Bitcoin Whales Swallow $5.7B Sell-Off, Propel BTC to Record Highs

Whale appetite defies gravity—again.

While paper hands panicked, crypto's megaholders snapped up billions in BTC like it was a Black Friday fire sale. The result? A textbook V-shaped recovery that left shorts scrambling and chartists speechless.

Market mechanics 101: When whales eat dips, retail gets crumbs.

The $5.7 billion absorption proves institutional FOMO now drives this market more than any whitepaper or Elon tweet. Forget 'number go up'—this is algorithmic capital plowing through resistance levels like a Wall Street bulldozer.

Funny how these 'decentralized' assets keep getting rescued by centralized money. Almost like... nah, couldn't be.

Bitcoin Holders Sell, Whales Hold

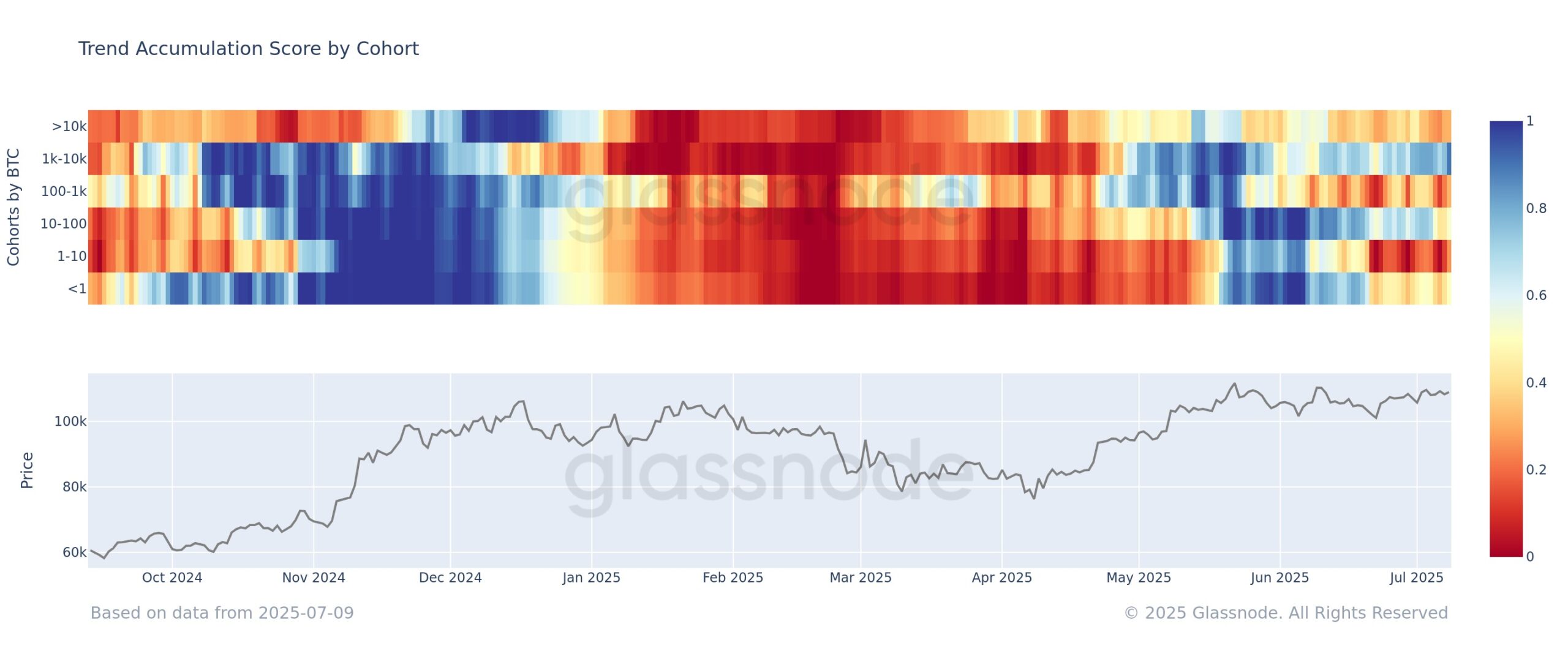

The current market sentiment reveals that different cohorts of Bitcoin holders are in distribution mode. Retail holders, particularly those with 1–10 BTC, have been selling, contributing to the increased supply on the market. This behavior has driven some price volatility.

However, the notable exception has been entities holding between 1,000 and 10,000 BTC. These whales are in accumulation mode, a behavior that contrasts sharply with the broader selling trend. Their approach is methodical and non-emotional, ensuring stability in Bitcoin’s price despite retail holders’ sales.

Whales have long been the stabilizing force in Bitcoin’s market. Unlike smaller holders who react to short-term fluctuations, large bitcoin holders typically follow a strategic, long-term outlook.

Their resilience has been key in supporting Bitcoin’s value, especially during times when retail sellers are driving price dips. As a result, whales have helped prevent a significant decline in price, providing a steady foundation for the recent surge.

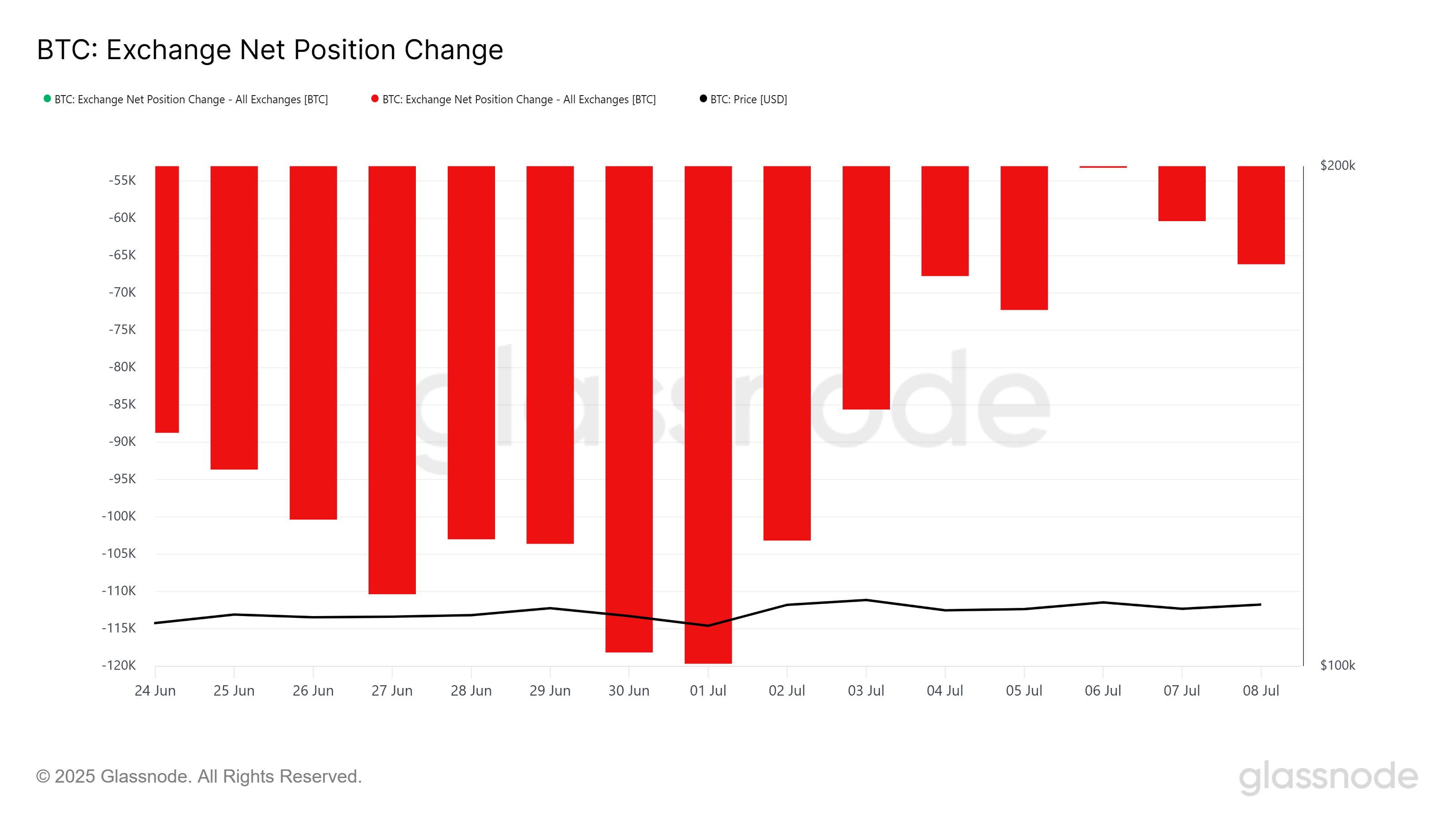

This is also visible in the change in the net position of exchanges, which tends to influence the macro momentum behind Bitcoin. Since the beginning of July, over 52,048 BTC, worth approximately $5.7 billion, have been sold to exchanges.

This heavy selling pressure WOULD typically drive the price down, but the impact has been offset by whales who have kept a strong hold on their Bitcoin positions. The net effect of these actions has allowed Bitcoin to maintain its upward trajectory, with bullish sentiment being reinstated.

BTC Price Forms New High

Bitcoin’s price has recently formed a new ATH, nearly reaching $112,000. This marks the first ATH in over a month and a half and has reinvigorated investor confidence. The latest price movement signals that the bullish trend is alive, with many expecting continued gains as Bitcoin builds support at higher levels.

At the time of writing, Bitcoin is trading at $111,183, aiming to secure $110,000 as a critical support floor. If BTC can hold this level and sustain the upward momentum, it may have another shot at breaching $112,000 and setting a new ATH. This could be the catalyst for further price appreciation, with strong demand expected to drive the market forward.

However, if investors begin to sell heavily, even the whales may not be able to counter the selling pressure. Should Bitcoin fall below $110,000, it could retrace to $108,000 or lower. A sustained drop past this level would invalidate the current bullish thesis.