BlackRock’s IBIT Nears Satoshi-Level Holdings: 700K BTC Stash Sparks Market Frenzy | US Crypto News

Wall Street’s quiet coup is complete—BlackRock just parked its tanks on crypto’s lawn. The asset manager’s Bitcoin ETF (IBIT) now holds 700,000 BTC, edging uncomfortably close to Satoshi’s legendary stash. Guess who’s playing the long game now?

### The Institutional Land Grab

While retail traders were busy chasing memecoins, BlackRock methodically accumulated enough Bitcoin to crash entire economies. IBIT’s holdings now rival the reserves of micro-nations—and they’re not stopping. Cue the ‘number go up’ theology.

### When ETFs Eat the World

700,000 coins. That’s 3.3% of all Bitcoin that will ever exist, locked up by a single trad-fi product. The irony? The same institutions that mocked crypto now can’t get enough of its scarcest asset. The ultimate ‘if you can’t beat them, tax them’ play.

### The Punchline

As BlackRock quietly builds a Bitcoin war chest that would make Satoshi blush, one question remains: When the suits own all the supply, do we finally admit they were right all along? Or just start mining Monero?

Crypto News of the Day: BlackRock is 62% Away from Surpassing Satoshi’s Bitcoin Stash

BlackRock’s spot bitcoin ETF, IBIT, has reached a new milestone, accumulating 700,000 BTC.

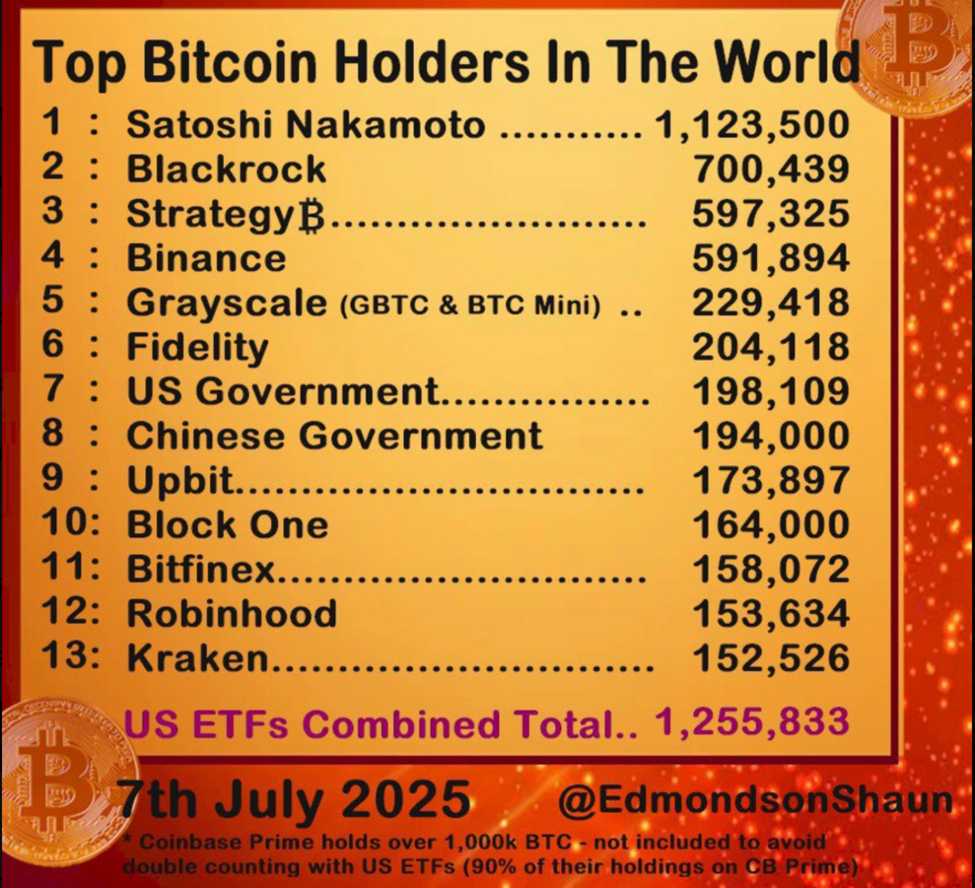

Lauding this momentum, ETF analyst Eric Balchunas indicates that this puts the world’s largest asset manager within striking distance of overtaking Satoshi Nakamoto as the largest single holder of Bitcoin.

“BlackRock holds 700,000 BTC now, and is 62% of the way there to passing Satoshi as world’s largest single holder of bitcoin,” wrote Balchunas.

Satoshi’s estimated holdings stand at roughly 1.1 million BTC, untouched since Bitcoin’s inception. At its current clip, gobbling up 40,000 BTC per month, or about 1,300 BTC daily, IBIT is now 62% there.

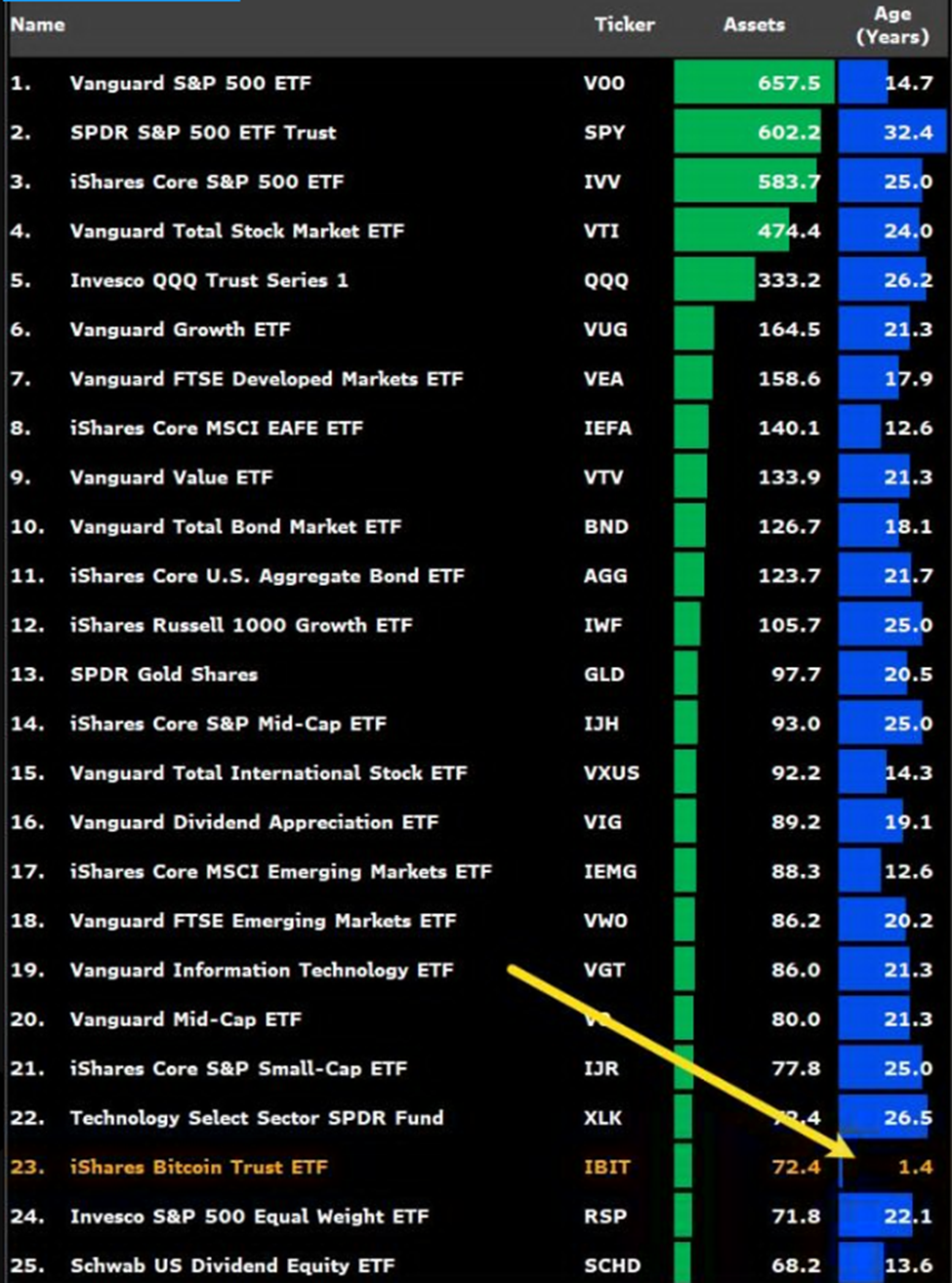

If the pace holds, IBIT is on track to surpass Satoshi by May 2026, just two years after its launch. That fast growth makes IBIT the youngest member among the top 25 largest ETFs globally by assets under management, at only 1.4 years old.

Recently, Balchunas highlighted IBIT as BlackRock’s third-highest revenue-generating ETF out of 1,197 funds, and it is only $9 billion away from being the first.

$IBIT is now the 3rd highest revenue-generating ETF for BlackRock out of 1,197 funds, and is only $9b away from being #1. Just another insane stat for a 1.5yr old (literally an infant) ETF. Here's Top 10 list for BLK (aside, how about the forgettable $IWF at top spot, who knew?) pic.twitter.com/T4xdIA2Rea

— Eric Balchunas (@EricBalchunas) July 3, 2025BeInCrypto reported that IBIT had already become BlackRock’s most profitable ETF by fee revenues, overtaking its $624 billion S&P 500 fund (IVV).

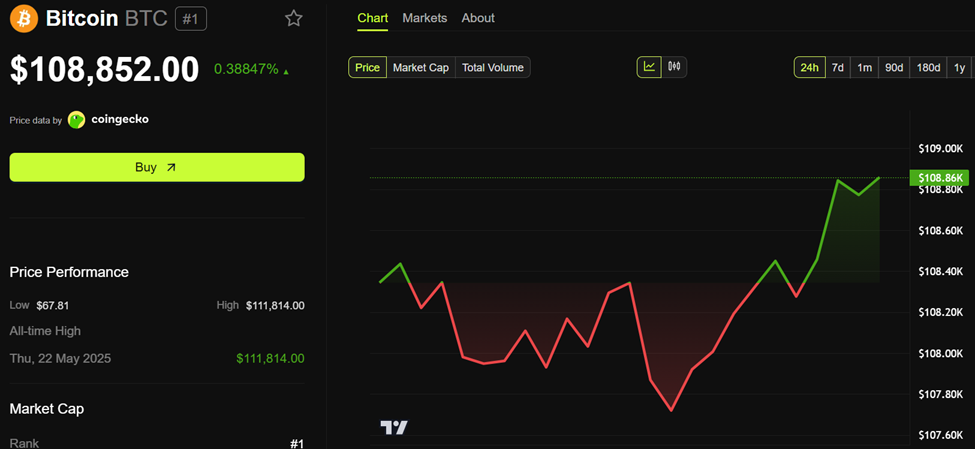

With Bitcoin trading over $108,000, institutional appetite remains high, and BlackRock is leading the charge.

While ETF providers have already collectively surpassed Satoshi’s stash, IBIT may soon hold that title individually. Such a milestone would add to the growing dominance of BlackRock in the crypto investment arena.

However, while BlackRock’s rise marks a maturing market, others see it as a centralized threat, contradicting Bitcoin’s original decentralized ethos.

There once was a dream that was Bitcoin… this is not it.

ETFs

MSTR

Blackrock

Governments

"Institutional grade" custodians![]() pic.twitter.com/NuFwvq6mJD

pic.twitter.com/NuFwvq6mJD

![]()

In the same tone, others also see rising institutional dominance as a detractor for Bitcoin volatility, with annualized realized volatility decreasing since 2018.

“I still wish Bitcoin never got an ETF. It moves slower than most stocks and has lost it’s appeal to trade. We replaced exciting volatility with boring stability, just what the suits and institutions wanted,” analyst IncomeSharks said recently.

Notwithstanding, Bitcoin’s largest holders are no longer pseudonymous coders but Wall Street giants.

In a related development, reported in a recent US Crypto News publication, Bitwise CIO Matt Hougan predicted an explosive second half (H2) of the year for ethereum ETFs.

The Bitwise executive forecasted up to $10 billion in inflows into Ethereum ETFs in H2 2025.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Experts predict public companies could soon buy up all newly issued ETH since The Merge.

- Japan’s 30-year bond yield breaches 3%—is this the black swan for Bitcoin?

- Bit Digital sells Bitcoin for Ethereum, and the stock jumps 18% after the strategic shift.

- Crypto giants seek banking licenses: A betrayal of decentralization or a natural evolution?

- EU approves 53 crypto firms under MiCA while Tether and Binance miss out.

- President Trump’s tariff letters trigger a 4.5% dip in the crypto market, and stocks follow suit.

- Everyone expects the PI price to crash, but hidden RSI divergence hints at a surprise reversal.

- Ethereum (ETH) is rising, but on-chain indicators say $5,000 can wait.

- Sei Network sets new record as TVL soars over $626 million.

- Why Europe is key for Gemini in 2025 — Mark Jennings points to the UK, France, and Italy.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 6 | Pre-Market Overview |

| Strategy (MSTR) | $395.67 | $400.04 (+1.10%) |

| Coinbase Global (COIN) | $357.10 | $361.30 (+1.18%) |

| Galaxy Digital Holdings (GLXY) | $19.69 | $20.20 (+1.58%) |

| MARA Holdings (MARA) | $16.75 | $16.99 (+1.43%) |

| Riot Platforms (RIOT) | $11.55 | $11.72 (+1.47%) |

| Core Scientific (CORZ) | $14.83 | $14.90 (+0.47%) |