Ripple’s US Banking License Play: Why XRP Bulls Shouldn’t Pop Champagne Yet

Ripple’s bid for a US banking license has XRP holders buzzing—but here’s why the hype might be premature.

The Regulatory Gauntlet

Even if approved, a license doesn’t guarantee XRP adoption. Banks love compliance, not necessarily crypto.

Liquidity vs. Legacy

Ripple’s tech may streamline cross-border payments, but Wall Street still prefers SWIFT’s clunky, expensive rails—because old habits die harder than a bear market.

The Cynical Take

Another 'bank-friendly crypto' narrative? Cue the eye-roll. Remember when XRP was 'the bankers’ coin'? Yeah, how’d that work out?

Ripple Becoming a Compliant US Custodian Doesn’t Impact XRP

The banking application was filed with the Office of the Comptroller of the Currency (OCC), the same federal regulator overseeing trust bank charters.

Ripple’s goal is to operate as a regulated bank entity, allowing it to custody digital assets and manage stablecoin reserves for its new product, RLUSD. This development mirrors similar moves by other crypto firms, like Circle and Fidelity.

However, Ripple’s strategy has limited implications for XRP’s price or demand in the NEAR term.

True to our long-standing compliance roots, @Ripple is applying for a national bank charter from the OCC. If approved, we WOULD have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market.

Earlier in the week via… https://t.co/IdiR7x3eWZ

Critically, the OCC license would not alter XRP’s current regulatory status in the US. Earlier, Ripple dropped its cross-appeal against the SEC in the XRP lawsuit. This means the federal court’s 2023 ruling stands.

To recap, the ruling found that XRP retail sales are not securities, but institutional sales by Ripple did violate securities laws.

That injunction still stands, andwithout proper SEC registration or exemption.

Therefore, even if Ripple gains bank status, it cannot use that charter to restart institutional XRP sales domestically. Nor does it make XRP a regulated or approved asset under federal securities law.

Conditional Bullish Scenario

What the license could enable is improved integration between Ripple’s services—especially RLUSD—and its broader infrastructure.

If Ripple uses its banking capabilities to serve regulated clients, XRP might indirectly benefit as a liquidity bridge. But that would depend on new business flows and corridor expansion, not legal change.

Now, Ripple could eventually use its bank status to build trust with US institutions. This would potentially revive interest in using XRP within tokenized asset systems or cross-border payment rails.

However, that’s a long-term narrative, not an immediate catalyst.

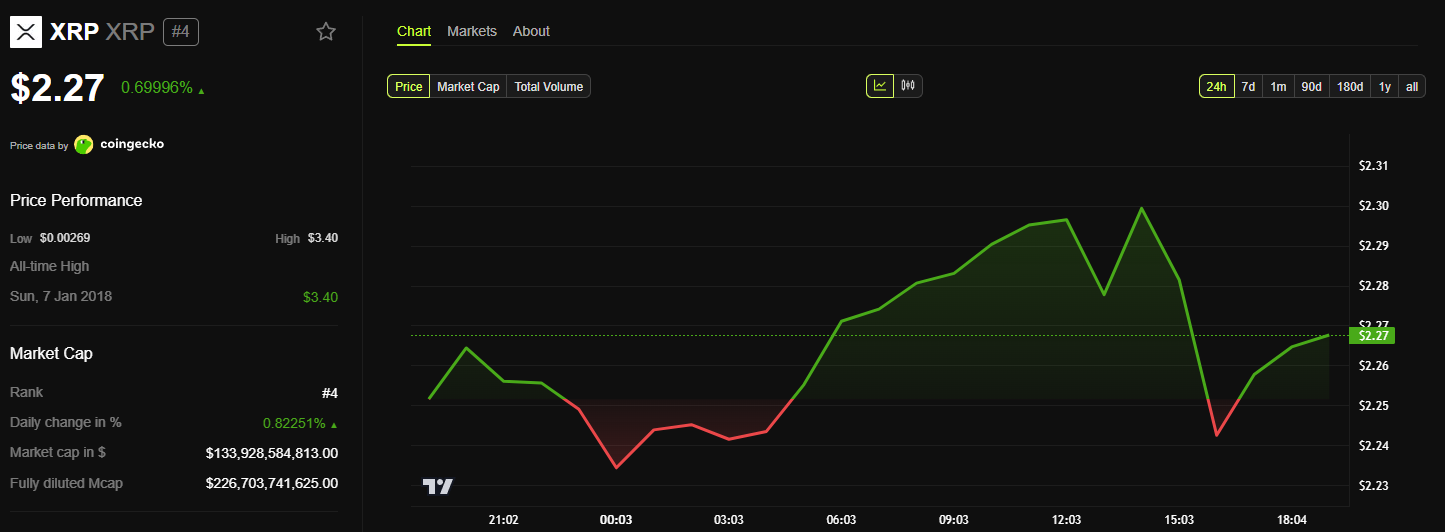

For now, XRP’s price action reflects that. Traders are pricing in a corporate compliance story, not a token utility upgrade.

Until XRP becomes central to Ripple’s bank-backed operations, the market will likely view this MOVE as neutral from a token value standpoint.

Ripple’s bank license, if approved, could reshape the company’s regulatory profile. But XRP remains where it was—partly cleared for retail, restricted for institutions, and waiting for a bigger use-case breakthrough.