3 Altcoins Facing Massive Liquidations Before July Ends—Will Your Portfolio Survive?

Crypto markets are sweating bullets as three altcoins teeter on the edge of a liquidation bloodbath. With leveraged positions stacking up like dominoes, the last week of July could deliver a reckoning—and not the fun, tax-deductible kind.

Liquidation Looms: Who’s Most Exposed?

Market watchers are eyeing leveraged positions like hawks circling prey. When the margin calls hit, they hit hard—no mercy, no refunds. Just ask the 'stablecoin maximalists' now scrambling for exits.

The Domino Effect: How One Crash Spills Into Others

Liquidations aren’t isolated events. They trigger cascading sell-offs, turning minor corrections into full-blown panic sessions. Remember: in crypto, ‘diversification’ just means losing money in multiple assets at once.

Last Week of July: Perfect Storm or Buying Opportunity?

Forced selling could create fire-sale prices—or deepen the pain. Either way, grab popcorn. The market’s about to remind everyone why ‘risk management’ isn’t just a buzzword… unless you’re a VC, then it’s someone else’s problem.

1. Ethereum

Ethereum has been surrounded by positive news about institutional accumulation in recent months. At times, its inflows even outperformed those of Bitcoin ETFs. More recently, SharpLink Gaming acquired 77,206 ETH worth $296 million last week, raising its total holdings to 438,000 ETH.

These bullish developments pushed ETH close to the $4,000 mark in the last week of July. Many analysts expect ETH to hit $4,000 soon—or even surpass it. But this level also acts as a strong psychological resistance, where profit-taking could emerge at any moment.

“A key resistance level ahead for ethereum $ETH is $3,980. Breaking above it could ignite a major bull rally!” crypto analyst Ali Martinez commented.

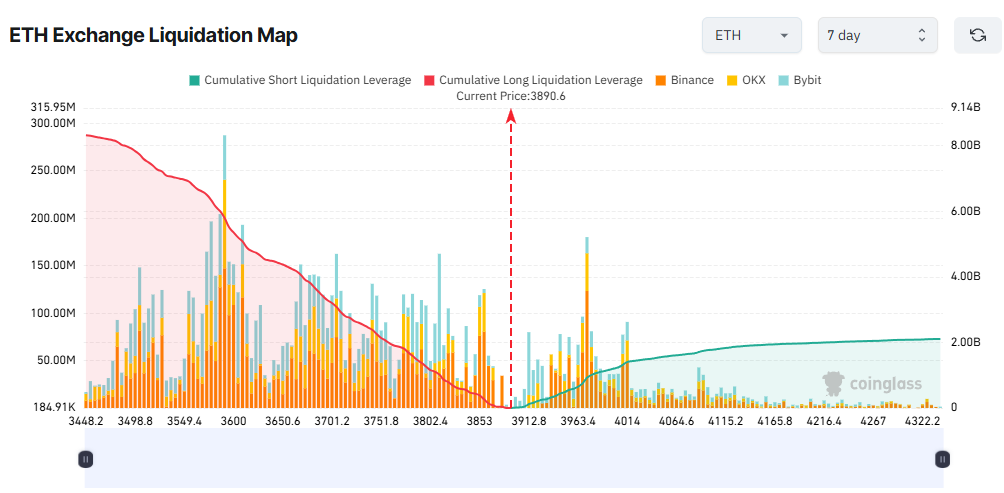

Regardless of direction, the liquidation map shows that potential liquidations could reach billions of dollars if ETH moves significantly.

According to Coinglass data, if ETH breaks above $4,000, total accumulated short liquidations could reach $1.2 billion. On the other hand, if ETH faces strong profit-taking and drops to $3,500, long liquidations could soar to $7.8 billion.

The map also reveals an imbalance between longs and shorts, indicating that many traders are betting more money and leverage on a downward correction.

2. Solana

Although solana still needs to rise over 50% to revisit its early-year high of nearly $300, its open interest has already exceeded $11 billion. That’s over 25% higher than when SOL peaked in January.

This suggests that traders are more exposed to Solana now than in the past. However, most of this exposure comes from derivatives rather than spot trading.

CoinMarketCap data shows that SOL’s current daily spot trading volume is just over $6 billion. That’s far below the tens of billions seen in January.

This wide gap between derivatives and spot volume reflects that Solana traders are leaning toward short-term bets. As a result, the token is prone to sharp swings and potential liquidations.

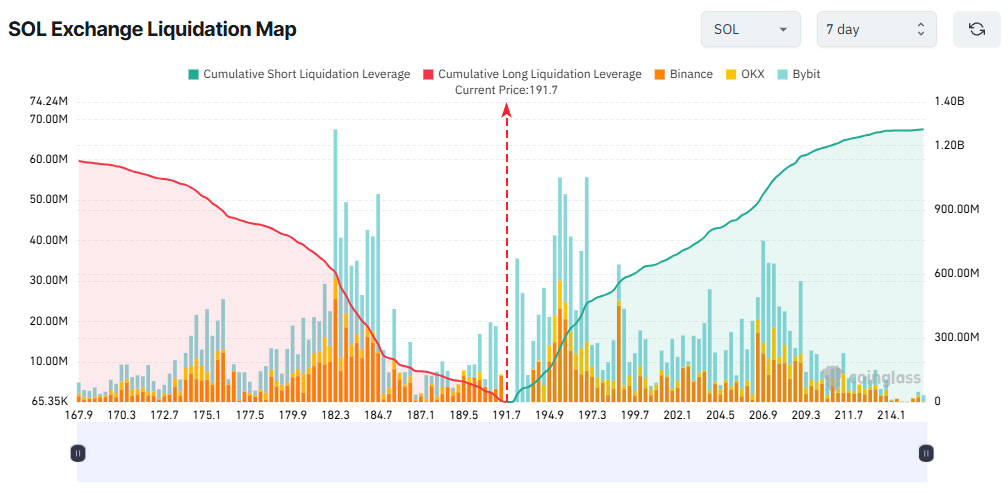

The liquidation map shows a balance between long and short positions. With SOL trading around $191, a MOVE above $200 could trigger more than $600 million in liquidations. Conversely, a drop to $181 could liquidate over $700 million in long positions.

3. BNB

Entering the last week of July, BNB hit a new all-time high of $859. This rally was fueled by growing activity on BNB Chain and increased interest from companies in the BNB treasury.

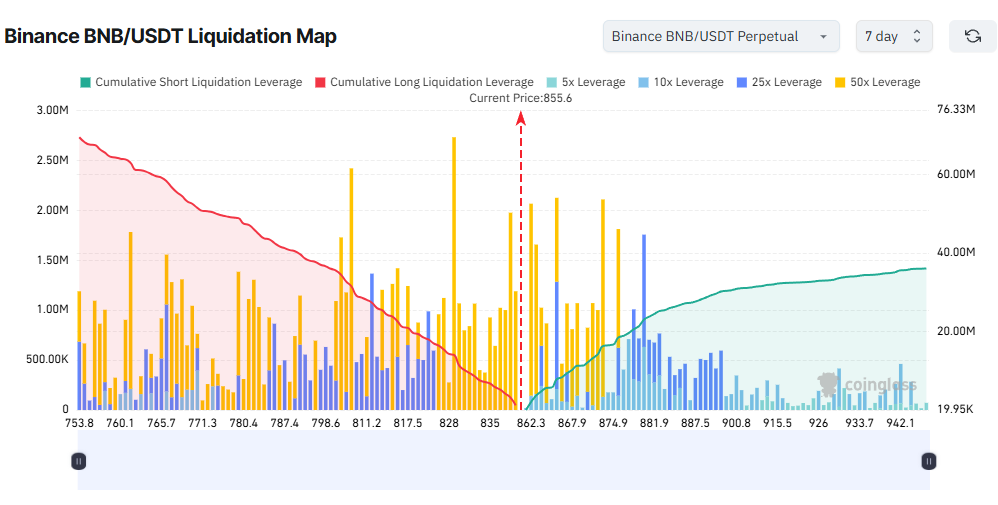

While BNB hasn’t shown signs of a pullback yet, the BNB/USDT liquidation map on Binance reveals heavy leverage—up to 50x.

The map is almost entirely covered in yellow (indicating 50x leverage), especially around the $753 to $875 range.

On Binance alone, total long liquidations outweigh shorts. If BNB surpasses $875, short positions worth $18.5 million could be liquidated. On the other hand, if BNB drops below the psychological $800 mark, more than $36 million in long positions WOULD be wiped out.

Ignoring short-term noise, many analysts believe BNB could soon reach $1,000. However, some offer a more detailed view, suggesting that the price might first fall below $800 before resuming its uptrend.