HBAR Surges to 5-Month Peak—Then Gets Slammed by Profit-Taking

HBAR bulls got a taste of glory—before getting sucker-punched by sellers.

The altcoin briefly kissed its highest price since February today, only to get smacked down in a classic crypto reversal. Textbook profit-taking or the start of a deeper correction? Grab your charts and let’s dive in.

The Pump Before the Dump

HBAR’s rally wasn’t just a blip—it was a full-throated challenge to the bears. For a hot minute, it looked like the token might just hold its ground. Then? Wham. The order books flipped faster than a trader’s sentiment during a Fed announcement.

Who’s Holding the Bag Now?

Retail FOMO meets institutional sell walls. The pullback was so sharp you’d think it was orchestrated by a hedge fund manager eyeing a new yacht. Classic crypto: where ‘number go up’ meets ‘take profits or die trying.’

Will HBAR recover or is this the start of another ‘buy the rumor, sell the news’ cycle? Place your bets—the house always wins.

HBAR Buckles Under Profit-Taking Pressure

HBAR has bucked the broader market uptick to record a 5% price drop over the past 24 hours. The dip suggests that traders who rode the rally to $0.30 are now locking in gains, putting downward pressure on the token’s price.

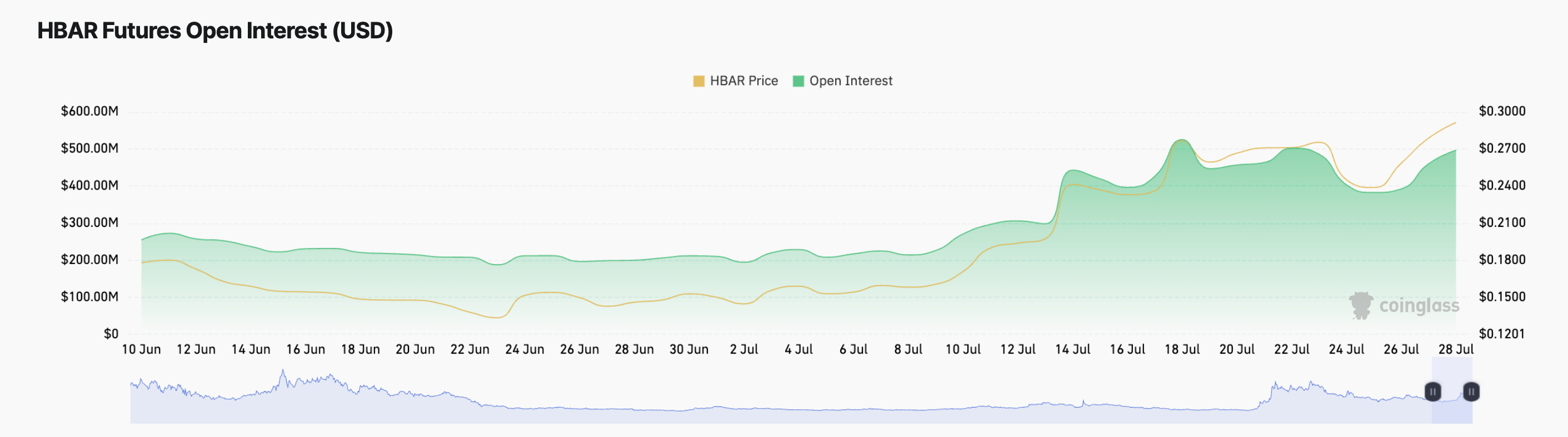

According to Coinglass, HBAR’s open interest has increased by 8% in the past 24 hours, reaching $497 million, even as the token’s price trends downward. This is typically viewed as a red flag, as it indicates that more futures positions are being opened, betting on further declines.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Open interest refers to the total number of outstanding futures contracts that have not yet been settled. When it rises and the price drops, it means new money is entering the market to bet against the asset, rather than to support it.

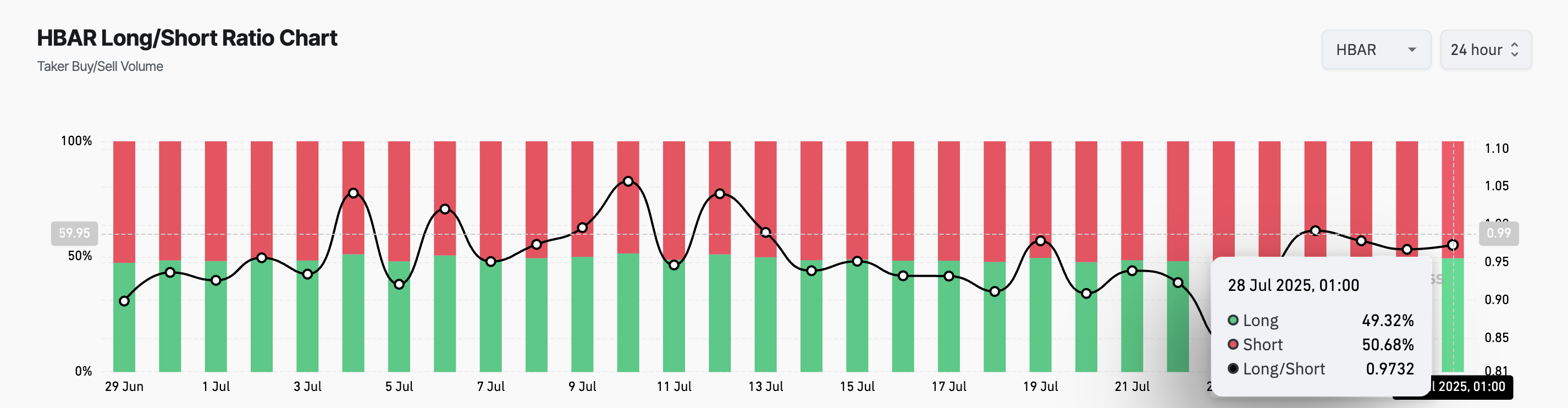

This pattern is generally interpreted as a bearish signal, especially if a falling long/short ratio accompanies the rise in open interest. This is the case with HBAR, adding to the bearish pressure facing the altcoin. As of this writing, the ratio stands at 0.97.

The long/short metric measures the proportion of bullish (long) positions to bearish (short) positions in an asset’s futures market. When the ratio is above one, there are more long positions than short ones. This suggests bullish sentiment, with most traders expecting the asset’s value to rise.

On the other hand, as is the case with HBAR, a ratio under one means more traders are betting on a price decline than on a price increase. This reflects growing skepticism around the altcoin’s short-term price outlook, as more traders attempt to lock in gains.

HBAR at a Crossroads: $0.26 Breakdown or $0.30 Breakout Next?

Unless new demand enters the market to offer support, HBAR’s price may continue to face downside pressure, driven by both spot selling and bearish derivatives positioning. If this continues, the altcoin could fall to $0.26.

On the other hand, if buying climbs, HBAR could breach the resistance at $0.29, reclaim the cycle peak of $0.30, and attempt to climb further.