Decentralized Exodus: Binance, KuCoin & Upbit See Volume Collapse as Traders Defect to DEXs

Centralized exchanges are bleeding users—and liquidity—as DeFi's siren song grows louder.

The Great Migration

Trading volumes at Binance, KuCoin, and Upbit have plunged as crypto's retail army rediscovers the 'not your keys, not your coins' mantra. The irony? This shift comes just as regulators finally start pretending to understand centralized platforms.

DEXs Eat Their Lunch

Uniswap, PancakeSwap, and friends are feasting on CEX outflows. No KYC, no middlemen, and (best of all) no customer support tickets when things go sideways. Traders seem oddly willing to risk smart contract bugs over exchange insolvency these days.

Wall Street's Worst Nightmare

A self-custody revolution is bad news for institutions still trying to 'tokenize' paper gold. Meanwhile, decentralized volume quietly flips Coinbase—but don't expect CNBC to cover that before their next stablecoin promo segment.

CEXs Are Gradually Losing Spotlight

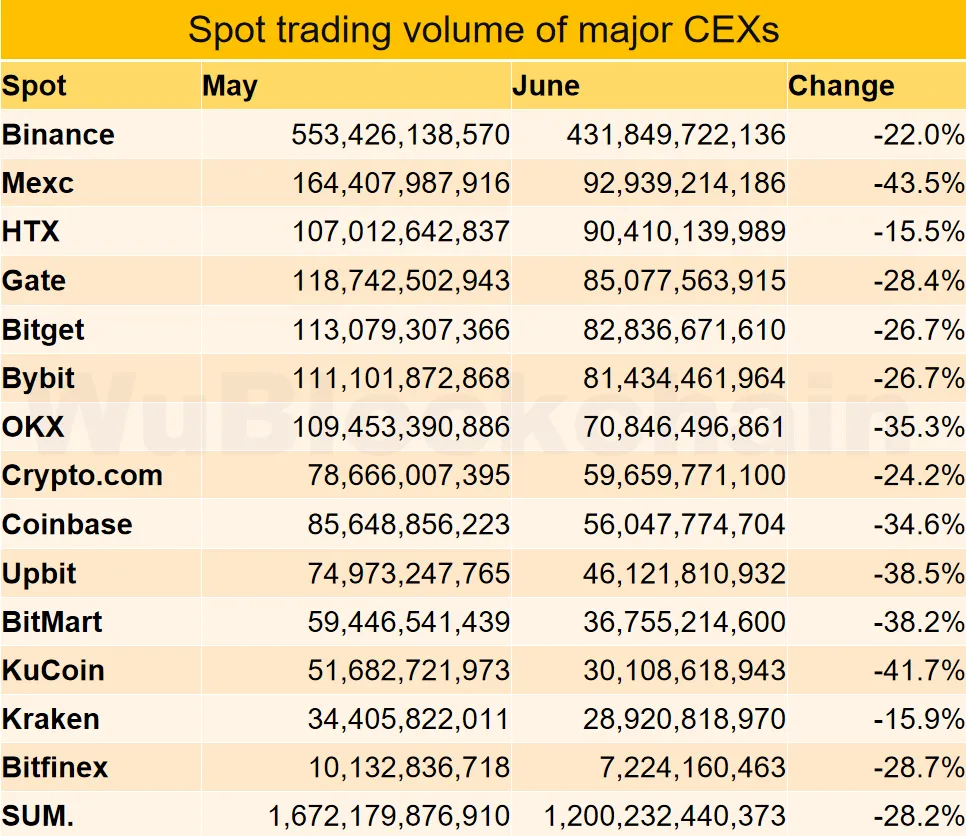

Amid a volatile crypto market shaped by liquidity concerns and shifting investor sentiment, a recent report from Wu Blockchain reveals a worrying trend. Trading volumes on centralized exchanges (CEXs) dropped sharply in June 2025.

According to the report, most major centralized exchanges experienced a significant decline in trading volumes last month. The three platforms with the steepest drops were MEXC (-44%), KuCoin (-42%), and Upbit (-39%).

These exchanges are widely used by retail users in Asia, particularly in South Korea and Southeast Asia. This trend may indicate waning speculative capital in those regions.

On the other end of the spectrum, the three exchanges with more moderate declines were HTX (-15%), Kraken (-16%), and Binance (-22%). Although Binance remains one of the largest platforms by market capitalization and consistently leads in liquidity, the more than 20% drop in trading volume suggests growing investor caution.

The broad-based trading volume decline in June can be attributed to several factors.

First, after the strong growth phase in early 2025, the crypto market has entered a correction period. The absence of strong catalysts such as spot Bitcoin ETFs has also led to a noticeable decline in market participation.

Second, ongoing geopolitical conflicts exert pressure on risk assets like cryptocurrencies. Investors are increasingly pulling funds out of the market in search of safer instruments such as bonds, certificates of deposit, or gold.

A Shift in User Behavior?

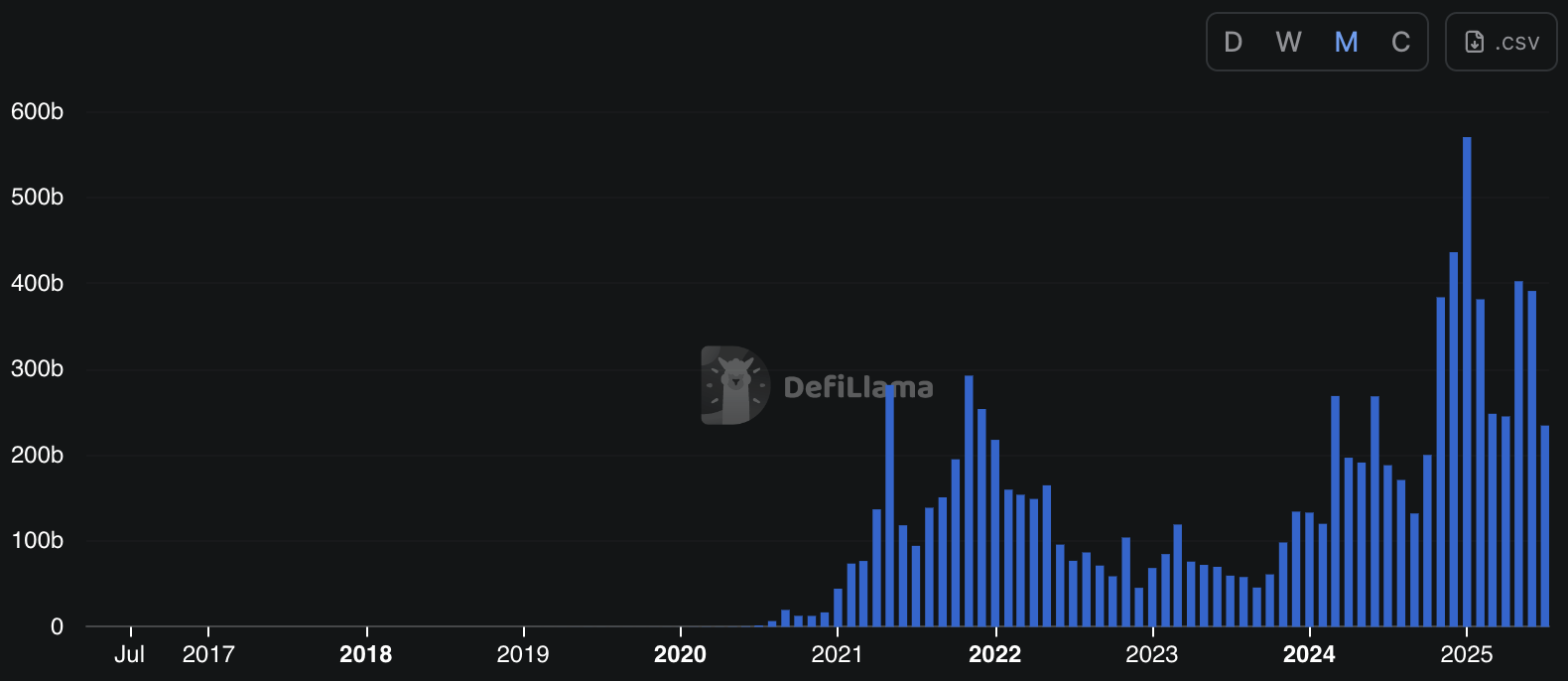

Another noteworthy factor is the growing capital shift toward decentralized exchanges (DEXs). A chart from DefilLama shows that DEX trading volume in June 2025 reached approximately $391 billion. Although it recorded a slight decline compared to May ($402 billion), it also showed impressive growth compared to 2024.

In addition, DEXs’ characteristics also show many benefits for users who love privacy in transactions. As proposed by CZ, the dark pool model for perpetual futures contracts is expected to reshape the confidentiality and security of DEXs.

However, it is important to emphasize that the decline in trading volume does not necessarily signal the onset of a “crypto winter” like in 2022. Instead, this could be a psychological and expectation reset period where professional investors observe and await clearer macroeconomic signals before re-entering the market.

Moreover, a large chunk of traders prefer decentralized trading platforms such as Hyperliquid.

The final months of Q3 and the beginning of Q4 will be critical, particularly as token unlock events, Layer-2 project updates, and policy developments from the U.S. and Europe gradually come into focus.