🚀 Bitcoin Rockets to $118K, Obliterates Records with $1.25B Liquidation Carnage

Bitcoin just rewrote the playbook—again. The king of crypto didn't just break resistance at $118,000; it napalmed the derivatives market with a record-shattering $1.25 billion liquidation event. Leveraged traders? Obliterated like a meme coin in a bear market.

Blood on the charts—and Wall Street's watching

This isn't just another ATH. The sheer velocity of the move turned over-leveraged positions into kindling—proof that crypto markets still eat 'risk management' for breakfast. Meanwhile, traditional finance bros are stuck explaining why their gold ETFs yielded 3% this year.

The new math: volatility = opportunity

Every double-top pattern, every 'overbought' RSI warning—none of it mattered. Bitcoin's liquidity furnace burned hotter, leaving algorithmic traders scrambling to update their 'historical models' (read: crystal balls).

Cynical footnote: Somewhere in Connecticut, a hedge fund manager is still trying to short BTC with your pension fund.

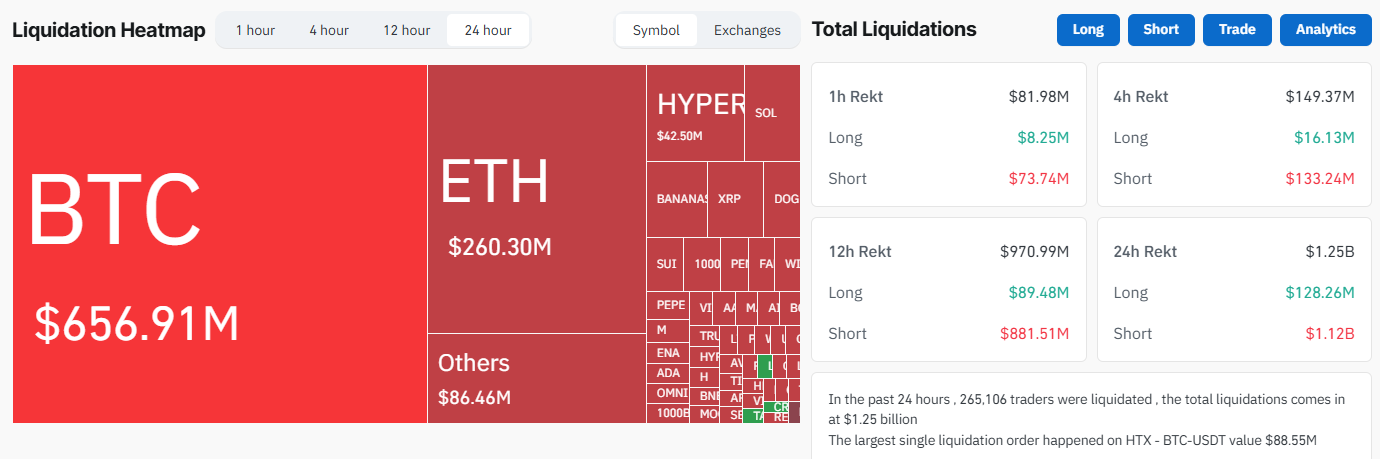

More Than $1.25 Billion Liquidated, 90% Were Short Positions

According to liquidation data from CoinGlass, total market liquidations exceeded $1.25 billion over the past 24 hours. Out of that, $1.12 billion came from short positions. Bitcoin alone saw over $656 million in liquidations.

“In the past 24 hours, 265,106 traders were liquidated. The total liquidations come in at $1.25 billion,” CoinGlass reported.

This suggests that traders had heavily bet on a market correction once bitcoin passed $112,000. But that correction never happened.

One clear example is James Wynn, a well-known trader who frequently uses high leverage on Hyperliquid. According to Lookonchain, Wynn’s Leveraged short position on BTC was fully liquidated in under 12 hours, and he lost $27,921.63.

In addition, Byzantine General, an advisor at Velo, reviewed data from several exchanges and concluded that this might be the biggest short squeeze on Bitcoin in years.

“This is the biggest BTC shorts liquidation event in years,” he said.

More Liquidations May Be Coming as Open Interest Hits ATH

Liquidations could grow even larger in the coming days. Open Interest (OI), which reflects the total value of futures contracts, just reached a new all-time high this July.

Total crypto market OI has now surpassed $177 billion, the highest level on record. Bitcoin’s OI alone has hit $78.6 billion, another record. This shows intense interest from traders in the current market.

These new highs indicate that the market is in an extremely sensitive phase. High OI shows that many traders are using heavy leverage. Even a small price swing in Bitcoin could trigger massive losses.

Trader Sentiment Shifts from Short to Long

Market sentiment is also shifting. As BTC price rises, traders are increasingly moving from short positions to long ones, betting that the rally will continue.

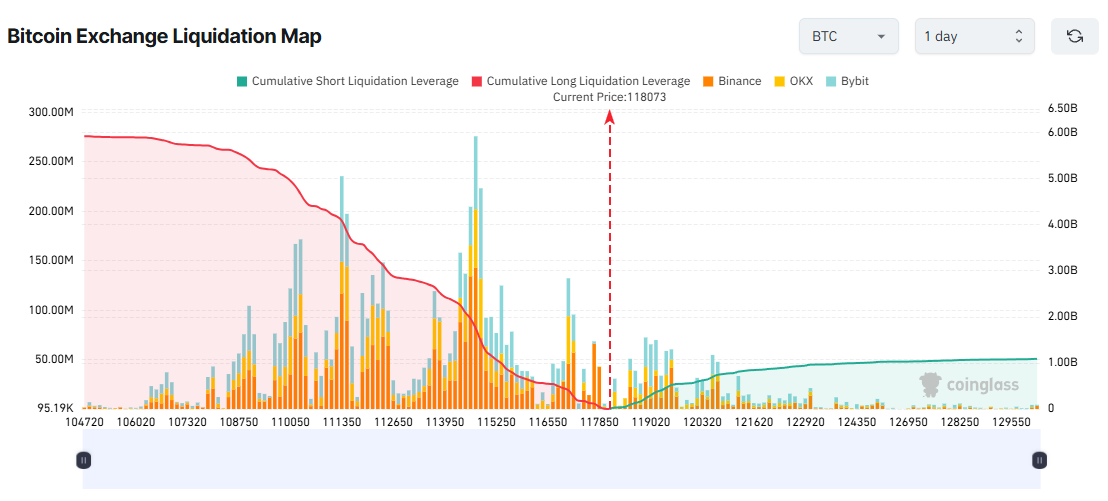

Coinglass liquidation heatmap shows that cumulative long liquidations (shown in red on the left) on major exchanges now outweigh short liquidations (in green on the right). Analyst Joe Consorti warned of risks in this setup.

“Long liquidation leverage now outnumbers short leverage 10:1 in this range. Be careful out there,” Consorti said.

This shift suggests that Bitcoin and altcoins’ recent rally has convinced traders to change their expectations. However, this Optimism comes at a cost. A surprise news event or sudden volatility could still trigger major losses.