Solana Crushes Ethereum and Tron: Rakes in $271M Q2 Revenue—Proof That Speed Pays

Move over, legacy chains—Solana just schooled the competition with a quarter that'd make even Wall Street raise an eyebrow. $271 million in pure network revenue? That's not just growth; that's a middle finger to scalability skeptics.

How Solana Outpaced the Giants

While Ethereum was busy counting gas fees and Tron recycled its usual hype, Solana's lean, mean throughput machine turned blockchain into a revenue rocket. No 'future upgrades' needed—just raw, unfiltered performance.

The Cynical Take

Let's be real: in a market where 'institutional adoption' often means VC exit liquidity, Solana's numbers are that rare beast—actual usage, not just speculative vaporware. (But don't tell the ETH maxis—they're still waiting for sharding.)

Solana Revenue Rockets Past All Chains for Third Straight Quarter

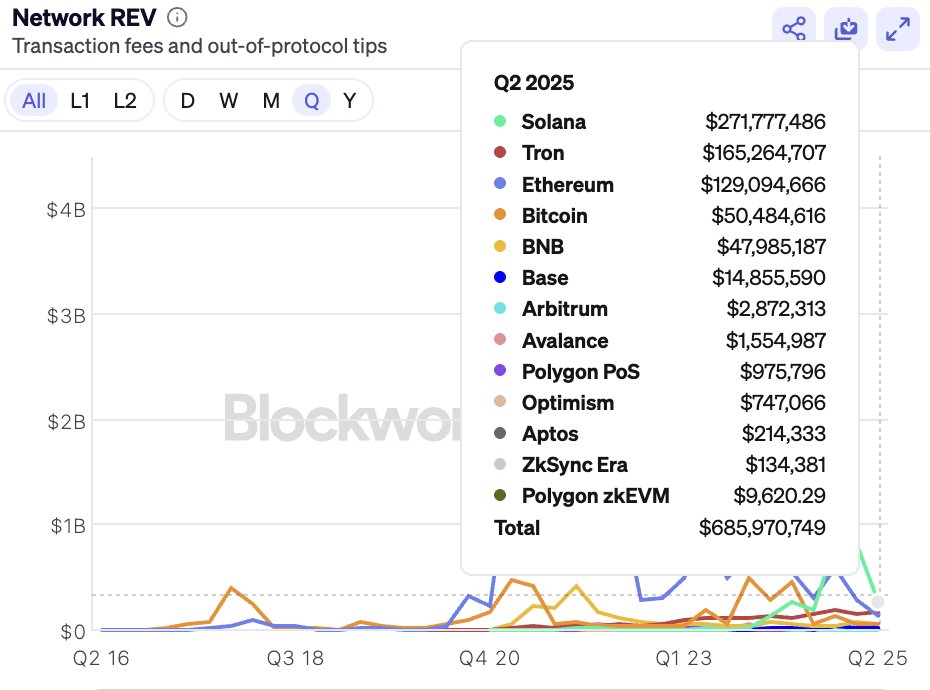

According to Blockworks data, this marks the third consecutive quarter that Solana (SOL) has outperformed all Layer-1 (L1) and Layer-2 (L2) chains. Specifically, Solana’s network revenue significantly outpaced competitors like Tron ($165.26 million), ethereum ($129.09 million), and Bitcoin ($50.48 million).

This growth highlights Solana’s superior strength and strengthens investor confidence in its blockchain ecosystem.

Revenue charts from Q2 2016 to Q2 2025 show Solana maintaining steady growth, while other chains like Ethereum and Tron experienced sporadic spikes but lacked consistency. Total network revenue reached $685.97 million, with Solana accounting for nearly 40%, demonstrating its competitive edge.

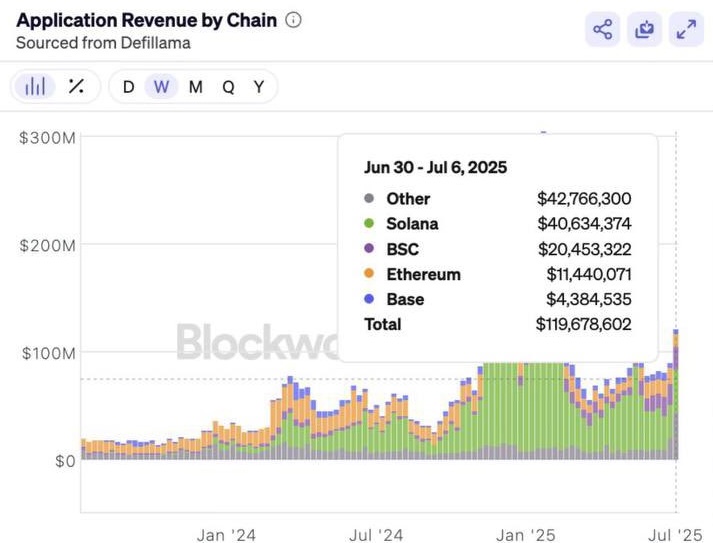

Decentralized applications (DApps) on solana have also led in weekly revenue for 10 consecutive months, proving that Solana excels in infrastructure and as an ideal developer environment.

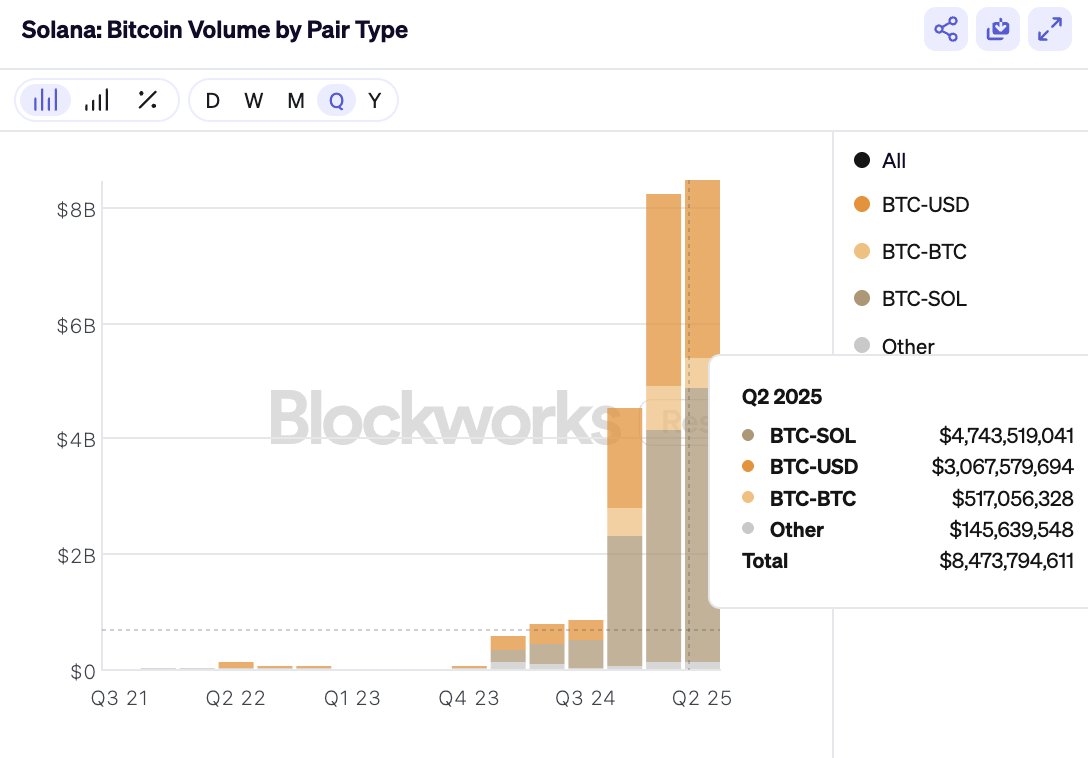

Another highlight is Solana’s record-high Bitcoin trading volume in Q2 2025, reflecting increased cross-chain trading activity and its pivotal role in decentralized finance (DeFi).

The total value of tokenized real-world assets (RWA) on Solana rose to $418 million, a new all-time high. At this level, Solana trails Aptos (APT), which reached $538 million.

With fast transaction processing speed and low costs combined with the explosion of meme coin launchpads such as LetsBonk or Pump.fun, Solana continues to attract attention from both individual and institutional investors.

However, analyst RuzTV on X suggests SOL’s price may correct to $143 before a strong breakout. SOL is currently trading at $151.

Charts from Blockworks also indicate that chains like Arbitrum and Optimism are gradually closing the gap. Maintaining its leading position will require Solana to innovate continuously to stay ahead of competitors like Ethereum, which is improving its L2 scalability.