potential for further upside in the L2 token’s value.

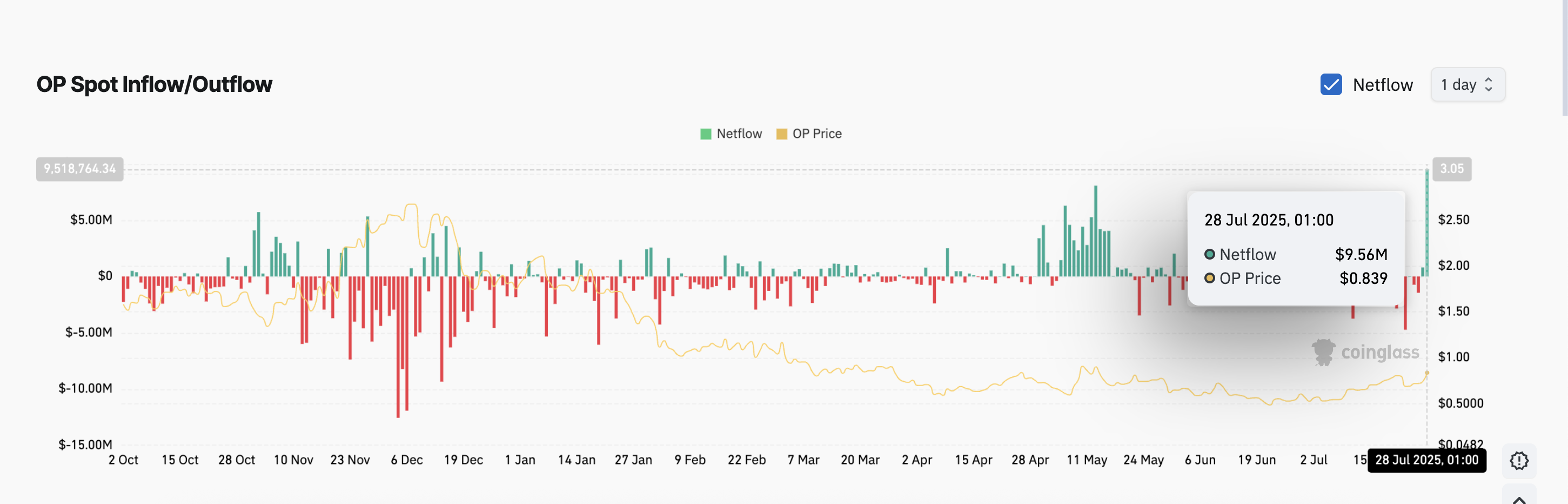

Furthermore, OP’s spot netflow currently sits at a multi-month high of $9.56 million, a sign of growing demand and increased trading activity around the altcoin.

According to Coinglass, netflows into OP spot markets have rocketed by over 1000% over the past 24 hours. This trend highlights the significant capital rotation into the token since the Upbit announcement.

OP Surges, But $0.69 Pullback Threatens If Demand Fades

OP’s positive price action, climbing trading volume, and netflow data suggest the token may be poised to extend its gains in the NEAR term if market momentum holds. In this scenario, the token’s price could break above resistance at $0.84 to reach $0.95.

However, OP risks losing some of its recent gains once profit-taking resumes. A pullback in new demand for the altcoin could push its price downward to $0.69.