5 RWA Altcoins Primed to Explode This July – Don’t Miss the Next Big Trade

Real-world asset tokens are eating traditional finance—and these five altcoins are leading the charge. Here's what's moving the needle as institutions finally wake up to blockchain's killer use case.

The RWA Gold Rush Isn't Slowing Down

From tokenized Treasury bills to carbon credits, blockchain is turning paper assets into programmable money. The sector's grown 400% since 2023, with July's institutional inflows hinting at another leg up.

1. The Commodities Kingpin

One project's quietly building the digital infrastructure for oil and metals trading. Its recent partnership with a Dubai free zone could open the floodgates for Middle Eastern capital.

2. The Bond Market Disruptor

This protocol's tokenized T-bills now yield 5.2%—beating most bank accounts while Wall Street still charges 2% management fees for the 'privilege' of holding your money.

3. The Real Estate Play

Fractional skyscrapers? Check. A project slicing Manhattan property into 24-hour tradable tokens just onboarded its first sovereign wealth investor.

4. The Carbon Credit Crusader

With regulators cracking down on greenwashing, this blockchain-based carbon registry is forcing actual transparency. Even oil majors are being dragged kicking and screaming onto its ledger.

5. The Private Credit Dark Horse

Bypassing loan sharks and banks alike, this DeFi protocol's funding small businesses at 12% APY—proving blockchain does what fintech promised but never delivered.

The bottom line? RWAs are where crypto grows up—assuming TradFi dinosaurs don't regulate it to death first.

Plume (PLUME)

PLUME powers the Plume Network, described as the first full-stack Layer-1 (L1) RWA blockchain. It currently trades at $0.102, up 26% over the past seven days.

An assessment of the PLUME/USD one-day chart shows the token’s Aroon Up Line at 92.86. This indicates that its current uptrend is strong, backed by significant demand and not driven by speculative trades.

An asset’s Aroon Indicator measures the strength and direction of a trend by tracking the time since the highest and lowest prices over a given period. It comprises two lines: Aroon Up, which measures bullish momentum, and Aroon Down, which tracks bearish pressure.

As with PLUME, when the Aroon Up line is at or NEAR 100, the asset has recently hit a new high, with the dominant trend being bullish. This suggests that buying pressure is high, and PLUME’s price may continue rising.

In this scenario, the token could break above $0.116. If successful, the altcoin’s value could surge to $0.141.

On the other hand, if demand craters, PLUME’s price could dip to $0.095 and lower.

StrikeX (STRX)

STRX is the native utility token of the StrikeX ecosystem. Its price is up 54% over the past week, making it one of the RWA coins to watch in July.

STRX’s Chaikin Money FLOW (CMF) continues to climb as its price rallies. As of this writing, the momentum indicator rests above the zero line at 0.11, signalling buying pressure behind the uptrend.

The CMF measures the volume-weighted money Flow into or out of an asset over a specific period, helping gauge buying or selling pressure. A positive CMF reading and rising prices indicate growing demand and strengthen STRX’s current move.

If it continues, STRX could extend its rally toward $0.388.

However, if selloffs resume, the token’s price could fall below $0.331.

XDB Chain (XDB)

XDB is the native coin of the XDB network. Its price has soared 37% over the past seven days, making it an RWA asset to watch in July. At press time, the token’s MACD line (blue) rests above its signal line (orange), confirming the accumulation trend among XDB traders.

The MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As with XDB, when the MACD line rests above the signal line, bullish momentum is building and the asset is in an uptrend. This crossover suggests that buying pressure is stronger than selling pressure, often seen as a signal to hold or enter long positions.

If buying activity persists, the altcoin’s price could climb to $0.00075.

XDB Price Analysis. Source: TradingView

Conversely, if profit-taking resumes, the token’s price could dip to $0.00063.

Hifi Finance (HIFI)

HIFI trades at $0.133, up 31% in the past seven days. The RWA altcoin currently trades above its 20-day exponential moving average on the daily chart, confirming the buy-side pressure.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When price trades above the 20-day EMA, it signals short-term bullish momentum and suggests buyers are in control.

If this continues, HIFI could extend its rally to trade at $0.163.

However, if profit-taking resumes, the token’s price could fall under $0.125.

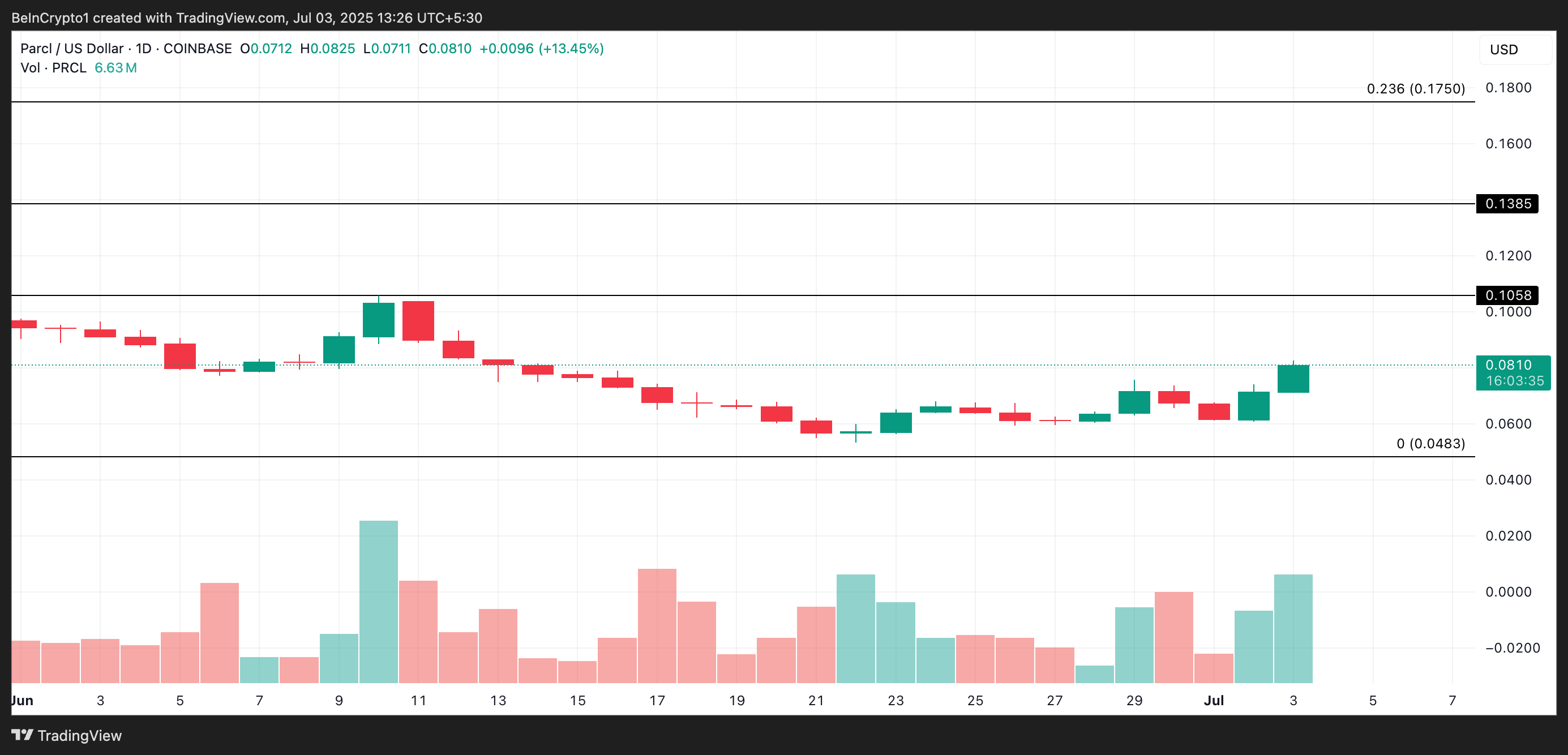

Parcl (PRCL)

PRCL has seen impressive upward momentum, gaining 24% over the past seven days as interest in RWA altcoins continues to build. This surge has been accompanied by an increase in daily trading volume, signaling growing investor confidence and participation.

In the past 24 hours alone, PRCL’s price has rallied by 30%, fueled by a 193% spike in trading volume. This suggests that the rally is backed by strong market demand rather than thin liquidity. The combination signals a healthy and sustainable uptrend for PRCL in the short term.

If buyers remain in control, they could push PRCL’s price to $0.175.

However, if sellofs commence, the price could fall to $0.048.