HBAR’s Bullish Divergence Signals Potential Rally—But Can It Overcome Its Fundamental Weaknesses?

HBAR's price action is flashing a classic bullish divergence—just as traders start paying attention. But here's the catch: weak fundamentals might haunt this party before the confetti even drops.

Technical traders are circling, but smart money knows charts don't pay the bills. The real test? Whether HBAR can turn pretty lines on a screen into actual utility—or if this is just another crypto pump waiting for greater fools.

Remember: In crypto, 'fundamentals' is just Wall Street slang for 'things we ignore during a bull run.'

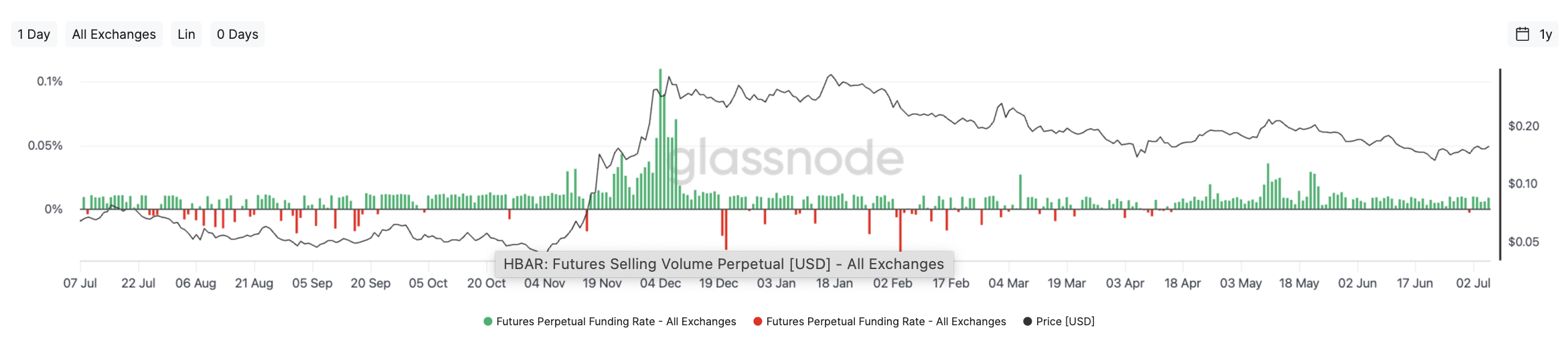

Funding Rates Show Bullish Build-Up, But No Euphoria Yet

Futures traders have been steadily rotating bullish on HBAR, as seen in the rising funding rates across perpetual contracts. Since early June, the majority of candles have stayed green, meaning long positions are paying shorts, a typical sign of bullish bias returning.

The last time HBAR maintained this pattern for an extended stretch was in September–October 2024. That period preceded a brief price rally, which aligns with the current slow upward grind.

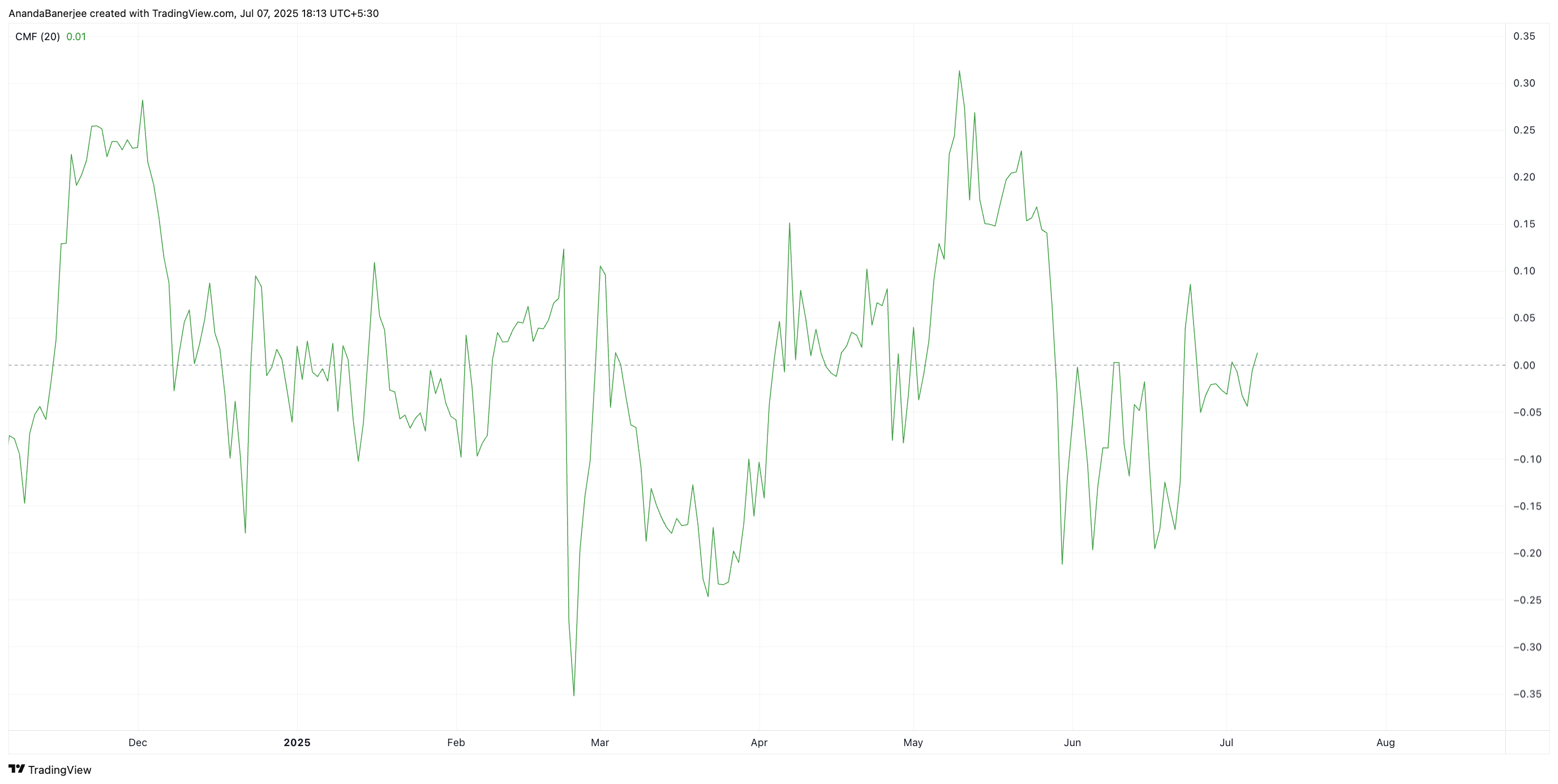

Chaikin Money Flow Crosses Into Positive Zone

For the first time in nearly two months, the Chaikin Money FLOW (CMF) has crossed above the zero line. This indicator, which tracks buying and selling pressure weighted by volume, is often used to validate whether accumulation is genuine or just noise.

The current CMF reading around +0.01 is still marginal, but it breaks a long streak of negative values. That crossover alone doesn’t confirm sustained inflows, but when paired with a strengthening price structure and RSI divergence, it adds a LAYER of technical support.

Development Activity Remains Concerning

While price and derivatives sentiment are turning, Hedera’s development activity continues to trend downward. According to your Santiment chart, the purple line representing development contributions has been on a slow but steady slide since March.

It’s now sitting near its lowest level in six months, indicating fewer updates or visible work on the Hedera ecosystem.

Price Approaches Breakout With RSI Divergence

HBAR is trading just below a descending trendline that stretches from the March high to today’s structure. The token now sits just under the $0.162 resistance, a level that’s been tested three times in the past week but hasn’t yet broken.

What strengthens the bullish case here is the classic RSI divergence. While price action remains mostly flat or slightly down from mid-June, the Relative Strength Index (RSI) has been making higher lows. This gap between momentum and price typically signals a potential breakout.

If the breakout confirms above $0.162, the next resistance lies near $0.178, followed by $0.217. But a rejection here could drag the HBAR price back to $0.143 support, especially if development activity continues to stagnate.