Shiba Inu Bleeds Out—87% of Holders Underwater. Is This the Bottom or the End?

Shiba Inu’s price collapse has left nearly 9 out of 10 investors holding bags of regret. The meme coin’s brutal downturn sparks a familiar question: dead cat bounce or final capitulation?

### The Bloodbath in Numbers

With 87% of addresses now in the red, SHIB’s chart looks like a cliff dive. Retail traders who FOMO’d in during the hype cycles are now learning the oldest lesson in crypto—dogs don’t always fly.

### What’s Next for the Dogecoin Killer?

Technical analysts see two paths: a Lazarus-style recovery if Bitcoin rallies, or a slow bleed into obscurity. Meanwhile, ‘strong hands’ are either averaging down or finally admitting their ‘investment’ was really just a lottery ticket.

### The Silver Lining?

If history repeats, this could be peak pain before a reversal. Or it’s proof that even meme coins need more than Elon Musk tweets and Reddit hype to survive. Either way, Wall Street hedge funds will keep shorting retail sentiment—some things never change.

SHIB Bleeds as 87% of Addresses Now ‘Out of the Money’

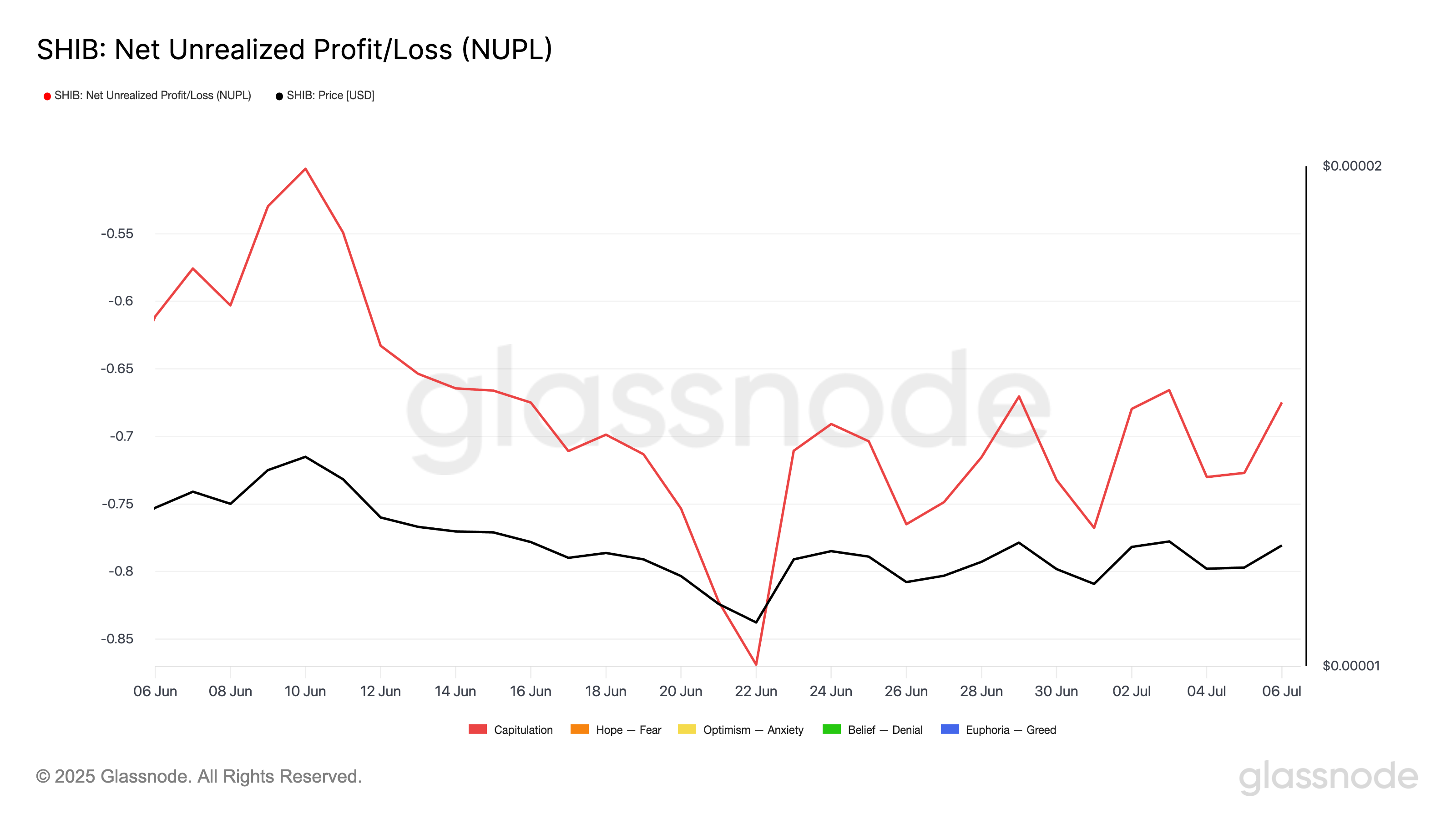

According to Glassnode, SHIB’s Net Unrealized Profit/Loss (NUPL) metric shows that the meme coin is firmly in the capitulation zone.

The NUPL metric measures the difference between all holders’ total unrealized profits and unrealized losses relative to an asset’s market cap. It offers insight into whether the market, on average, is in a state of profit or loss.

Per Glassnode, market participants are in capitulation when an asset’s NUPL is negative. This occurs when the total unrealized losses in the market exceed unrealized gains, suggesting that most holders are underwater. It reflects a period of loss where investors either panic sell or hold in distress.

IntoTheBlock’s Global In/Out of the Money confirms this bearish sentiment. At press time, the metric shows that over 87.34% of all SHIB holders are currently “out of the money.”

An address is considered “out of the money” when the current market price of the asset it holds is lower than the average acquisition cost of the tokens in that address. This means the holder WOULD incur losses if they sold their assets at the market price.

SHIB Capitulates—But Is a Price Bottom Closer Than It Looks?

Historically, negative NUPL readings mark the late stages of a bearish cycle. It usually precedes a price bottom and eventual rebound in an asset’s price. This happens for two reasons.

First, when many holders are sitting on losses, they are often unmotivated to sell. Instead, they choose to wait for a recovery to break even. This behavior reduces selling pressure, which can help stabilize the asset’s price over time. As volatility declines and the price begins to consolidate, it creates conditions that encourage fresh SHIB buying and potentially drive the price upward.

Also, periods of capitulation tend to flush out “weak hands” while paving the way for “diamond hands” (more confident, long-term investors) to enter the market. These more resilient buyers accumulate during market distress, bringing in capital that could support a bullish price reversal.

Will SHIB Reclaim Higher Ground Above $0.000012?

At press time, SHIB trades at $0.00001180. If selling pressure wanes and fresh buying resumes, it could propel the meme coin past the immediate resistance at $0.0000198. A breach of this price barrier could propel SHIB toward $0.00001362.

However, if bearish pressure strengthens and the decline continues, SHIB’s price could fall to $0.00001105.

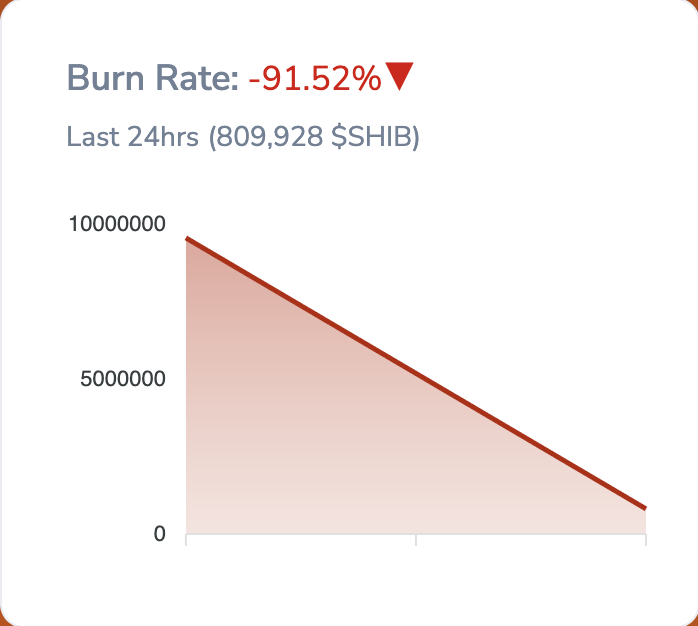

Adding to the short-term bearish outlook is SHIB’s declining burn rate. Over the past day, this has dropped by 92%. As fewer tokens are being taken out of circulation, it makes it harder for SHIB’s price to rally in the absence of new demand.

If burn activity fails to recover soon, it could delay SHIB’s attempt to reclaim higher price levels.