$2 Billion Floods Into Crypto as Ethereum Steals Bitcoin’s Thunder in Altcoin Frenzy

Crypto markets are roaring back—and this time, altcoins are leading the charge. Ethereum just flipped Bitcoin in the race for investor dollars as nearly $2 billion pours into digital assets. Here's why the smart money's betting on ETH and friends.

The altseason nobody saw coming

While Wall Street was busy shorting memecoins (again), Ethereum quietly assembled an institutional army. The blockchain's defi ecosystem and looming protocol upgrades have turned it into a magnet for capital—proving there's more to crypto than Bitcoin's digital gold narrative.

Meanwhile, Bitcoin maximalists are sweating. The OG crypto's dominance is slipping as traders chase higher beta plays. Some analysts whisper this could be the start of a full-blown 'flippening'—though good luck getting a Bitcoin holder to admit that over their third whiskey of the afternoon.

One cynical take? The sudden altcoin love affair coincides perfectly with hedge funds needing to window-dress their Q3 portfolios. Nothing pumps bags like other people's money chasing performance. But with $2 billion entering the space, even the skeptics can't ignore the momentum.

Bottom line: The crypto tides are turning fast. Bitcoin might still be the market's North Star, but Ethereum and altcoins are writing the next chapter—whether the old guard likes it or not.

Ethereum Leads Crypto Inflows as Altcoin ETF Speculation Builds

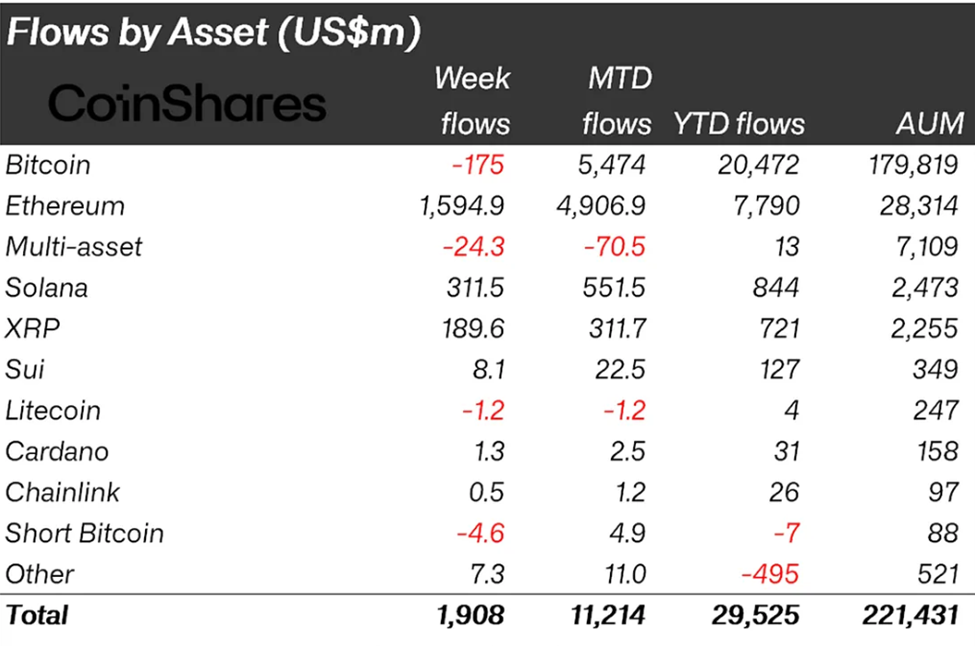

The latest CoinShares report indicates that crypto inflows reached $1.908 billion last week, a significant increase from the week ending July 19, which recorded $1.049 billion.

This drop came as Bitcoin bucked the trend, recording $175 million in negative flows. Meanwhile, ethereum extended its lead, with $1.594 billion inflows last week.

CoinShares head of research James Butterfill records this as Ethereum’s second-largest week ever, with year-to-date (YTD) flows surpassing 2024 totals.

“Ethereum stood out, unusually leading with US$1.59bn in inflows last week, its second-strongest week on record. Year-to-date inflows into Ethereum have now reached US$7.79bn, surpassing the total for all of last year,” read an excerpt in the report.

The CoinShares executive calls out bitcoin for its notable divergence from broader altcoin trends, with Solana and XRP seeing strong inflows. Butterfill says the turnout points to potential ETF (exchange-traded fund) anticipation rather than a broad altcoin season.

“This has raised the question of whether we are entering an altcoin season…These altcoin inflows may be driven less by broad-based enthusiasm and more by anticipation surrounding potential US ETF launches,” the report added.

Meanwhile, Ethereum’s notable performance in last week’s crypto inflows is unsurprising. Coming ahead of its 10th anniversary, the altcoin has seen a significant surge in institutional interest.

Among them are Bit Digital’s pursuit of a $1 billion pivot to Ethereum and BlackRock’s head of digital assets leaving to join the Ethereum Treasury company SharpLink Gaming.

Ethereum Becomes Institutional Favorite as Market Rotation Accelerates

Further, BlackRock’s Ethereum ETF inflows surpassed its Bitcoin fund (IBIT) last week.

In a statement to BeInCrypto, Andreas Brekken, CEO and founder of SideShift.ai, ascribed Ethereum’s performance to institutional conviction arriving en masse.

Similarly, MEXC Research Chief Analyst Shawn Young highlights Ethereum’s accelerating momentum as it nears the $4,000 mark. Like Brekken, Young cites strong institutional demand and a favorable macro backdrop.

With over $5 billion in inflows into US spot ETH ETFs across 16 consecutive days, Young notes that Ethereum is increasingly considered the cornerstone of on-chain financial infrastructure.

“This growth reflects the increased conviction in Ethereum’s utility, sustainability, and long-term staying power, particularly due to its use in tokenization, stablecoins, and on-chain settlement,” Young stated in a statement shared with BeInCrypto.

He emphasizes ETH’s resilience amid recent market dips, growing dominance in the crypto market cap, and its leadership role in an emerging capital rotation from Bitcoin to altcoins.

Technically, Ethereum has held key support levels while showing relative strength. According to the analyst, improving depth across altcoins signals a broader shift in market sentiment.

Based on this, Young points to a possible breakout toward $4,500 if upcoming GDP and FOMC data spark a risk-on rally. However, the analyst also cautions that a macro downturn could lead to a pullback to $3,300.

“Softer inflation data or dovish language from the Fed may reinforce the view that the rate hike cycle is nearing its end, potentially triggering a broader risk-on shift across the markets — a trend that typically benefits the crypto sector significantly,” he chimed.

As of this writing, Ethereum was trading for $3,886, up by over 3% in the last 24 hours.

Nevertheless, with ETF adoption accelerating and ETH accounting for a rising share of institutional portfolios, Ethereum is well-positioned to lead the next leg of crypto market expansion.