🚨 $150M WLFI ’Liquidity’ Exposed as Scam: Analysts Sound Alarm on Pump-and-Dump Red Flags

Crypto's latest 'too good to be true' scheme collapses under scrutiny.

The Illusion of Liquidity

On-chain sleuths dismantle WLFI's claimed $150M reserves—tracing funds through a labyrinth of wash trades and phantom wallets. Another day, another DeFi project confusing vaporware with valuation.

Anatomy of a Rug Pull

Patterns mirror classic exit scams: inflated APY promises, locked withdrawals, and team wallets quietly cashing out. But hey, at least the Telegram moderators are still insisting 'this is FUD' between bans.

Due Diligence or Die

While regulators nap at the wheel, analysts urge investors to verify—not trust—liquidity claims. Pro tip: When a project's whitepaper spends more pages shilling than coding, your exit strategy should be 'sprint.'

The crypto wild west rolls on—where the only thing growing faster than token supplies is the graveyard of 'revolutionary' projects that forgot to build anything.

Expert Warns: Viral 150 Million WLFI Liquidity Screenshot Is a Fake

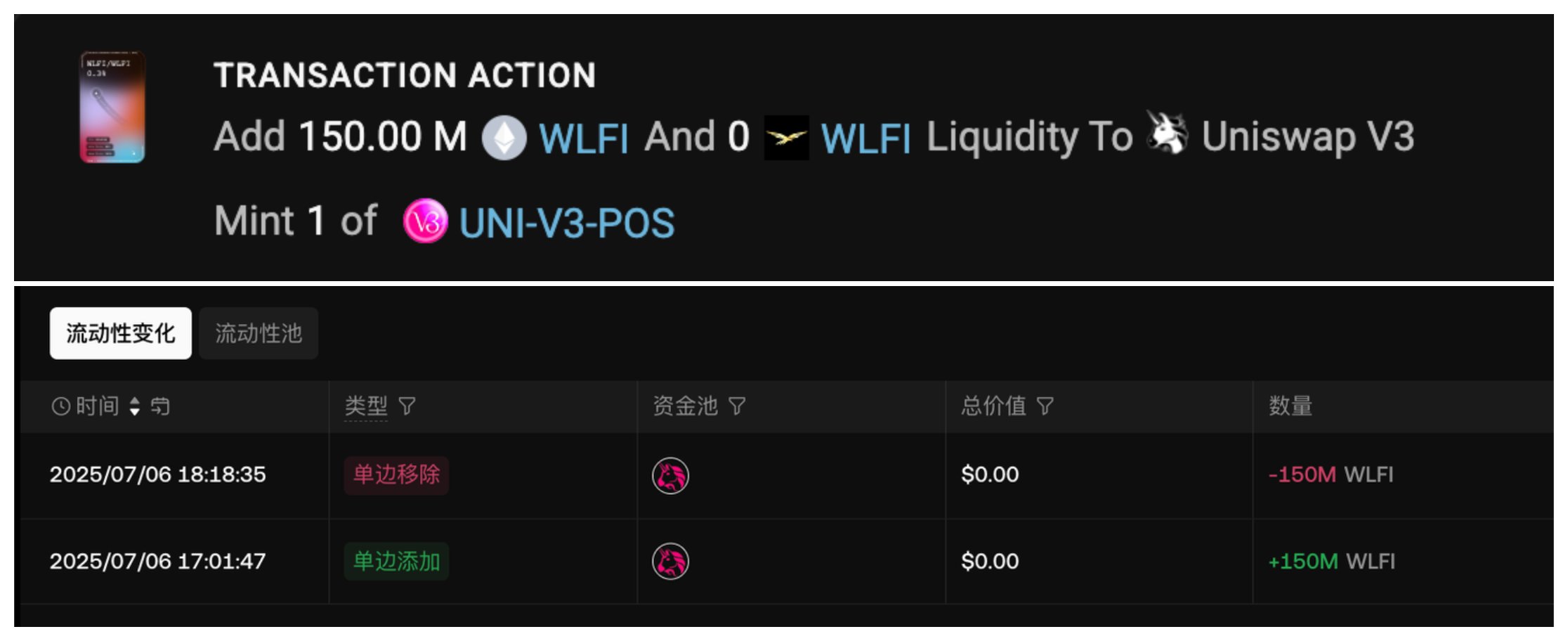

Last weekend, a screenshot on the social media platform X showed a transaction allegedly adding 150 million WLFI tokens to liquidity. However, according to analyst Ai, this is a fake token scam.

“You might have also seen the screenshot circulating in the community and on Twitter about 150 million $WLFI being added to liquidity. In fact, by checking the block explorer details, we can see that the address added ‘150 million fake WLFI tokens and 0 real WLFI tokens,’ causing this transaction to still be displayed in the LP section,” Ai explained about the appearance of the 150 million WLFI tokens.

This MOVE comes as the World Liberty Financial project is undergoing a vote to decide whether to allow WLFI token transactions. The official contract address (CA) of WLFI is 0xdA5e1988097297dCdc1f90D4dFE7909e847CBeF6, and currently, the token remains non-transferable.

Analyst Ai emphasized that verifying information from official sources is essential before engaging in any transactions related to WLFI. This helps investors avoid falling into unnecessary scam traps.

“Friends, don’t rush to take action, and beware of scams,” Ai reminded the community.

Although the liquidity rumor has been debunked, the WLFI project continues to attract attention due to its association with the TRUMP family and its development prospects in the decentralized finance (DeFi) sector. President Trump’s company recently reduced its stake in World Liberty Financial from 60% to 40%, with unclear motives.

Previously, a major whale or institution acquired 800 million WLFI tokens for 80 million USDT.

According to Polymarket predictions, there is a 56% chance that WLFI’s fully diluted valuation (FDV) will exceed 13 billion USD on its first launch day.

The appeal of the WLFI project reflects high community expectations but also raises questions about its sustainability and transparency. Therefore, to protect their assets, investors should thoroughly verify information from reputable sources or official announcements from the WLFI development team.