🚨 Bitcoin’s Coin Days Destroyed Just Exploded – Here’s Why Analysts Are on High Alert

Bitcoin's blockchain just coughed up a smoking gun. The Coin Days Destroyed (CDD) metric—a telltale sign of long-term holders moving coins—has spiked to levels that historically precede major price movements. Is this the calm before the storm?

The sleeping giants are stirring

When Bitcoin's CDD surges, it means previously dormant coins are suddenly on the move. July's spike suggests whales might be positioning for something big—whether that's a sell-off or accumulation phase remains to be seen.

Market psychology at play

These spikes often correlate with local tops or bottoms. The last time CDD jumped this dramatically was before the 2024 halving rally. Coincidence? Traders aren't betting their yacht on it.

Wall Street's watching (and probably overcomplicating it)

While analysts scramble to build fancy models, the truth is simpler: Bitcoin's network metrics still offer the purest market signals—if you know how to read them. The rest? Just noise to justify those 2% management fees.

One thing's clear: when Bitcoin's old money starts moving, new money should pay attention. Whether this is the start of the next bull run or a clever distribution play depends entirely on whose crystal ball you trust.

Bitcoin’s Coin Days Destroyed (CDD) Spike in July

Coin Days Destroyed tracks the movement of Bitcoins that stayed “dormant” for a long time. Analysts calculate the number of Bitcoins moved by the number of days they remained untouched.

This metric matters because it highlights what long-term holders are doing. These investors usually understand Bitcoin’s market cycles well. When CDD jumps, it often means older holders are selling, which many see as a bearish sign.

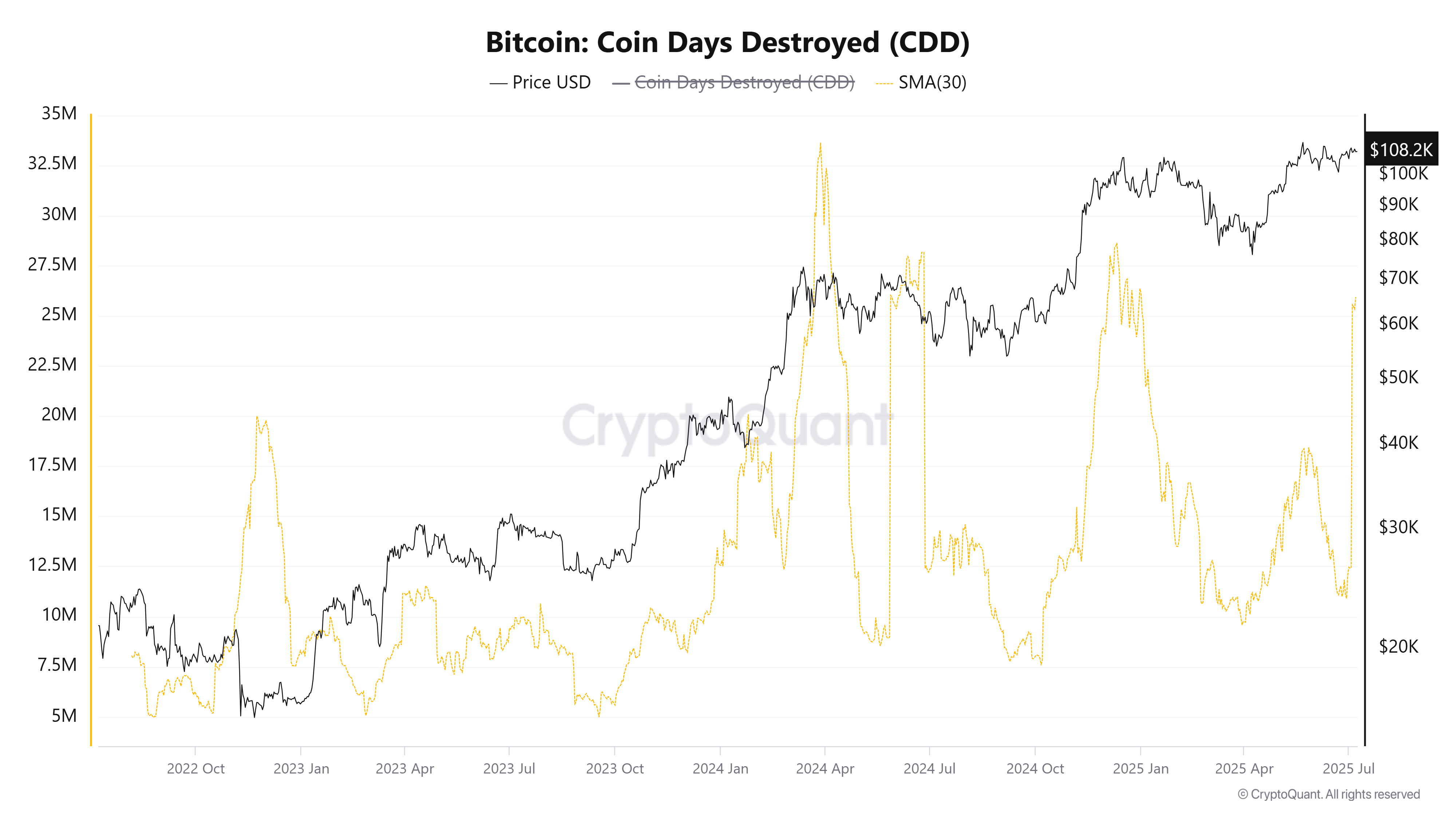

Data from CryptoQuant shows that from 2022 until now, CDD has exceeded 20 million only five times. The previous four instances all coincided with major market downturns. This most recent spike is the fifth instance.

At the beginning of July 2025, a historic transaction took place. 80,000 BTC worth over $8 billion were transferred from a “sleeping” wallet dating back to Bitcoin’s early days (around 2011). According to a report by BeInCrypto, this is considered one of the largest movements ever recorded of coins over ten years old.

The transaction involved eight wallets, each holding 10,000 BTC, and was carried out by an anonymous individual or entity. When these Bitcoins were originally purchased, their total cost was around $7,800 (based on the price of $0.78 per BTC in 2011). This shows the enormous profit the holder has gained.

What Analysts Say

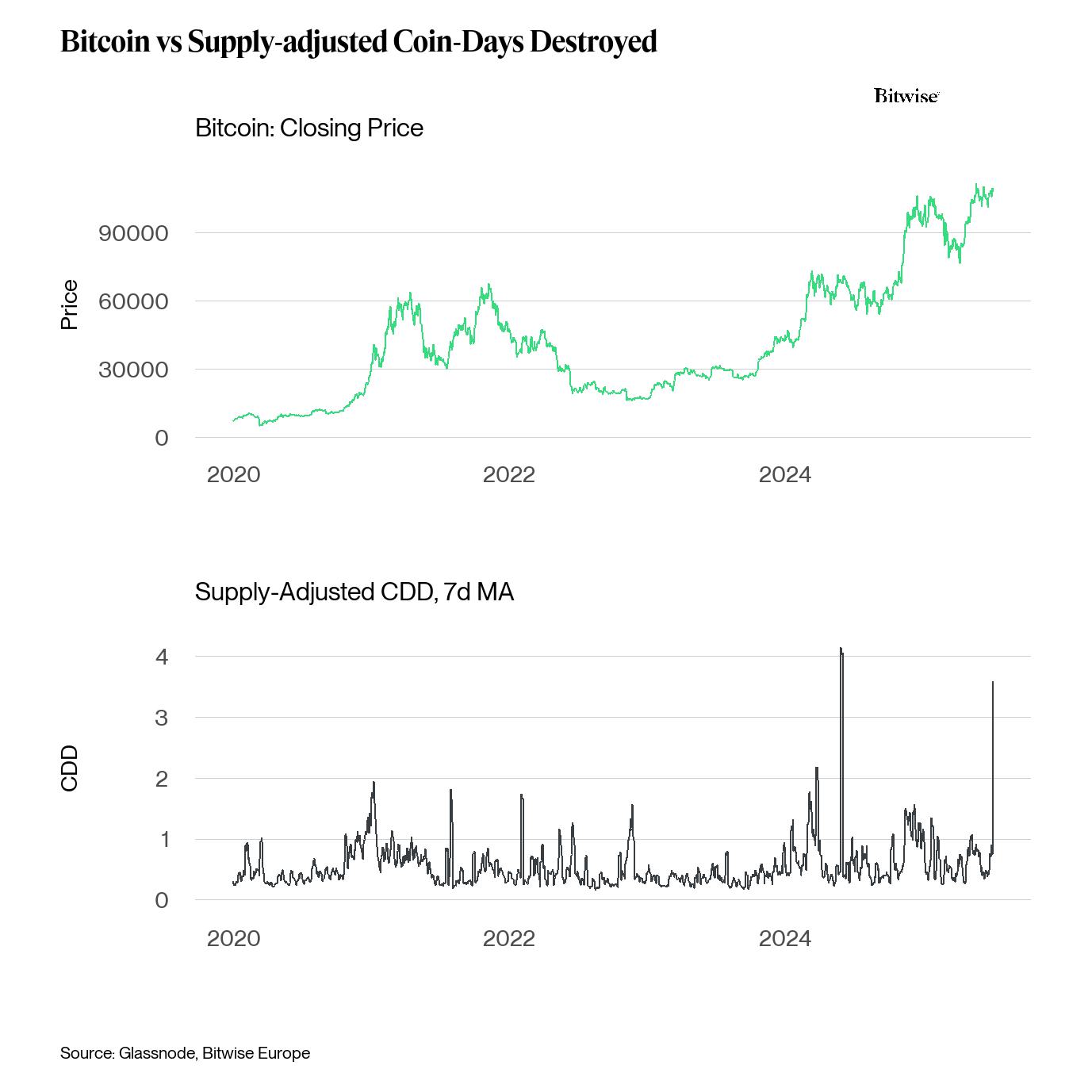

André Dragosch, an analyst from Bitwise, pointed out that this transfer led to the second-largest spike in CDD ever recorded, only behind the event in May 2024.

A Bitwise chart compares Bitcoin’s closing price with supply-adjusted CDD (7-day moving average), clearly showing the correlation. Bitcoin’s price ROSE steadily from 2020 to 2024. Yet peaks in CDD often appeared right before price corrections.

The recent event in July 2025 created an unusually high CDD peak, sparking concerns that the market might soon face a sell-off.

“The transfer of those 80,000 BTC has led to the 2nd highest spike in Coin Days Destroyed (CDD) ever recorded. The movement of large volumes of older coins usually tends to be a bearish signal for Bitcoin,” André Dragosch said.

Additionally, Alex Thorn from Galaxy Research added that other days with high CDD included asset distributions from the Mt. Gox hack and the US government’s recovery of stolen Bitfinex funds. Both of these events led to sharp declines in Bitcoin’s price.

“We haven’t heard the full story on these 80,000 BTC yet… and may never,” Alex Thorn said.

Although there might be reasonable explanations for July’s CDD spike — like wallet restructuring or security improvements — history still shows that Bitcoin often sees significant price drops after similar events.