Solana’s Silent Army: Why Long-Term Holders Are Doubling Down Before the Next Mega Rally

The price charts might look sleepy—but Solana's diamond hands are wide awake.

While retail traders chase memecoins, SOL's long-term holders are accumulating at levels that scream 'generational buying opportunity.' These aren't degenerate gamblers; they're the same cohort that rode SOL from $20 to $260 in the last cycle.

The Whisper Network Knows Something

Institutional OTC desks report record SOL accumulation from private clients—the kind who don't bother with 50% swings. Meanwhile, the network's developer activity just hit an all-time high (because apparently someone still builds real things in crypto).

Technical Trap or Springboard?

Yes, SOL's been rangebound for months. But that descending wedge pattern looks suspiciously like the 2023 setup before a 900% explosion. And let's be real—when has Solana ever done anything quietly?

Wall Street's still trying to tokenize imaginary real estate funds while Solana's builders deploy working products. Place your bets accordingly.

Solana Long-Term Holders Shrug Off Weak Price Action

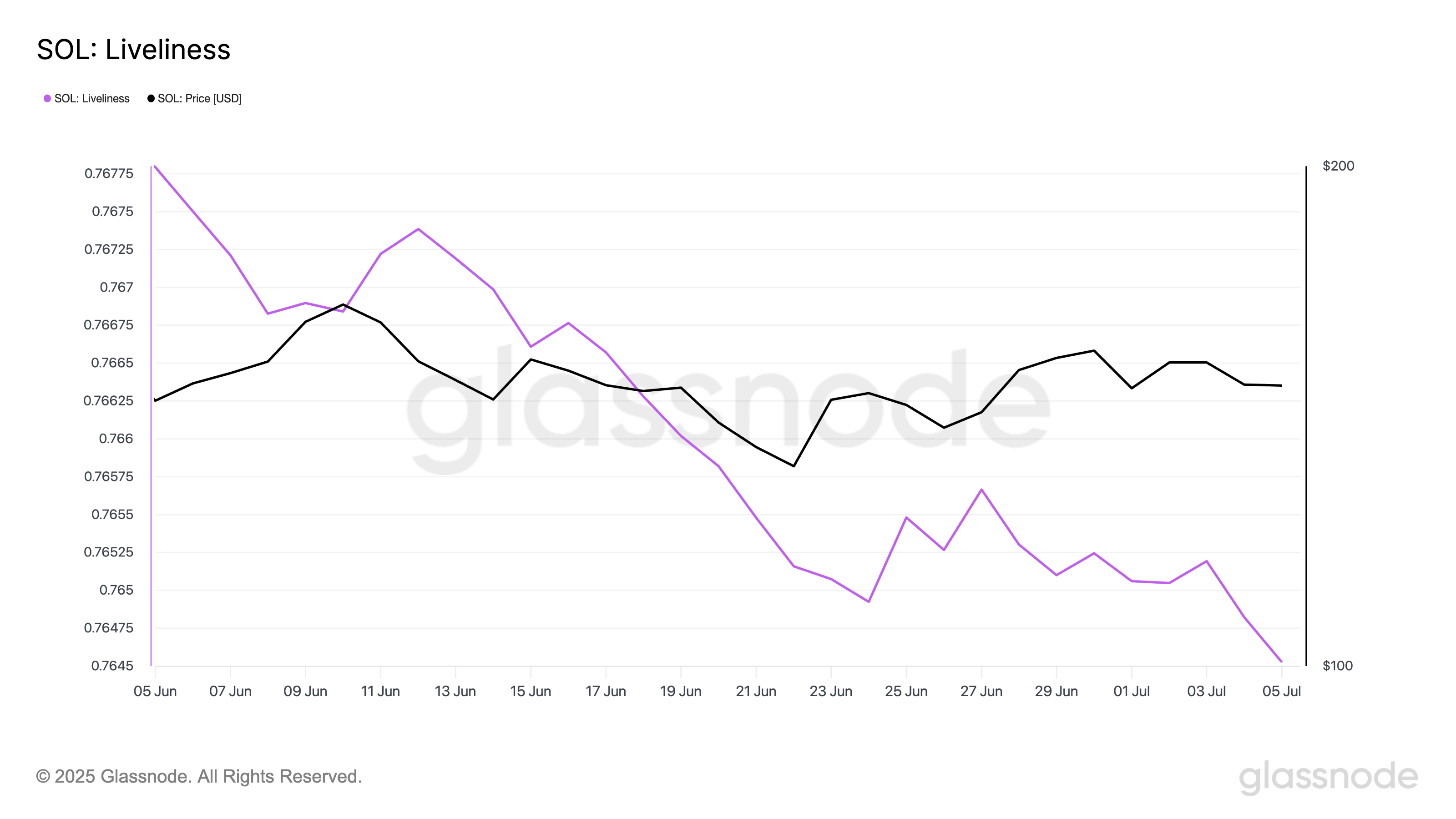

Glassnode’s data shows that SOL’s Liveliness has trended downward since climbing to a 90-day high on June 4. This metric, which tracks the movement of previously dormant tokens, fell to a 30-day low of 0.764 yesterday, indicating a notable decline in sell-offs among SOL’s LTHs.

Liveliness measures the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it climbs, it suggests that more dormant tokens are being moved or sold, often signaling profit-taking by long-term holders.

Converesly, when Liveliness declines, it indicates that LTHs are moving their assets off exchanges and opting to hold.

For SOL, this trend suggests that long-term holders remain confident in the prospect of a near-term rally and show little concern over the coin’s current lackluster performance.

Continued accumulation from these investors could build the foundation for a bullish breakout once market sentiment shifts in a more favorable direction.

Solana Holders Remain “Hopeful”

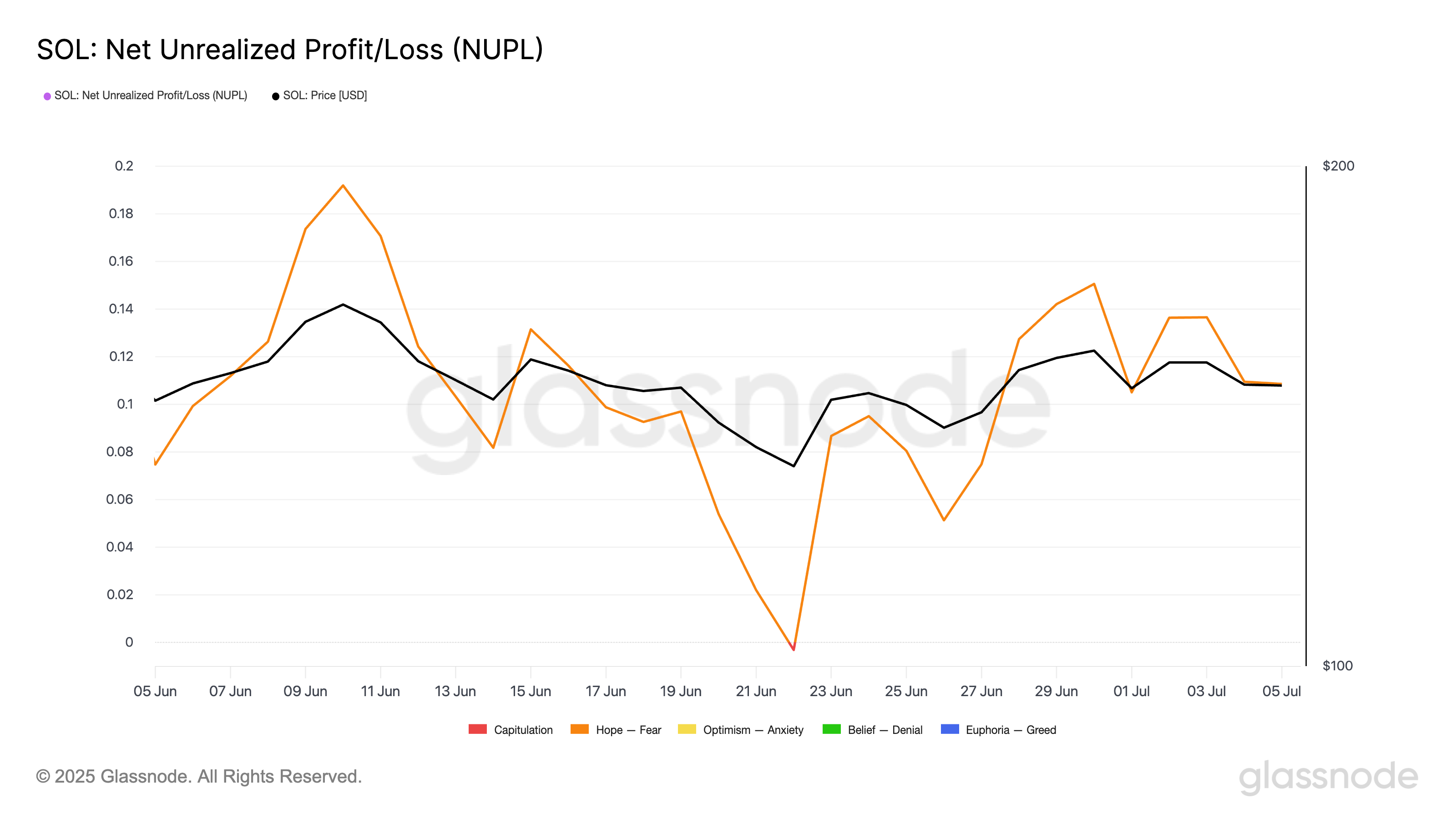

Moreover, readings from SOL’s Net Unrealized Profit/Loss (NUPL) confirm the likelihood of a bullish breakout. According to Glassnode, the metric has remained within the “hope” zone over the past 30 days. At press time, it is at 0.108.

The NUPL tracks the difference between the total unrealized gains and losses of investors based on the price at which coins were last moved. It indicates whether holders are, on average, in profit or loss and how likely they are to sell.

The “Hope” zone suggests that while many investors are back in profit, they have not yet begun taking profits aggressively. Instead, they are holding with the expectation of further upward momentum.

This trend signals cautious Optimism among SOL coin holders and often marks the early stages of a potential bullish trend.

SOL Bulls Eye $170 as Long-Term Holders Tighten Their Grip

At press time, SOL trades at $148.06. If the coin’s LTHs double down on their accumulation and historical patterns hold, this could propel SOL’s price above the resistance at $158.80.

A succesful breach of this long-term resistance zone could lay the groundwork for a rally toward $170.

However, if selloffs strengthen, SOL eyes a break below the support floor at $141.97. In this case, its price could fall to $123.49.