Turkey Cracks Down: PancakeSwap Blocked Amid Unauthorized Crypto Operations

Turkey slams the brakes on PancakeSwap—regulators pull the plug over alleged unlicensed DeFi activity. Another clash between decentralized dreams and government gatekeepers.

Subheading: The Regulatory Guillotine Drops

No warnings, no negotiations. Turkish authorities just yanked access to the BSC-based DEX, leaving traders scrambling. Classic case of 'ask forgiveness later' meeting 'not in our jurisdiction.'

Subheading: DeFi’s Persistent Paradox

PancakeSwap’s liquidity pools keep churning—just not where Ankara can see them. Another reminder that crypto moves faster than legislation… until it doesn’t.

Closing jab: Meanwhile, traditional finance institutions quietly lobby for CBDCs while pretending they ‘don’t understand’ yield farming. How convenient.

Turkey Crypto Regulations Focus on Decentralized Exchanges

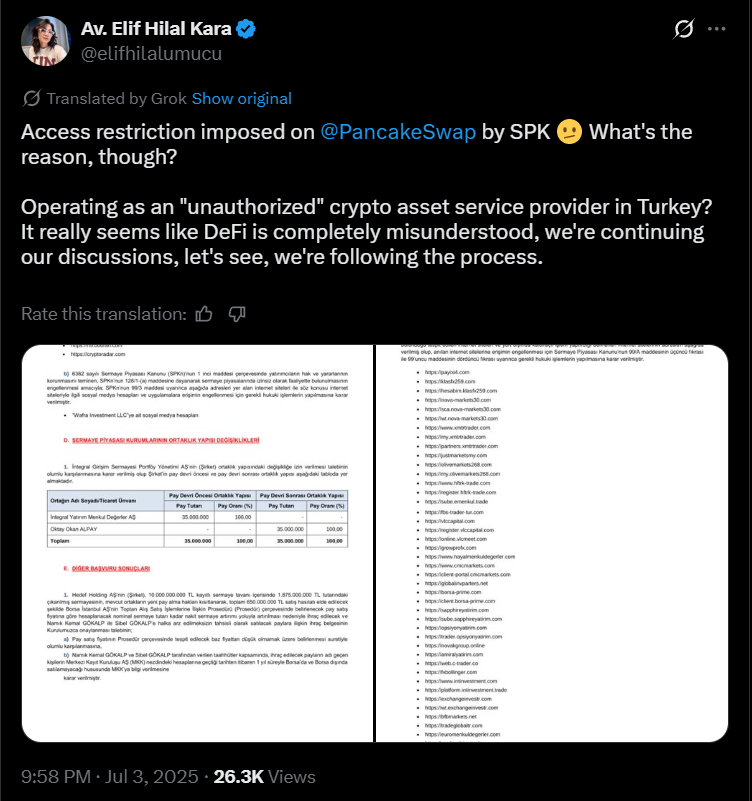

PancakeSwap, the leading decentralized exchange (DEX) on the BNB Smart Chain, was listed alongside several other websites in the SPK’s July enforcement bulletin. The regulator ordered Turkish ISPs to block access to the platform.

Following the news, CAKE price dropped nearly 4%.

Authorities say PancakeSwap enables financial transactions, such as token trading, staking, and yield farming, without complying with Turkish licensing requirements.

These activities fall under capital market operations, which require formal regulatory approval in Turkey.

The SPK also ordered the blocking of associated social media accounts and mobile applications, if any, linked to unauthorized financial services.

This action is part of a wider crackdown on unregistered crypto and forex platforms. Over 60 websites were included in the latest enforcement notice, including both centralized and decentralized platforms.

Turkish regulators have previously warned investors about the risks of engaging with unlicensed service providers.

PancakeSwap remains operational globally. However, access from within Turkey is now restricted via local internet service providers.

The SPK emphasized that these steps are aimed at protecting investor rights and preventing illegal financial activities in digital asset markets.

More regulatory actions against decentralized protocols may follow as Turkish authorities align their stance with global standards on crypto oversight.