3 US Crypto Stocks Primed for Explosive Moves in July 2025

Wall Street's playing catch-up with crypto again—these stocks bridge the gap between TradFi and the decentralized future.

1. The Miner Defying Bitcoin's Gravity

While BTC consolidates, one NASDAQ-listed rig operator keeps printing cash—analysts whisper about hidden reserves.

2. The Exchange Outpacing Coinbase

Forget the blue-chip darling. This compliance-first platform quietly tripled institutional inflows last quarter.

3. The Blockchain Infrastructure Bet

Every Fortune 500's 'web3 strategy' needs plumbing. This stock sells the shovels during the gold rush.

Just remember: when traditional finance finally 'gets' crypto, they'll still take 20% in management fees.

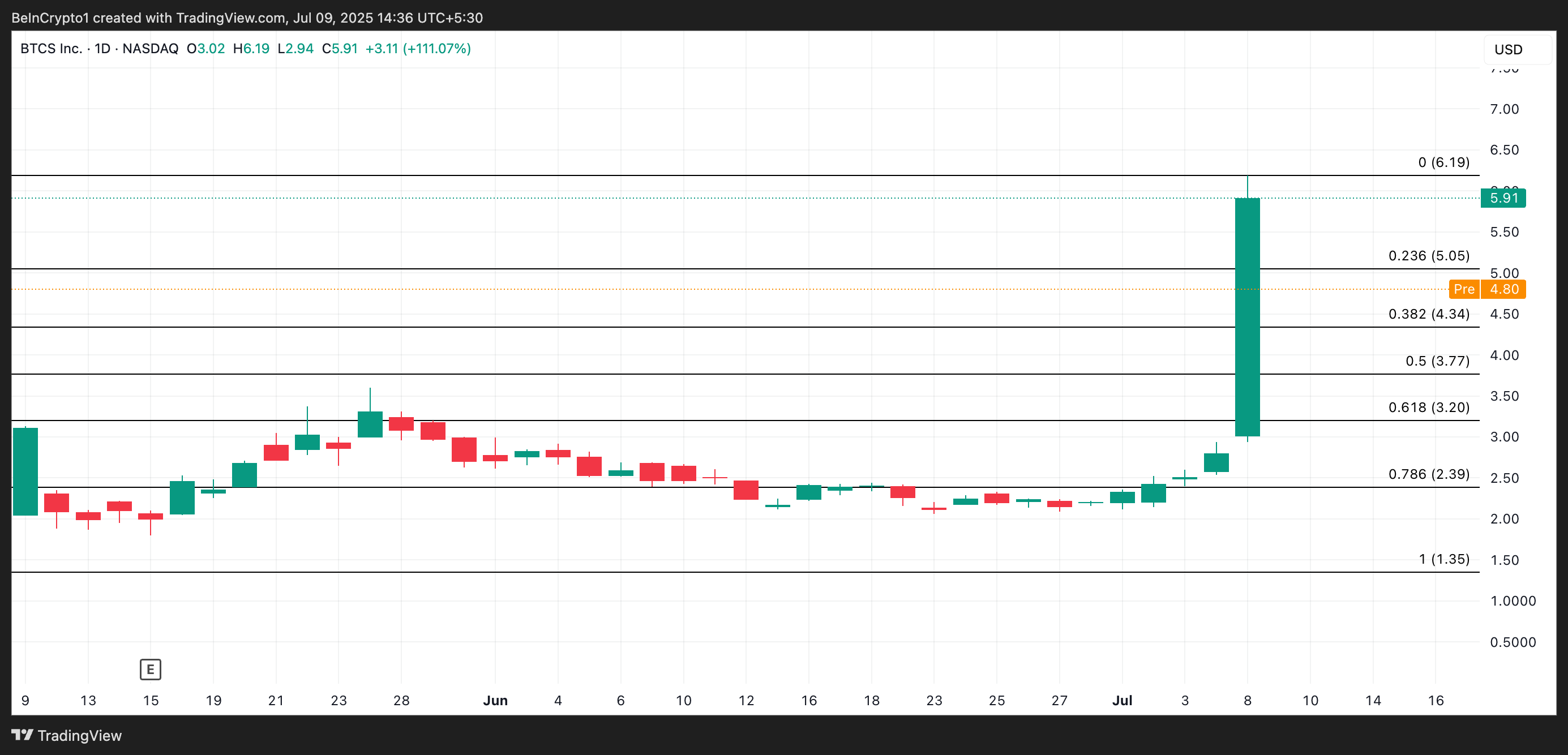

BTCS (BTCS)

BTCS shares surged 108.93% to close at a three-year high of $5.91 on Tuesday after the company announced a bold initiative to raise $100 million in 2025 to acquire Ethereum. The Maryland-based blockchain infrastructure company said the MOVE reinforces its long-term vision to become the leading publicly traded firm focused on Ethereum.

The company plans to use a hybrid DeFi-TradFi capital formation model—including ATM equity sales, convertible debt, on-chain borrowing via Aave, staking rewards, and block-building through Builder+—to minimize dilution while maximizing ETH accumulation and shareholder value.

The price of BTCS hovers around $4.80 during pre-market trading today. If demand surges at market open, the stock could attempt to rally back above yesterday’s close.

However, if bullish momentum fades, it risks slipping below $4.34 support

CleanSpark (CLSK)

CLSK climbed 2.38% to close at $11.60 in the latest session, following a bullish operational update released on Monday.

In a July 7 press release, the company announced it reached a major milestone in June 2025—achieving 50 EH/s of operational hashrate, becoming the first Bitcoin miner to do so entirely through fully self-operated infrastructure. This marks a 9.6% month-over-month increase in hashrate and improved fleet efficiency to 16.15 J/Th.

The bitcoin miner also revealed that it has secured 179 megawatts of additional power under contract, supporting future hashrate growth of over 10 EH/s.

During pre-market trading, CLSK is priced at $11.63. If buying continues when the market opens, the stock could rally toward $12.96.

However, if buy-side pressure fades, it could fall below support at $11.42.

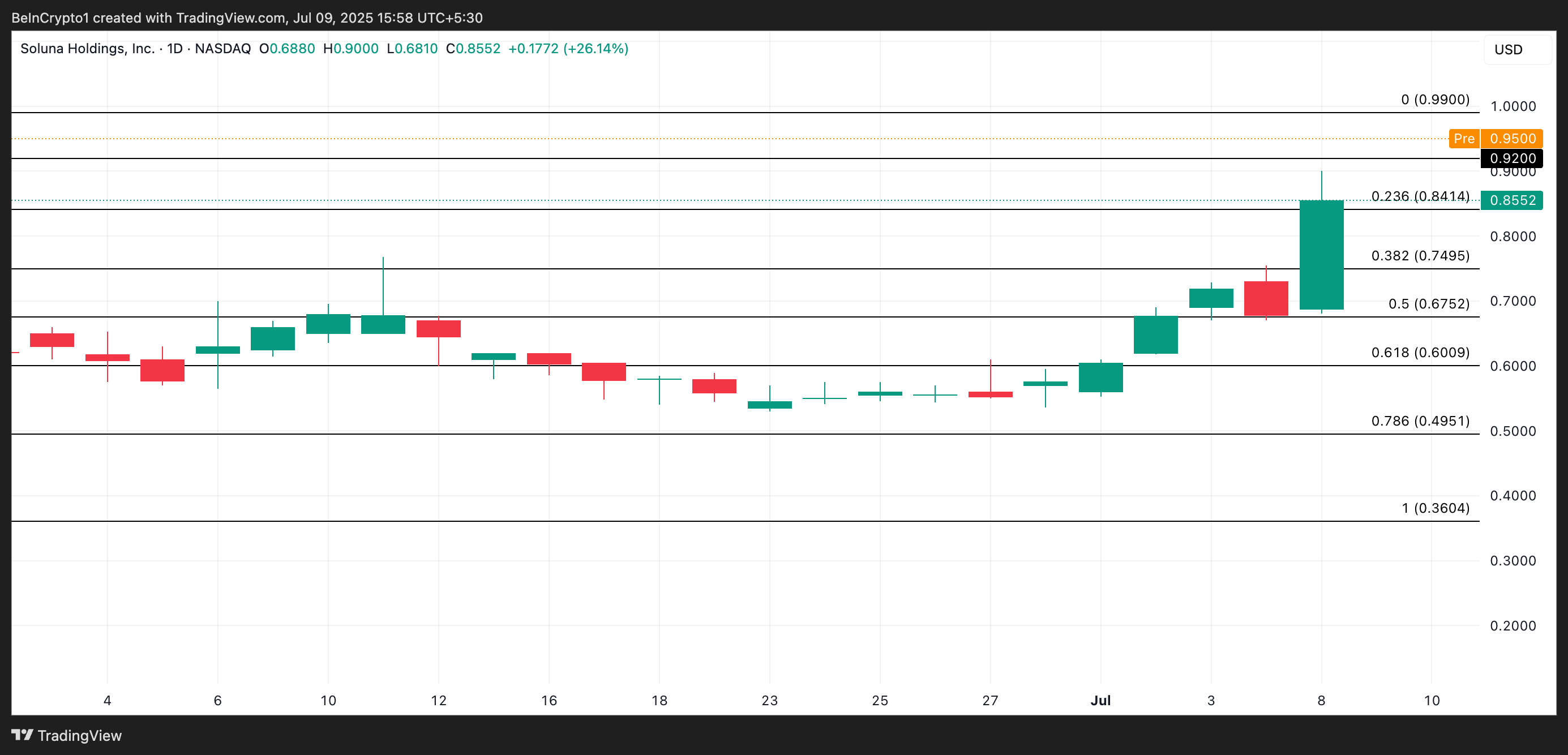

Soluna Holdings (SLNH)

Soluna Holdings shares climbed 27.88% to close at $0.85 on Tuesday after the company announced a major expansion at its Texas-based Project Dorothy 2 site.

The company revealed a 30 MW hosting deal with a leading Bitcoin miner—its third such agreement with this long-term customer. With the new contract, Project Dorothy 2 is now fully marketed and contracted, solidifying Soluna’s capacity buildout.

As of the pre-market session today, SLNH trades at $0.95. If the bulls maintain control at the opening bell, the stock could test resistance NEAR $0.99.

However, if buyers fail to sustain demand, the price could slip below $0.92.