Nano Labs’ $50M BNB Bet Backfires: Stock Slumps 4.7% Despite Mega Purchase

Another 'strategic' crypto play goes sideways.

Nano Labs just dropped $50 million on BNB—the kind of move that’s supposed to scream confidence. Instead, investors yawned and dumped shares, sending the stock down nearly 5%. So much for the 'if you build it, they will come' approach to digital assets.

Market shrugs at big buys

When even a nine-figure token purchase can’t move the needle, you know sentiment’s frosty. Nano’s BNB splurge joins a growing graveyard of corporate crypto bets that looked genius on PowerPoint slides.

Bonus jab: Maybe next time try buying during a bull market? Just a thought.

Nano Labs Buys $50 Million in BNB

According to the press release, the company acquired 74,315 BNB at an average price of $672.45 per coin. The transaction was executed through an over-the-counter (OTC) deal.

The $50 million BNB acquisition marks the first step in Nano Labs’ broader goal of building a $1 billion BNB reserve. In line with this, BeInCrypto reported earlier that the firm launched a $500 million convertible notes offering. The notes can be converted into Class A shares at $20 per share.

“Over the long run, Nano Labs intends to hold 5% to 10% of BNB’s total circulating supply,” the press release reads.

Meanwhile, Nano Labs is not alone in using BNB as a reserve asset. Earlier this year, Bhutan’s Gelephu Mindfulness City (GMC) included BNB alongside Bitcoin and ethereum in its reserves.

This reflects a broader trend where companies are seeking to diversify their reserves beyond the two largest cryptocurrencies. In 2025, assets such as Solana (SOL), XRP (XRP), Hyperliquid (HYPE), and more have attracted institutional interest, with firms increasingly integrating these assets into their financial strategies.

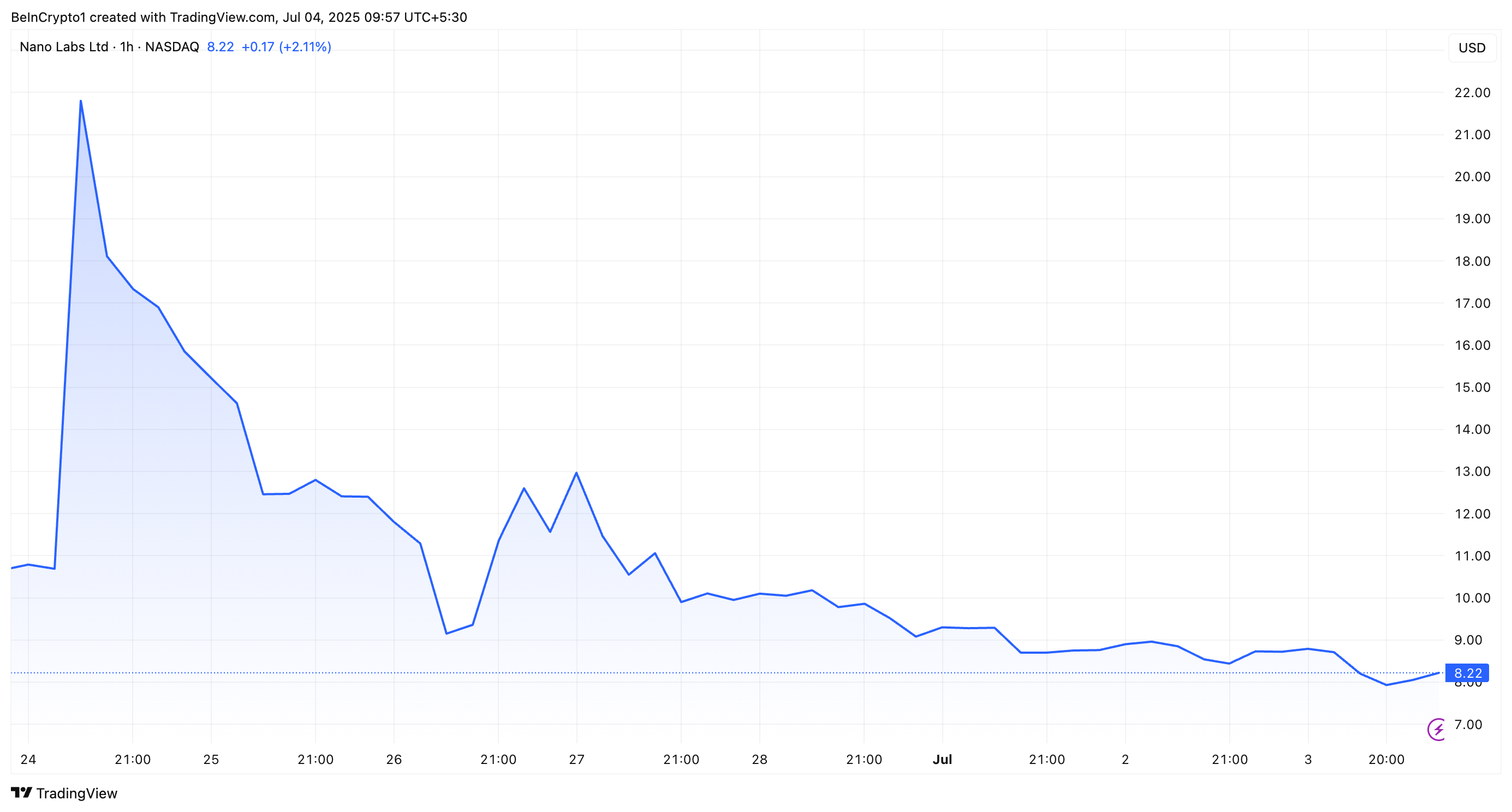

Nonetheless, the Nano Labs’ BNB purchase did nothing to boost the stock prices, which have been falling since last week. While the BNB treasury announcement led to over a 100% surge in value on June 24, NA has shed all of its gains.

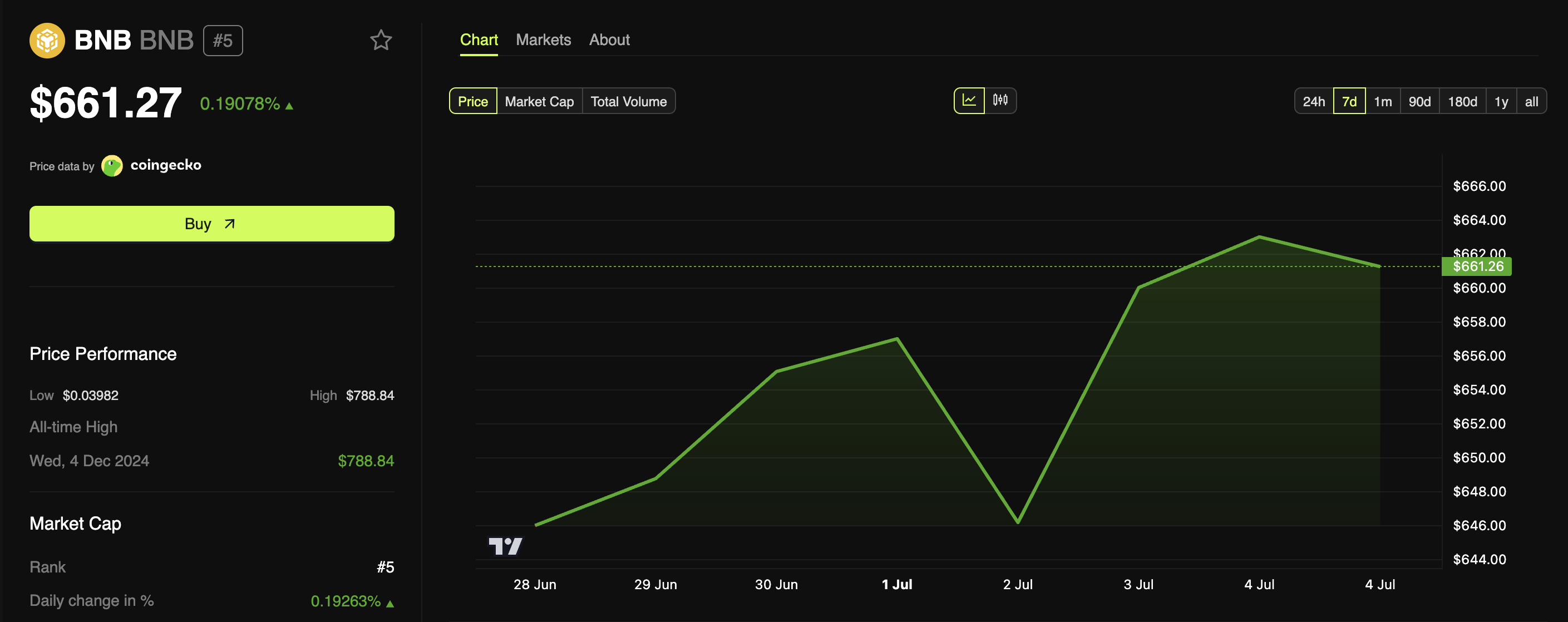

According to data from Google Finance, stock prices were down 4.7% at market close. The decline persisted in after-hours trading, with NA falling an additional 2.1%. Despite this, BNB has remained unaffected.

BeInCrypto data revealed that the altcoin appreciated 0.19% over the past day to trade at $661.2. Over the past week, the price has risen 2.6%.