Aptos RWA Explosion: How Private Credit Propelled the Network into Crypto’s Elite Top 3

Move over, legacy finance—Aptos just rewrote the rulebook. The blockchain's real-world asset (RWA) sector is eating traditional markets alive, with private credit deals single-handedly catapulting the network into the global top three.

The quiet ascent turned into a stampede when institutional money started chasing yield the old-fashioned way—just with blockchain's ironclad transparency. No more squinting at spreadsheets in bank vaults; every coupon payment and collateral swap lives on-chain.

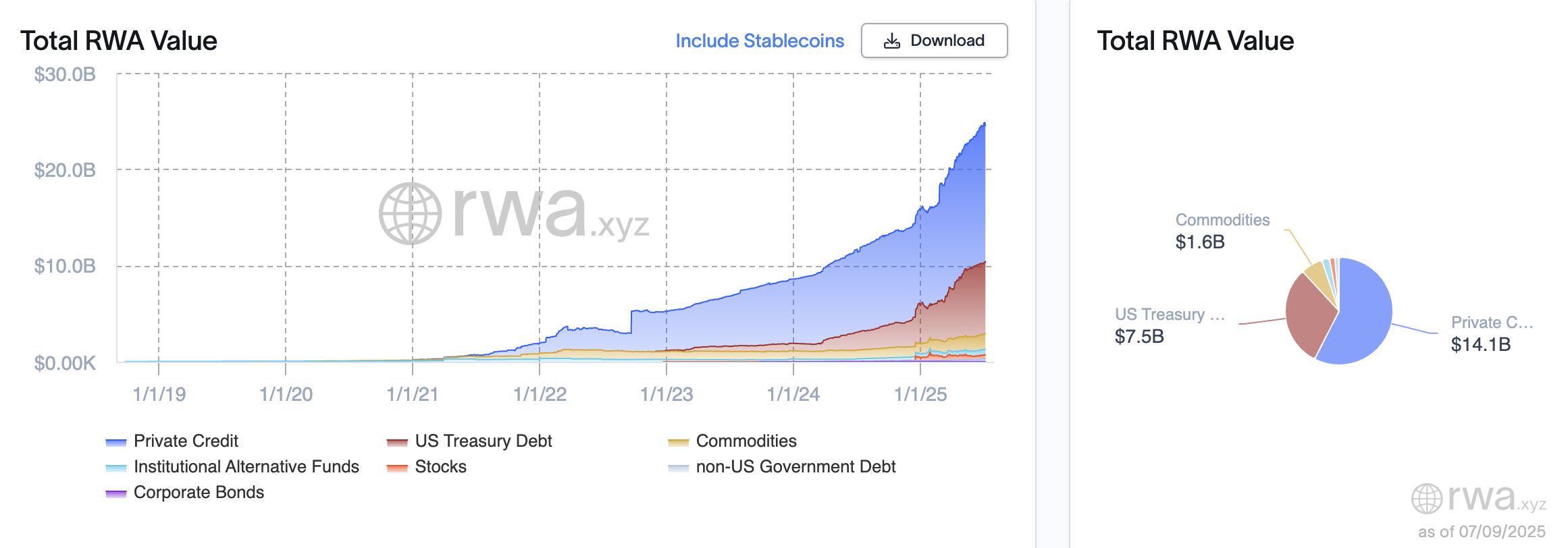

Private credit's dark magic? Turning illiquid debt into programmable assets. Suddenly, corporate loans get the same frictionless trading as memecoins—with slightly less volatility. The irony? Wall Street's 'boring' debt instruments became crypto's hottest tickets.

One hedge fund manager quipped: 'We finally found something safer than stablecoins—actual revenue-generating businesses.' Ouch.

As Aptos cements its position, the real question isn't about rankings—it's how long before TradFi admits they're running second place in their own game.

Dominating RWA with Strategic Focus and Stablecoin Surge

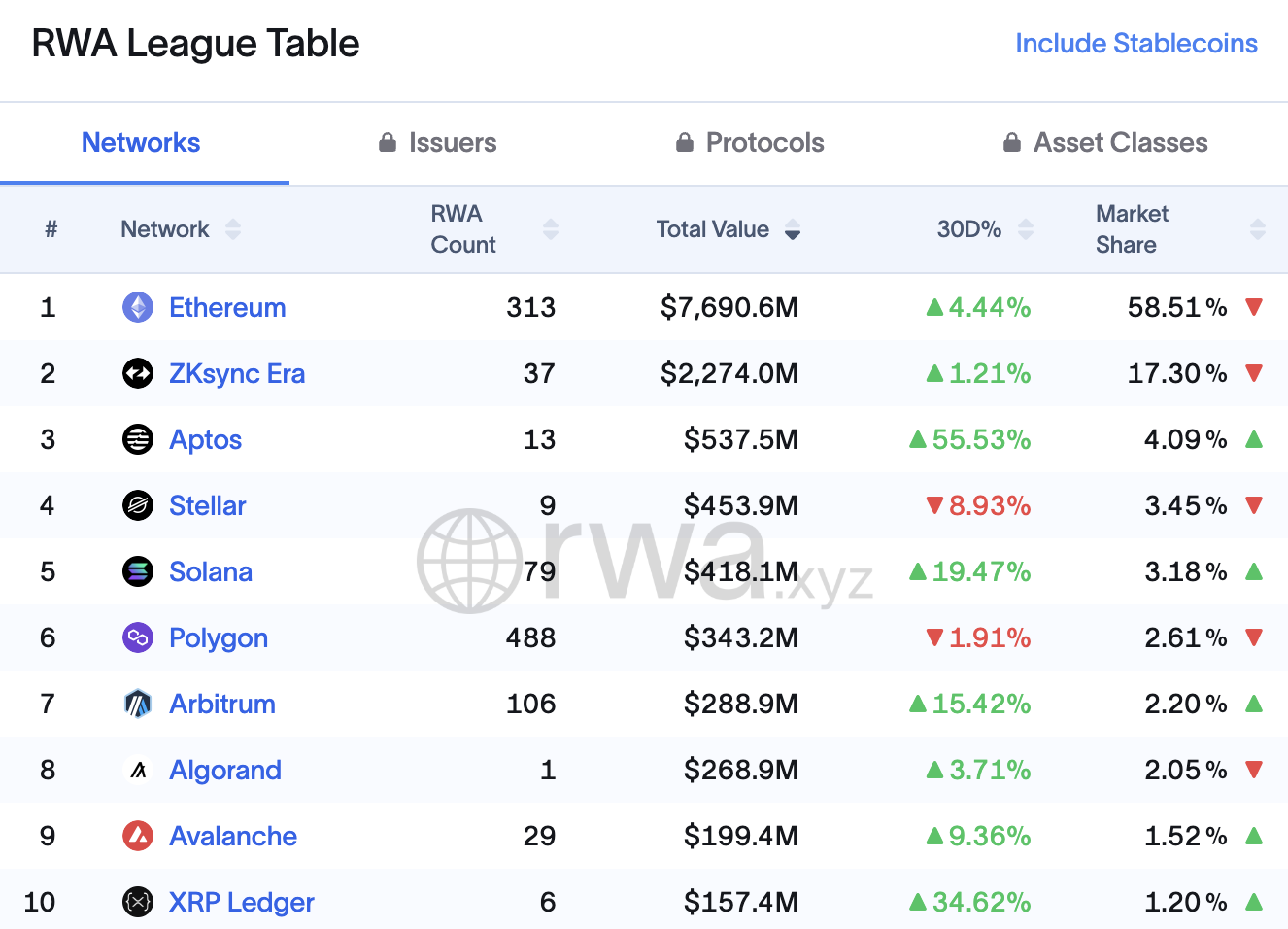

According to RWA.xyz’s data, Aptos’ total value of locked assets (RWA TVL) surged 56.28% over the past 30 days, reaching $538 million.

This includes nearly $420 million from private credit, $86.93 million from U.S. Treasury bonds, and $30.72 million from institutional alternative funds. These figures highlight strong breakthroughs and Aptos’ growing role in integrating real-world assets into decentralized finance (DeFi) ecosystems.

The RWA rankings show Aptos surpassing competitors like stellar ($454 million), Solana ($418 million), and Polygon ($343 million), achieving remarkable value with just 13 RWA projects. This growth is driven by a strategy prioritizing high-impact projects, as noted in a Redstone Finance report, rather than spreading resources thin.

“Aptos’s strategy centers on targeting fewer, high-impact partnerships that bring significant value onchain. By emphasizing institutional alignment and offering a technically, cost-effective alternative to Ethereum, Aptos positions itself as a compelling alternative for developers and asset managers looking to escape the limitations of EVM-based networks.” Redstone’s report stated.

This approach optimizes efficiency and attracts significant capital, especially in personal credit. Personal credit, accounting for nearly 78% of RWA TVL, paves the way for decentralized lending opportunities.

Another key factor is the rapid growth of stablecoins on Aptos, with over $1.2 billion in native stablecoins in circulation. Combined with ultra-low transaction fees (under $0.0008, dropping to $0.00055 per Aptos), the network is an ideal choice for global payment solutions, from payroll integration to cross-border commerce. Fast processing speeds and low latency enable Aptos to build flexible DeFi rails that appeal to retail and institutional investors.

However, Aptos’ success comes with challenges. Sustaining a 56.28% growth rate requires continuous innovation and transparency in RWA project management. Compared to ethereum ($7,590 million) and ZKsync Era ($2,274 million), Aptos still faces a significant gap, but its focused strategy and strong infrastructure position it to close this gap in 2025.