Sei Network Smashes Records: TVL Rockets Past $626M in Defi Dominance Play

Move over, legacy finance—Sei Network just flexed its DeFi muscles with a gravity-defying surge. The Layer-1 blockchain’s Total Value Locked (TVL) punched through $626 million, leaving skeptics scrambling to update their spreadsheets.

From Zero to Hero (While Banks Still Use Fax Machines)

Sei’s TVL milestone isn’t just a number—it’s a middle finger to sluggish traditional finance. While Wall Street debates yield curves, builders on Sei are deploying capital at speeds that’d give a high-frequency trader vertigo.

The Secret Sauce? Try ‘Actual Utility.’

No vaporware here. Sei’s explosive growth stems from real-world adoption—dApps, liquidity pools, and a user base that actually understands private keys (unlike your uncle who still thinks Bitcoin is a ‘PayPal competitor’).

Cynic’s Corner:

*‘But wait—didn’t Terra’s LUNA also post sexy numbers before imploding?’* Sure. But unlike algorithmic stablecoins, Sei’s growth is backed by something radical: functioning code.

One thing’s clear: while banks roll out ‘blockchain pilots,’ Sei Network is busy rewriting the rules. Buckle up.

Sei Goes Vertical: TVL Skyrockets

According to insights from analyst Kyledoops on X, SEI Network’s TVL has reached a new ATH.

“With more capital flowing in and more on-chain activity picking up, the Sei ecosystem’s clearly pulling in fresh attention,” Kyledoops noted.

An analysis of Sei Network’s TVL chart on DeFiLlama reveals growth since early 2024, escalating from modest levels to nearly $700 million. Compared with other blockchains, SEI’s TVL growth rate is regarded as a “rare case.”

“…but at the same time its TVL grew from $60.8M to $623M in a year. In comparison with other chains, there TVL grew literally by 10-50%, rare cases where more,” shared X user Ronin.

This meteoric rise follows news that Sei Network has received approval from the Japan Financial Services Agency (JFSA), opening the door to the world’s most heavily regulated cryptocurrency market.

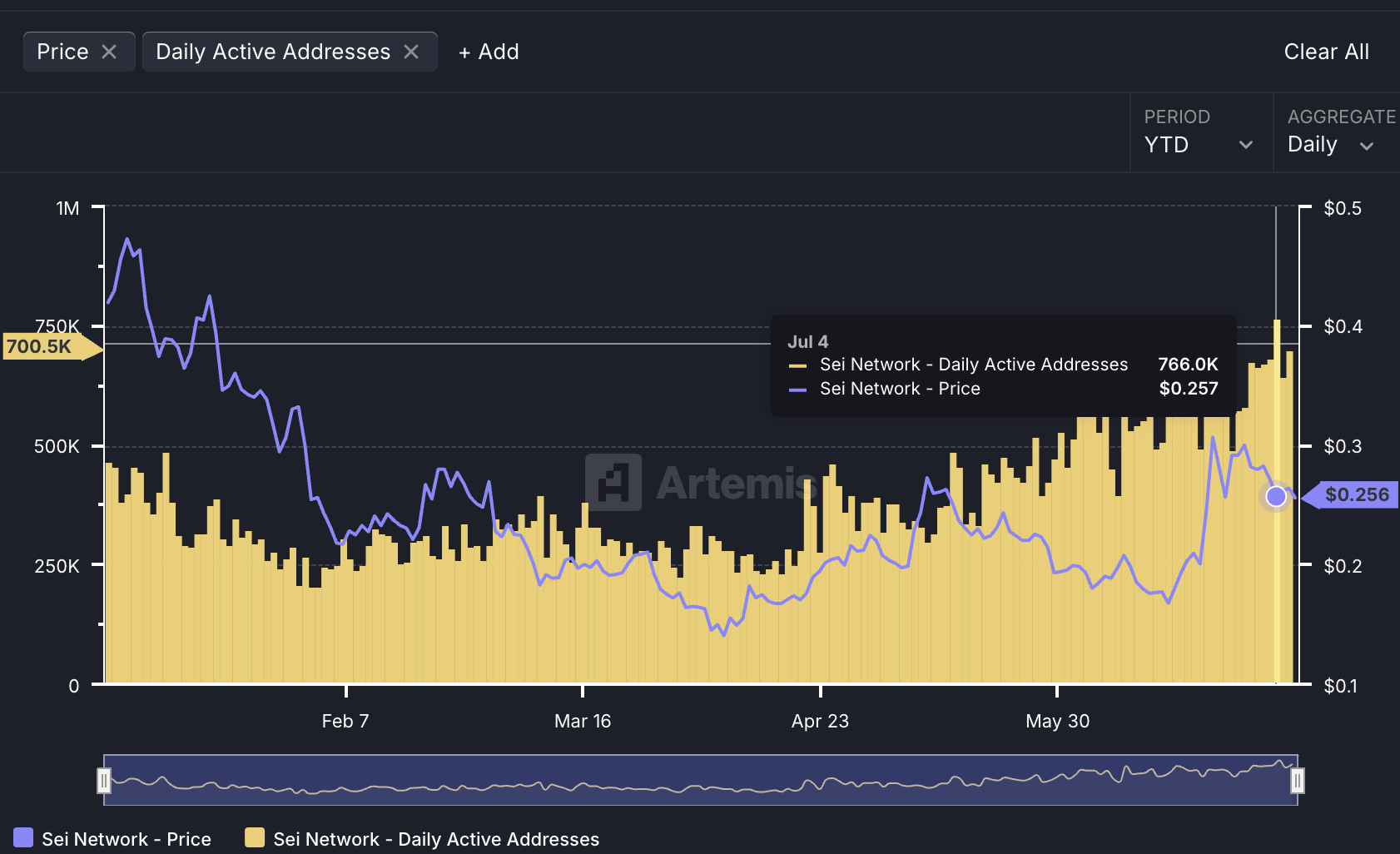

According to Artemis Analytics, this milestone has driven daily active addresses to a two-year peak. The synergy of regulatory approval and heightened on-chain activity has generated substantial momentum, attracting individual and institutional investors.

SEI’s price surged 100% in June, driven by a US government-backed stablecoin pilot, growing institutional interest, and an expanding ecosystem. Recently, Sei Labs proposed SIP-3 to transition the Sei network to an EVM-only model, removing CosmWasm and native Cosmos support.

However, the token has declined by over 78% from its peak in March 2024 and is currently trading at $0.2649. According to an analysis by ChiefraFba on X, the price level of $0.2540 serves as critical support on the 8-hour chart. Should this level fail to hold, SEI may face a correction toward $0.2000.

This situation poses challenges for investors, necessitating vigilant monitoring amid market fluctuations. Nevertheless, with its exceptional TVL growth and regulatory backing from Japan, numerous experts remain optimistic about SEI’s potential for recovery and sustained upward momentum in 2025.