Ethereum Whale Activity Explodes — So Why Isn’t ETH Price Moving?

Whales are gobbling up ETH like it’s going out of style—yet the price refuses to budge. What’s the deal?

Big Money, No Action

Institutional-sized wallets are making waves, but Ethereum’s price charts look flatter than a DeFi token after a rug pull. Are whales accumulating for a breakout, or just playing with their food?

The Liquidity Trap

Market depth suggests these mega-transactions are getting absorbed without sparking rallies—classic ‘buy the rumor, sell the news’ behavior from traders who think ‘whale watching’ counts as fundamental analysis.

Wall Street’s Shadow

Some suspect OTC desks are quietly matching block trades off-exchange, because why move markets transparently when you can overcomplicate everything with dark pools? (Thanks, traditional finance.)

Patience Pays—Or Does It?

History says whale accumulation often precedes big moves. But in crypto, ‘soon’ could mean tomorrow or 2026—assuming the SEC doesn’t arbitrarily redefine ‘security’ again first.

Ethereum Stalls as Whale Support Fails to Spark Retail Demand

Readings from the ETH/USD one-day chart reveal that ETH has been locked in a sideways trend since May 9. During this period, the leading altcoin has faced resistance NEAR the $2,750 level, while finding support around $2,185.

A recent CryptoQuant report suggests that this stagnation stems from a deadlock between strong whale accumulation and declining retail participation.

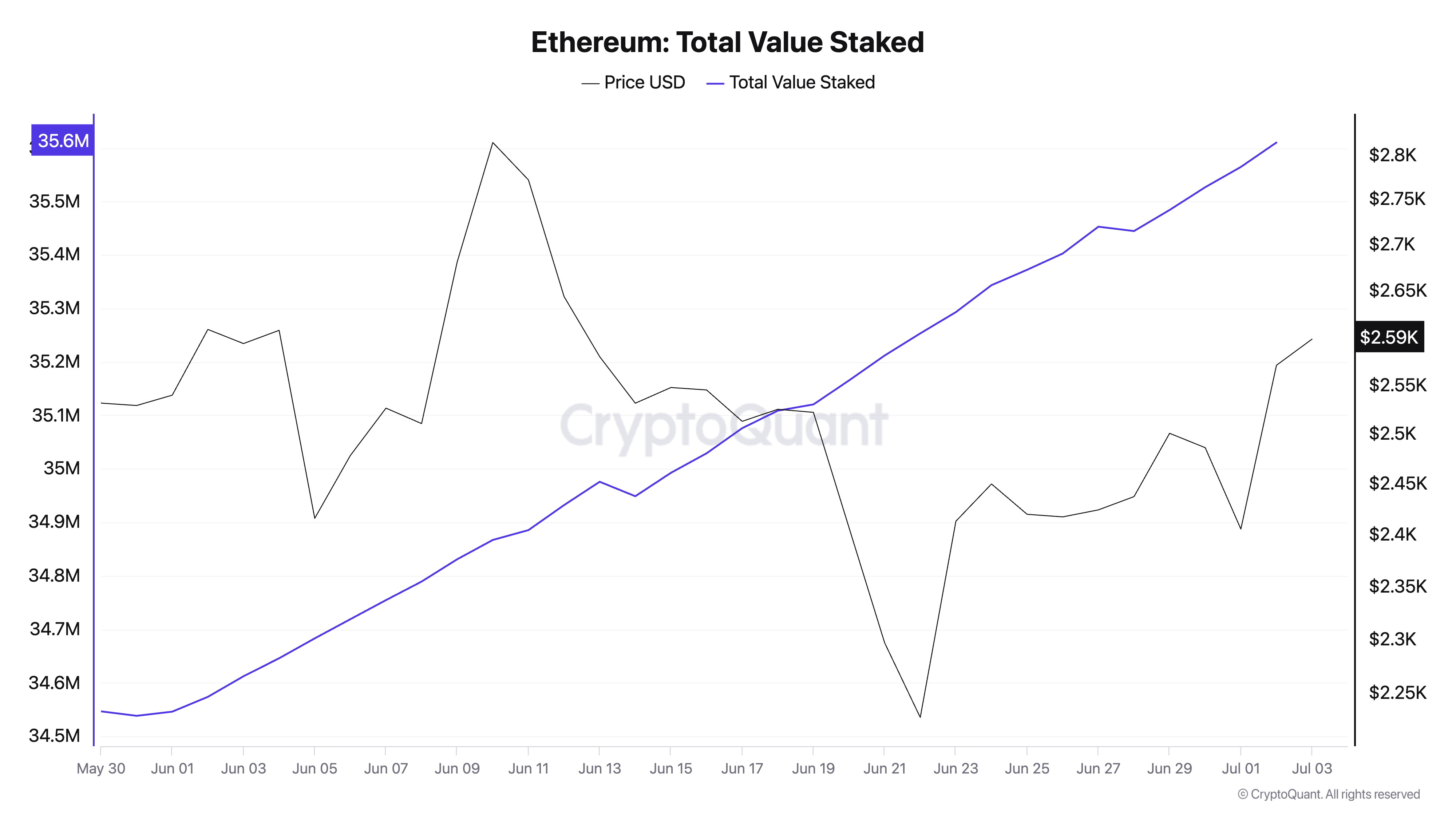

According to the report, whales have consistently moved around 60,000 ETH per week into staking contracts, demonstrating long-term confidence in the network and its coin. Per CryptoQuant’s data, the total value of staked ETH has reached 36 million coins, climbing 3% in June.

Also, large-scale exchange withdrawals—some exceeding 200,000 ETH—highlight these investors’ attempts to absorb selling pressure and reduce available supply.

When the total value of ETH staked climbs, it signals growing confidence among key holders in the coin’s long-term prospects. This, combined with a decline in exchange inflow, often tightens market liquidity and potentially supports price stability.

However, this has not been the case for ETH. Retail demand remains weak despite the bullish behavior of larger investors.

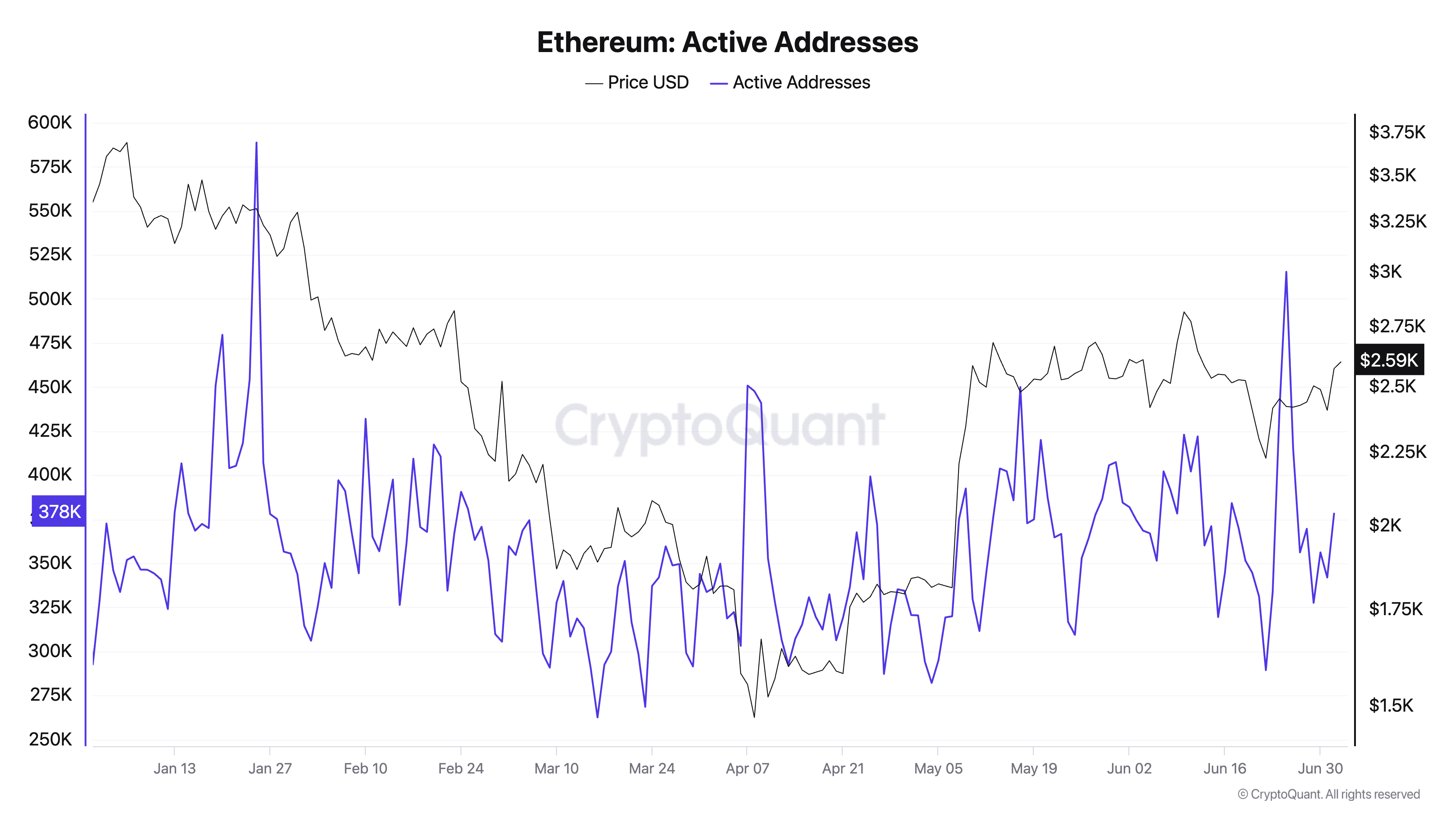

The CryptoQuant report notes that daily active addresses trading ETH have plateaued between 300,000 and 400,000, a far cry from the levels typically seen during bullish breakouts.

Ethereum Active Addresses. Source: CryptoQuant

While whales continue to absorb ETH, the decline in retail demand for the coin has left its price stuck within a range.

ETH Eyes Breakout Above $2,750

At press time, ETH trades at $2,602. A resurgence in demand could see the altcoin break above the key resistance level at $2,750, potentially paving the way for a rally toward $3,067.

However, if bearish pressure intensifies, ETH risks sliding further to $2,424.