Scammers Exploit OP_RETURN in Bold Attempt to Claim Mt. Gox’s Lost 80,000 Bitcoin Haul

Crypto grifters are at it again—this time weaponizing Bitcoin's OP_RETURN function to 'prove' ownership of Mt. Gox's legendary 80,000 BTC stash. Because nothing says 'trust me bro' like an arbitrary data field.

How the scam works

They're embedding fake claims in blockchain transactions, banking on the chaos of Mt. Gox's unresolved collapse. The 80,000 BTC figure isn't just plucked from thin air—it's the actual amount that vanished in the exchange's 2014 implosion.

Why this matters now

With Mt. Gox creditors finally seeing movement in repayments, opportunists are flooding the zone. The OP_RETURN field—normally used for legit data storage—becomes a free-for-all when scammers get creative.

Finance's dirty little secret: Where there's unclaimed money, there's always a queue of 'rightful owners' holding upside-down PDFs of their 'proof.'

How OP_RETURN Is Helping Scammers Target Mt. Gox’s Missing 80,000 Bitcoin

The Mt. Gox collapse in 2014 resulted in 850,000 BTC going missing. Although 140,000 BTC were recovered for creditor repayments, wallets like 1Feex have remained untouched until now.

Whoever is behind the scam is likely banking on two outcomes. The first is collecting sensitive user data by masquerading as the wallet’s custodian.

Second, they are laying the groundwork for a legal claim to ownership, perhaps similar to past lawsuits aimed at forcing Bitcoin developers to hand over access to lost coins.

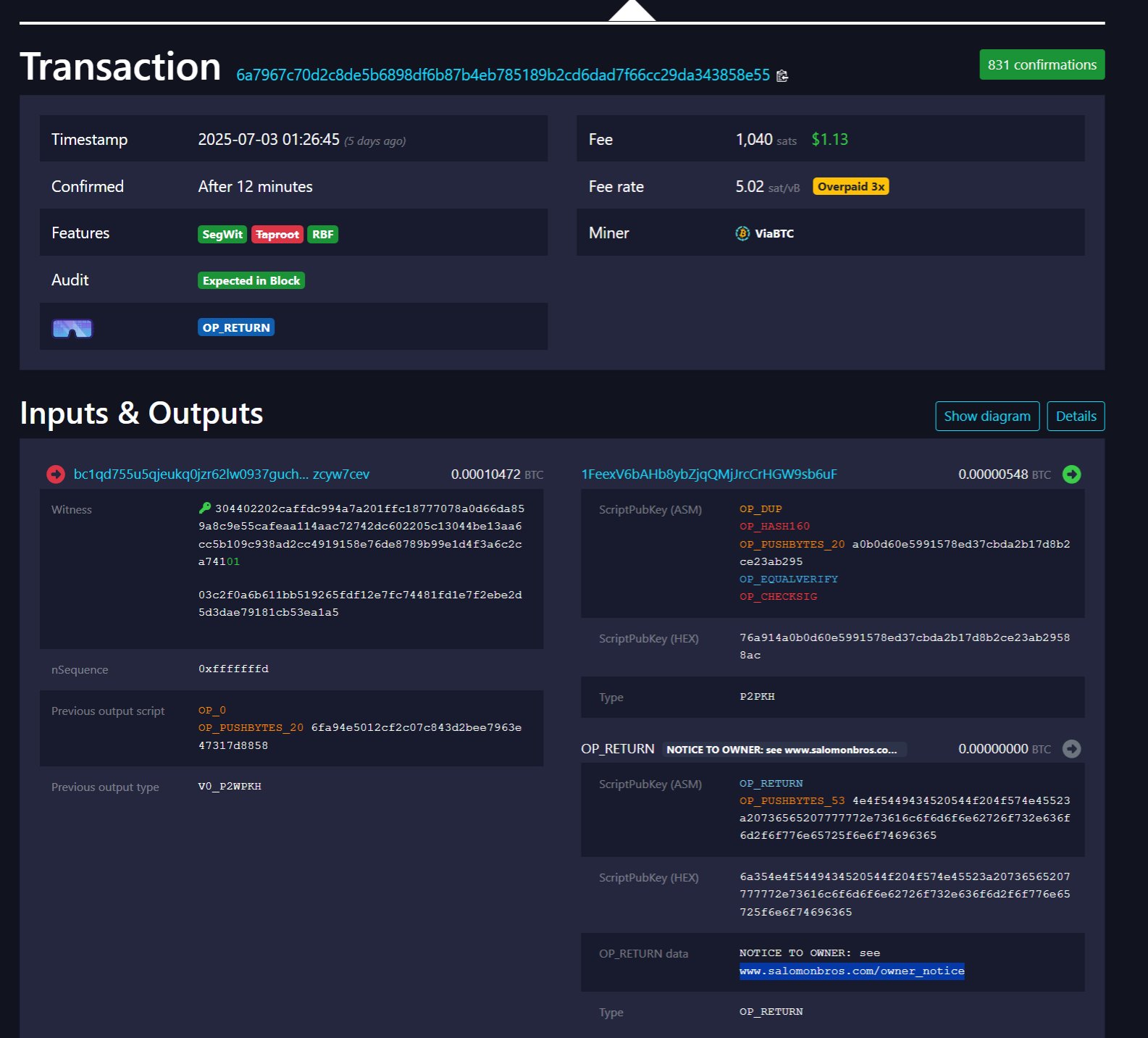

Going by the latter, BitMEX Research has uncovered a scam. It involves sending small transactions to legacy bitcoin addresses using the OP_RETURN field. This is a space in the Bitcoin blockchain meant to store arbitrary data.

One such transaction to the dormant 1Feex address contains a message directing viewers to a suspicious website.

“NOTICE TO OWNER: see www.salomon[]bros.[]com/owner_notice,” BitMEX Research revealed.

The linked website represents a client who has taken “constructive possession” of the wallet and is seeking to identify a “bona fide owner.”

It reportedly claims affiliation with the historic Wall Street firm Salomon Brothers. However, BitMEX researchers state that the links are fake.

“Do NOT fill in this form,” the team warned.

BitMEX Research team also pointed out that the site seeks personal identification data under pretenses. The scam attempts to cloak itself in legal legitimacy.

scam? or hack, with legal cover?https://t.co/UMByMICG8z

— matthew sigel, recovering CFA (@matthew_sigel) July 8, 2025Matthew Sigel, Head of Digital Assets Research at VanEck, reflects broader concerns in the crypto community, especially regarding the scam’s legal framing.

Why Calvin Ayre’s Legal History Resurfaces in OP_RETURN Ownership Controversy

Users immediately mentioned Calvin Ayre, a longtime Bitcoin SV proponent and controversial figure. Ayre has reportedly funded legal actions asserting ownership over dormant or stolen Bitcoin.

Calvin funded a case where ownership of this exact address was claimed. Legal action was taken against the Bitcoin developers over it

— BitMEX Research (@BitMEXResearch) July 8, 2025However, some users took this insight with a pinch of salt, cautioning against slander. More closely, one user asked for proof that Ayre has run phishing-style scams.

I’m not following. So there is a shady website listed in the op return that could collect personal information?

Why WOULD somebody who moves 80k coins participate in such a scam? There is a short list of people this could be?

Notwithstanding, the fact remains that OP_RETURN is now being weaponized in a gray zone between spam and pseudo-legal attacks.

Meanwhile, this scam arrives amid renewed controversy over OP_RETURN limits in Bitcoin Core. BeInCrypto reported on a proposal to restrict OP_RETURN data to 80 bytes under Bitcoin Core v0.30. The report cites network bloat and spam concerns.

While the limit remains under review, the new wave of scams may give fresh weight to the argument for tighter controls.

“OP_RETURN outputs greater than 83 bytes will increase significantly, UTXO bloat will keep getting worse and there will be more garbage on chain. This is going to age like a bad tattoo,” self-proclaimed Bitcoin expert Jimmy Song said at the time.

Further, in late April, BeInCrypto reported a rift among Bitcoin CORE developers triggered by Peter Todd’s proposal to restrict OP_RETURN even further.

Critics argued that it would stifle innovation and off-chain use cases. Meanwhile, others supported it to reduce attack surfaces and abuse.

Also, Bitcoin should not follow an "L2 centric" roadmap. It's actually what killed Ethereum.

Bitcoin is money and should be focused on that.

![]()

![]()

However, as this new exploit demonstrates, OP_RETURN is now being twisted for phishing schemes. Bad actors prey on legal uncertainty and dormant assets.

In this case, billions are at stake as the line between technical freedom and exploitable vectors is again under scrutiny. The interest comes as OP_RETURN transactions anchor these messages immutably into Bitcoin’s ledger.