Algorand Dominates Tokenized Stock Boom with 66% Market Share – The New Wall Street?

Move over traditional exchanges—Algorand just ate Wall Street's lunch. The blockchain platform now commands a staggering two-thirds of the tokenized stock market, leaving legacy finance scrambling to catch up.

How a blockchain outmaneuvered Wall Street at its own game

While bankers were busy arguing about blockchain's viability, Algorand's pure-proof-of-stake architecture quietly became the backbone for stock tokenization. No middlemen, no 9-to-5 trading windows—just global markets running 24/7 on cryptographic rails.

The 66% stranglehold proves institutional money's dirty secret: they'll preach about 'real finance' all day, but when it comes to efficiency? They'll dump their own grandmothers for better settlement times.

Tokenization isn't coming—it's already here. And Wall Street's either getting on chain or getting left behind.

Algorand Holds Over 66% of The Tokenized Stock Market Share

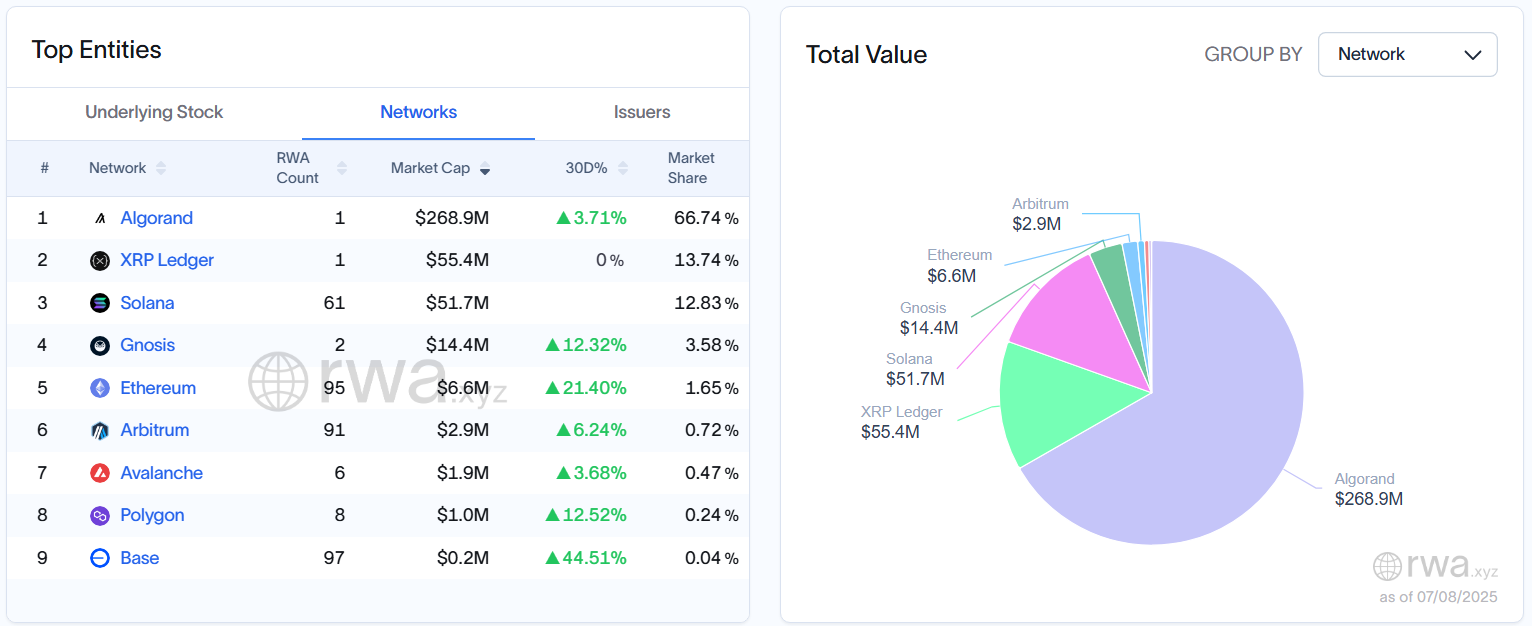

According to data from RWA.xyz, the market cap of tokenized stocks increased by 19% over the past month, reaching more than $400 million.

Remarkably, holders surged by 1,845%, rising to over 48,000. Monthly active addresses soared by over 8,800%, reaching almost 38,000. This data shows growing interest from the investor community.

It appears Algorand commands over 66% of the market share, with a total value of more than $268 million. This confirms its position as the leading network in this emerging trend.

This LAYER 1 network could gain a first-mover advantage by capturing market share early. Other institutions might consider Algorand as one of the first options.

“We heard that 2025 will be the year of tokenized stocks. Algorand is already winning in this vertical. The future on other chains is often the present on Algorand,” the Algorand Foundation declared.

Yet, if we look deeper into the data, Algorand hosts only one RWA asset, similar to XRP Ledger. Meanwhile, other chains like Base, Ethereum, and Arbitrum support over 90 assets.

That single asset is EXOD stock from Exodus, provided by Securitize, and it has been tokenized on Algorand since mid-2024. At the time, this marked an important milestone, showing the integration of blockchain technology with traditional finance (TradFi).

However, since then, this chain has not tokenized new assets. Currently, the market cap of tokenized EXOD stock accounts for 77% of the entire tokenized stock market. This reveals that the tokenized stock space remains in its early stages and lacks diversity.

Experts predict that the trend of tokenizing stocks will grow rapidly, and the market share could shift quickly.

“Every stock, every bond, every fund, every asset—can be tokenized. If they are, it will revolutionize investing,” Larry Fink, Chairman of BlackRock, said.

Other networks like ethereum and Layer-2 solutions such as Polygon and Base are actively expanding their reach. Although the market cap of tokenized stocks on these chains isn’t as large as Algorand’s, the data shows they’re growing much faster, between 12% and 44%.

This raises questions about whether Algorand can keep its leading position as competition intensifies.