Bot Armies Exposed: How Automated Trading Is Fueling XRP’s Wild Price Swings

XRP’s rollercoaster price action has traders scratching their heads—but the real puppeteers might be silicon, not humans. High-frequency bots are turning the market into their personal casino, and retail investors are left holding the bag.

### The Algorithmic Circus

Market makers? More like market shakers. Liquidity patterns suggest bot clusters are executing lightning-fast trades to exploit micro-volatility—pumping, dumping, and repeating while SEC lawyers nap at their desks.

### Whale Watching for Nerds

Order book analysis reveals telltale bot fingerprints: precise 0.0001% spreads, millisecond-level trade timing, and suspiciously round-numbered sell walls. Meanwhile, 'HODLers' keep praying for another 2017-style miracle.

### The Cynic’s Corner

Remember when finance was about fundamentals? Neither do we. In today’s market, the only 'utility' that matters is how fast your algo can front-run the next sucker.

Are Trading Bots Behind XRP’s Sharp Price Jumps?

Vincent Van Code, a well-known software engineer on X, has noticed that XRP’s price often jumps sharply when there’s positive news, like a legal victory or a strategic partnership. Strangely, unrelated tokens such as ADA (Cardano) and XLM (Stellar) also rise in price, even without any direct supporting news.

![]() The Hidden Hands Behind XRP’s Price: How Bots MOVE the Market and When It Might Stop

The Hidden Hands Behind XRP’s Price: How Bots MOVE the Market and When It Might Stop![]()

Every time XRP gets major news — like a legal victory or a high-profile partnership — its price rises as expected. But what’s strange is that unrelated tokens often rise too. ADA, XLM, even…

Van Code argues that the main reason is high-frequency trading bots that use priority APIs (often on Binance) to manipulate the market. He explains that these bots react to news within milliseconds, faster than humans can act. They run strategies like arbitrage, spoofing, and wash trading to create artificial price momentum.

“Bots act as market makers with tight spreads but tilt the book in a desired direction. This subtly nudges price up or down while absorbing real trades,” said Vincent Van Code.

He added that the bots buy correlated assets like ADA and XLM when XRP pumps. This spreads the illusion of a broad market rally, even without any catalysts.

Vandell, Co-founder of BlackSwan Capital, confirmed this view in his response. He stressed that HFT bots operate exactly as described, and many people don’t realize how significant their impact is.

Similarly, Denver Ulland, an investor, shared that these bots can create real-time buy/sell pressure, pushing the price in any direction they choose. He noted that while bots generate price volatility, the new money flowing into the market isn’t large enough. As a result, prices don’t rise significantly until big institutional capital comes in.

Because of this, Van Code suggested stricter regulations on priority APIs or a move toward more transparent decentralized exchanges (DEXs) to reduce their impact. Meanwhile, if Ripple successfully rolls out global liquidity corridors, real demand for XRP could outweigh bots’ short-term influence.

XRP is one of the rare altcoins attracting both retail and institutional investors. Recently, Ripple filed for a US national banking license to expand RLUSD and offer digital asset custody services, giving XRP investors more reason to hold and buy XRP.

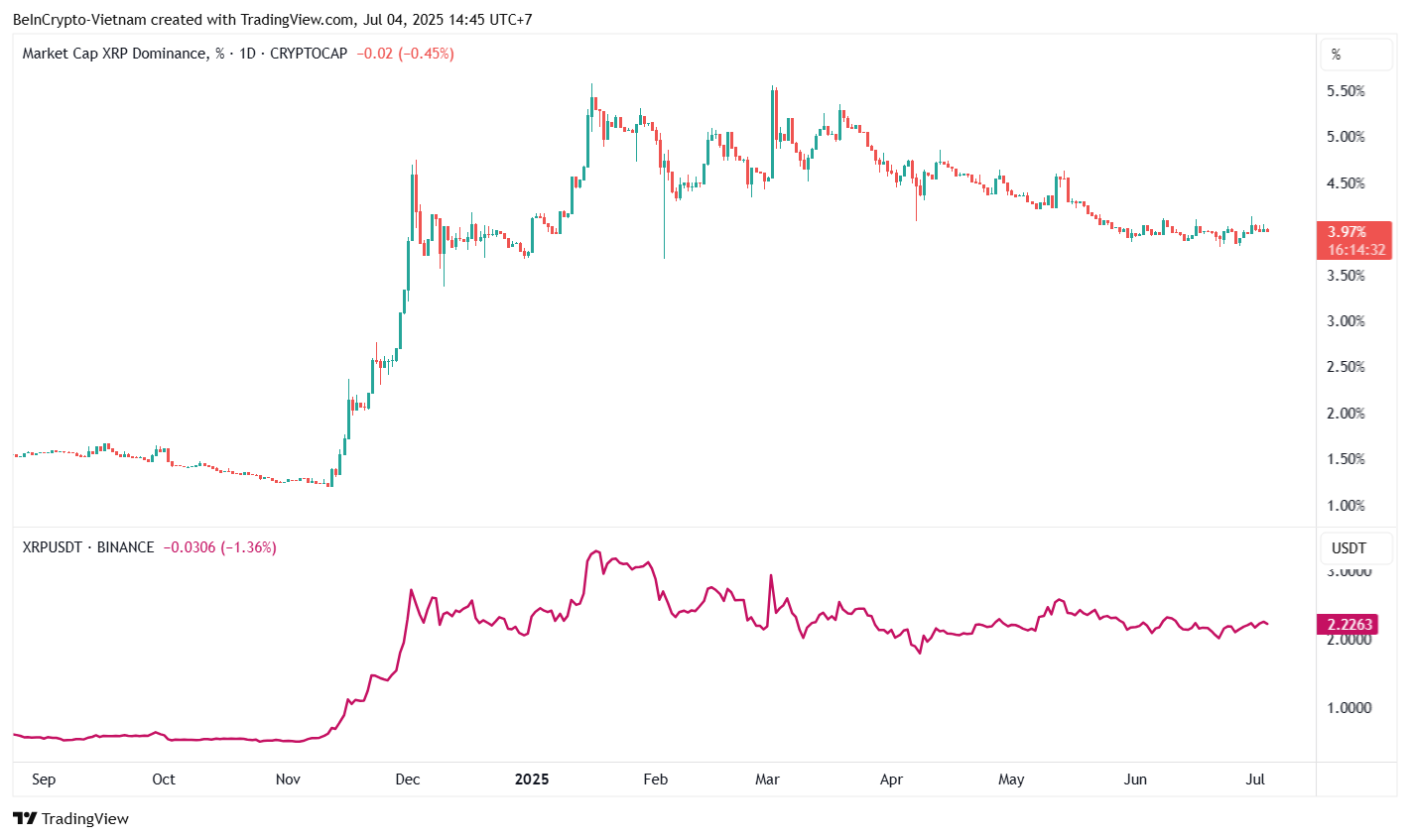

TradingView data shows that XRP dominance ROSE from 1.1% at the end of 2024 to 5.5% in Q1 2025 before adjusting to 3.97% today.