Why Bitcoin Crashed on Independence Day 2025 – Weekly Whale Watch Reveals the Truth

Bitcoin just gave traders fireworks they didn’t want—a Fourth of July price plunge. Here’s what really happened.

The Whale Effect: Big players moved markets (again). When crypto’s megaholders sneeze, retail traders catch pneumonia.

Liquidity Games: Thin holiday trading volumes turned routine volatility into a 10% nosedive. Thanks, Wall Street vacation schedules.

Macro Ghosts: Old Fed fears resurfaced—because apparently, Bitcoin still cares about Powell’s coffee orders.

Silver lining? The dip got bought faster than a meme coin at a VC happy hour. Same cycle, different summer—welcome to crypto’s Groundhog Day.

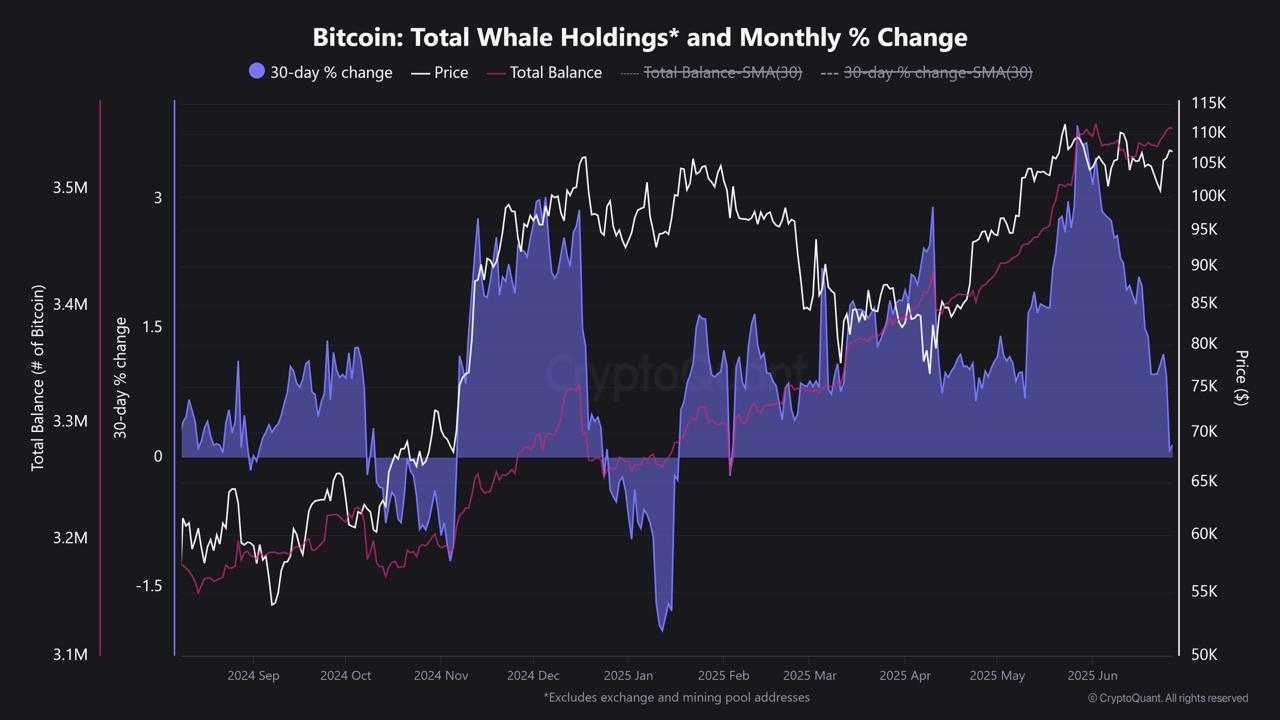

Whale Accumulation Trend Turns Negative

On-chain metrics from CryptoQuant reveal a deeper structural shift. The 30-day percentage change in total whale holdings has now turned negative for the first time in six months.

Whale holdings steadily increased from to a peak of . This accumulation phase helped support Bitcoin’s price recovery through Q1 and Q2.

However, this upward trend has now reversed. The decline in net whale holdings signals the start of a distribution phase, when large holders begin offloading or reallocating capital.

Historically, negative shifts in this metric have coincided with short- to mid-term corrections. Institutional and long-term holders often reduce exposure or prepare for liquidity events.

If more of these dormant coins start moving—or selling pressure mounts—we may see a short-term retest of support zones NEAR $105,000.

![]() Unprecedented Wake-Up!

Unprecedented Wake-Up!

20,000 $BTC (2 × 10,000) both untouched for 14.3 years just moved. This is never before witnessed in Bitcoin’s entire history.

All the deatils![]()

![]() pic.twitter.com/c7eO3wI0q6

pic.twitter.com/c7eO3wI0q6

Dormant Bitcoin Whales Wake Up After 14 Years

Seven dormant Bitcoin wallets dating back to April and May 2011 transferred a combined 70,000 BTC, valued at $7.6 billion, in the past 24 hours.

Blockchain data shows these addresses had been inactive for over 14 years. At the time of receipt, BTC traded below $4.

Today, the same holdings are worth billions.

BILLIONAIRE bitcoin WHALE WALLETS ARE WAKING UP

So far, 7 addresses have now moved a total of $7.6 Billion in BTC since last night.

The addresses below have all been holding since April-May 2011, over 14 years. pic.twitter.com/AMbc3sUMAM

The coordinated nature of these moves suggests they belong to a single entity—possibly an early miner or institutional custodian.

At least 12 transactions were logged today, each moving 10,000 BTC, flagged by analysts as originating from a whale cluster labeled “BTC Whale 4th July.”

These funds were sent to fresh addresses, but no exchange deposits have been confirmed yet.

Meanwhile, one transaction traced back to a consolidation of 180 block rewards—each 50 BTC—into a single output of 9,000 BTC.

These rewards were earned during Bitcoin’s first reward era, indicating the coins came from early solo mining operations.

The BTC that is on the MOVE today appears to be from a single miner from 2011

Here is the transaction where they consolidated 180 mined reward blocks a few hops back. They had an address with 200k BTC in it at one point in 2011 (would be $22B today) which is a top 5 wallet ever https://t.co/m34YohdQWC pic.twitter.com/4zgCD6czqD

The timing—on US Independence Day—has also drawn attention. Some analysts interpret the symbolic date as deliberate, echoing past instances where whale activity aligned with major calendar events.

While none of the transferred coins have been sold yet, the market often reacts preemptively to such movements.