Crypto Whales Are Gobbling Up These Assets Before the U.S. CPI Bombshell Drops

Crypto's big players aren't waiting for the inflation numbers to settle—they're front-running the market with strategic buys. Here's where the smart money's flowing before the economic data hits.

Whale Watching: The CPI Playbook

While retail traders panic over Fed rumors, institutional accumulators are loading up on volatility hedges and inflation-resistant altcoins. No surprise—when the whales move, they move first.

The Cynic's Corner: Of course they know something we don't. They always do—that's why they can afford those 200-foot yachts while you're staring at candlestick charts on a cracked phone screen.

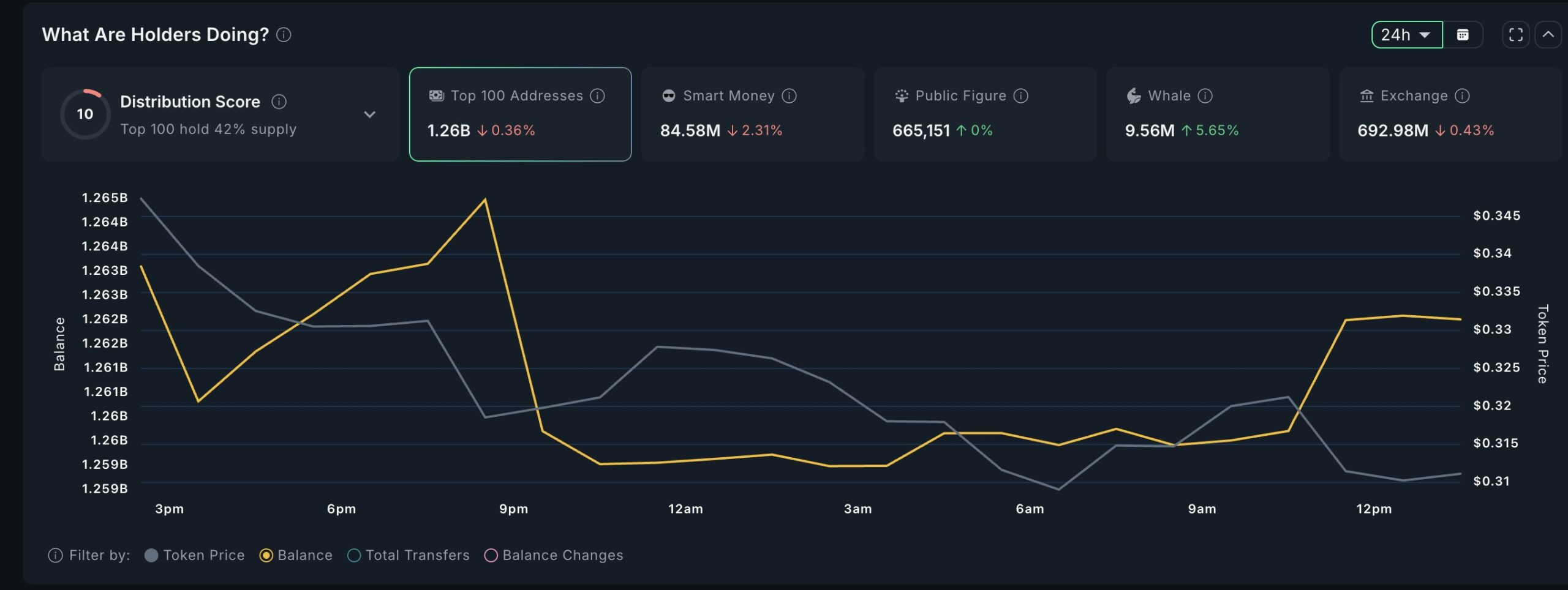

1INCH whale activity: Nansen

1INCH whale activity: Nansen

The balance chart shows a steady lift from around midday onwards on July 14, indicating fresh demand while the token price hovered between $0.32 and $0.33. Meanwhile, smart money and exchange balances barely moved, suggesting the action was mainly large wallet accumulation.

Despite a 5.65% surge in whale holdings, the 1INCH price dipped by nearly 8% day-on-day, suggesting whales may be positioning early ahead of expected on-chain volume spikes, rather than chasing short-term gains.

Crypto whales may be rotating into 1inch as a bet on DEX activity surging if CPI drops and risk-on sentiment returns, boosting on-chain trading volumes.

Chainlink (LINK)

From July 10 onward, LINK saw a 6.19% increase in whale holdings, now sitting at 2.84 million tokens. The most notable surge came between July 11 and 12, with a visible jump in balance just before the token price hit local highs NEAR $16.

Top 100 addresses now hold 654.73 million LINK, up slightly from earlier in the week. Exchange balances dropped 1.51%, supporting the view that LINK is moving to self-custody or cold wallets. The price of LINK surged almost 18% over the past week, which shows that crypto whales have been accumulating.

This hints at renewed optimism.

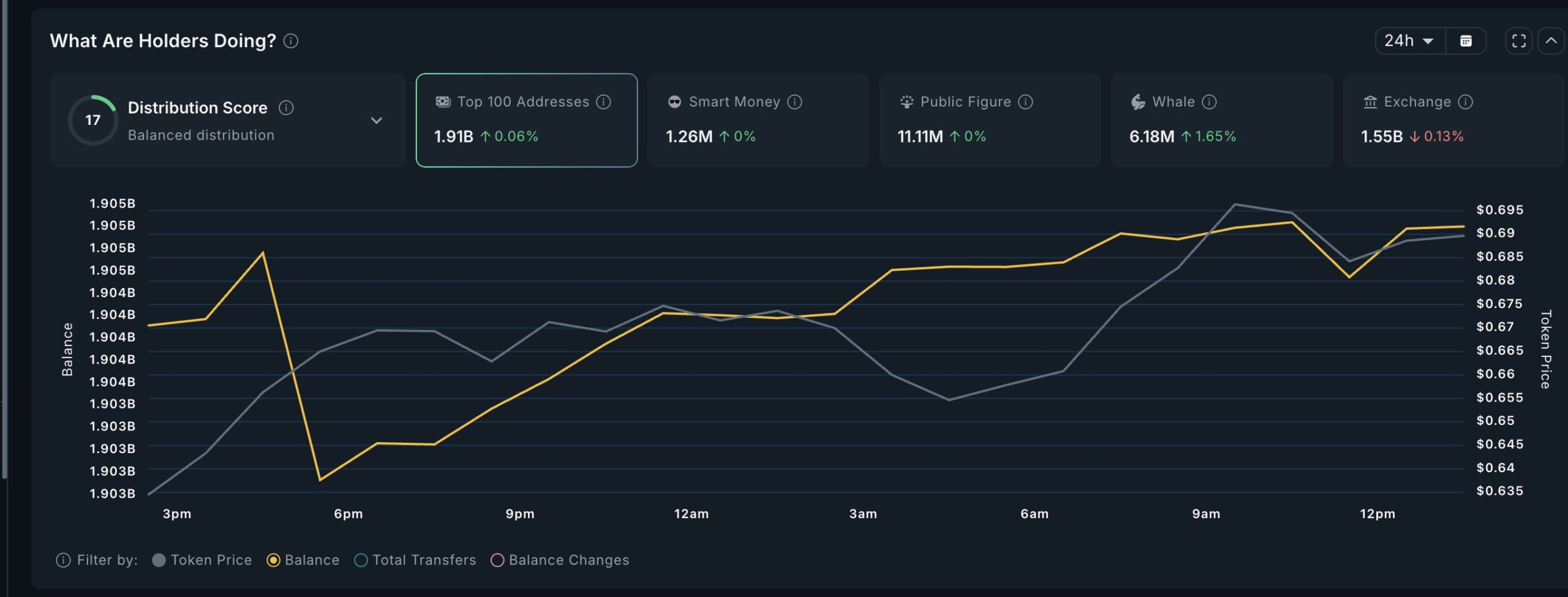

Curve DAO (CRV)

CRV’s crypto whale wallets added 1.65% more tokens, taking total holdings to 6.18 million. Though the shift is small, the pattern is consistent across the last 24 hours; the yellow balance line shows a steady climb throughout the night and into the morning of July 14.

The top 100 wallet holdings increased slightly by 0.06%, suggesting large holders are gradually re-accumulating. CRV’s price climbed toward $0.69, up almost 7% day-on-day, in line with the whale accumulation patterns.

Curve specializes in stablecoin swaps, offering low fees and deeper liquidity: traits that attract big money looking for a hedge when inflation data is due, like the U.S. CPI release tomorrow.

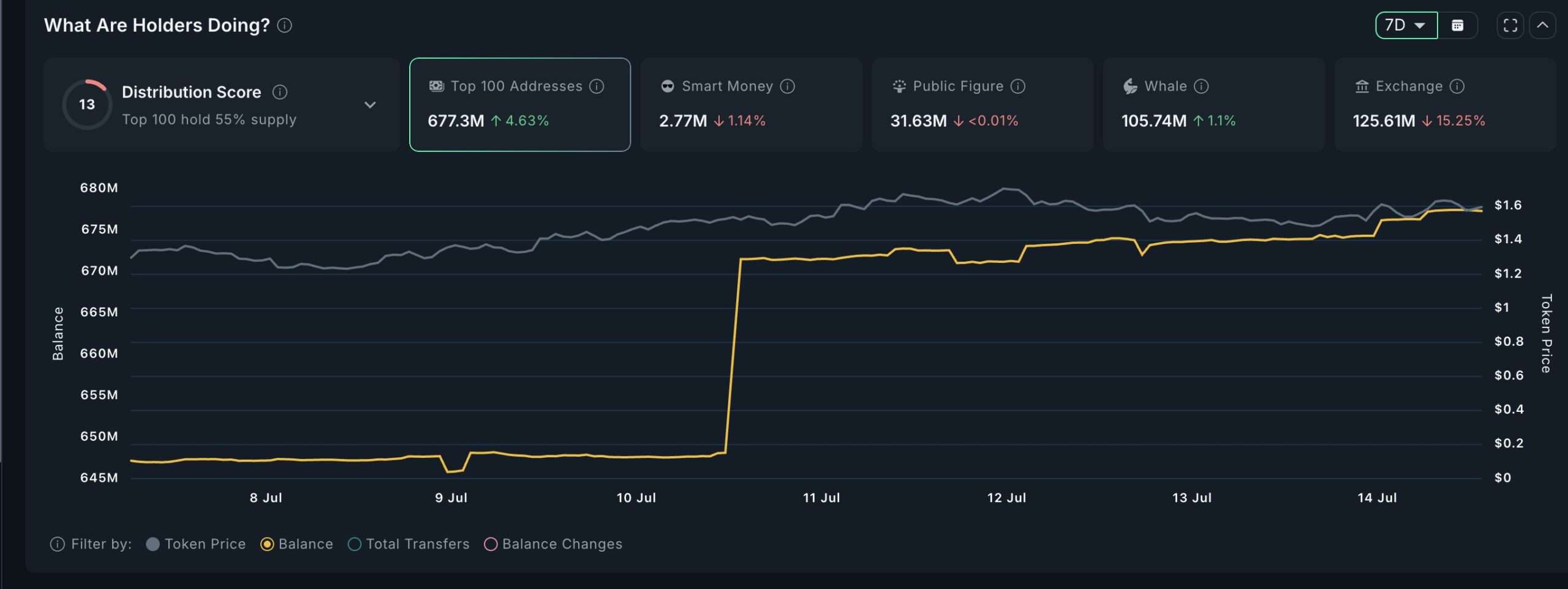

Honorary Mention: SPX6900 (SPX)

The SPX6900 token, often viewed as the sector index for meme coins, showed a 1.1% rise in crypto whale holdings, and top 100 wallets added 4.63% more tokens this week. While smaller in scale compared to the others, the directional flow adds weight to the broader meme coin rotation narrative.

The token price moved closer to $1.60, and the inflow pattern from July 10–13 shows coordinated entry points.

Even with CPI-driven caution, this quiet uptick in SPX hints that some traders are still betting on the meme coin supercycle to continue, especially if inflation data favors risk-on sentiment.