XRP Traders on Edge: Bullish Hope Battles Bearish Fear — Who Wins in 2025?

XRP’s rollercoaster sentiment has traders clutching their ledgers—flipping between moonboy optimism and doomsday doubt. Here’s the breakdown.

### The Bull Case: Green Candles or Wishful Thinking?

Proponents point to Ripple’s legal wins and institutional adoption whispers. Yet price action stays tighter than a banker’s grip on legacy SWIFT fees.

### The Bear Trap: FUD or Fundamental Flaws?

Skeptics cite stagnant development and whale sell-offs. Meanwhile, retail bagholders pray for a 2017-style miracle.

### The Bottom Line: No One Actually Knows

XRP’s fate hinges on regulatory chess moves and whether crypto’s ‘utility’ narrative outlasts the next Tether audit scare. Place your bets—just don’t mortgage your McMansion.

XRP Sentiment Split as Price Action Remains Sideways

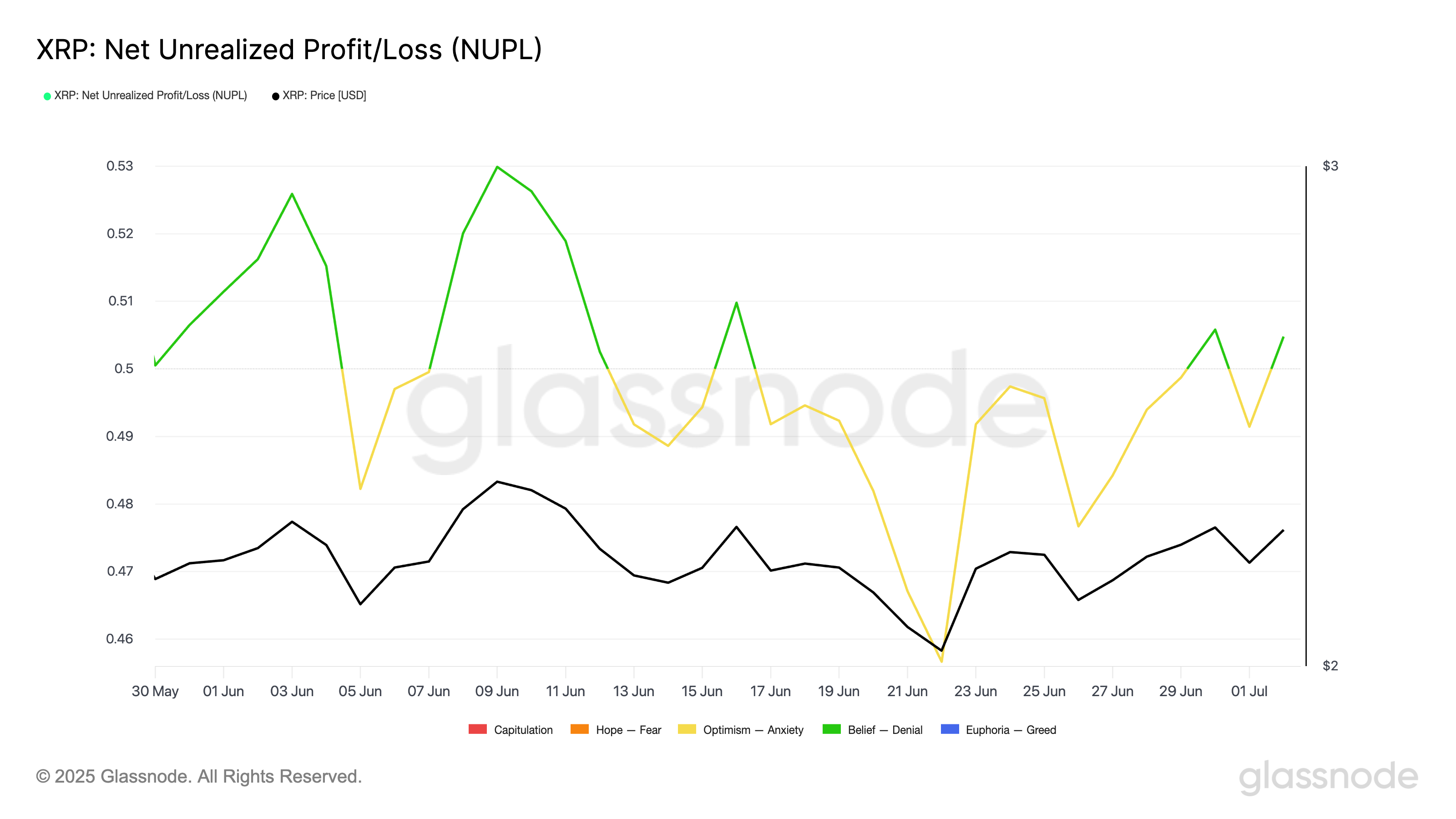

On-chain data reflects XRP’s sideways price action, pointing to market participants lacking conviction. Per Glassnode, the altcoin’s Net Unrealized Profit/Loss (NUPL) shows that XRP’s investor sentiment has been fluctuating between the “Optimism–Anxiety” and “Belief–Denial” zones over the past month.

This trend reflects a divided market: while some traders remain cautiously hopeful, others are skeptical of XRP’s near-term potential.

The NUPL metric reflects the difference between an asset’s current price and the average price at which its coins were last moved. It shows whether holders are, on average, sitting on profits or losses and how significant those are.

When an asset’s NUPL oscillates between the “Optimism–Anxiety” and “Belief–Denial” zones, investor sentiment has been indecisive or unstable. Some days, confidence rises (“belief”), and other days, anxiety creeps back in.

This back-and-forth movement typically happens during uncertain market phases, where price action is volatile and investors are unsure whether the rally will continue or reverse.

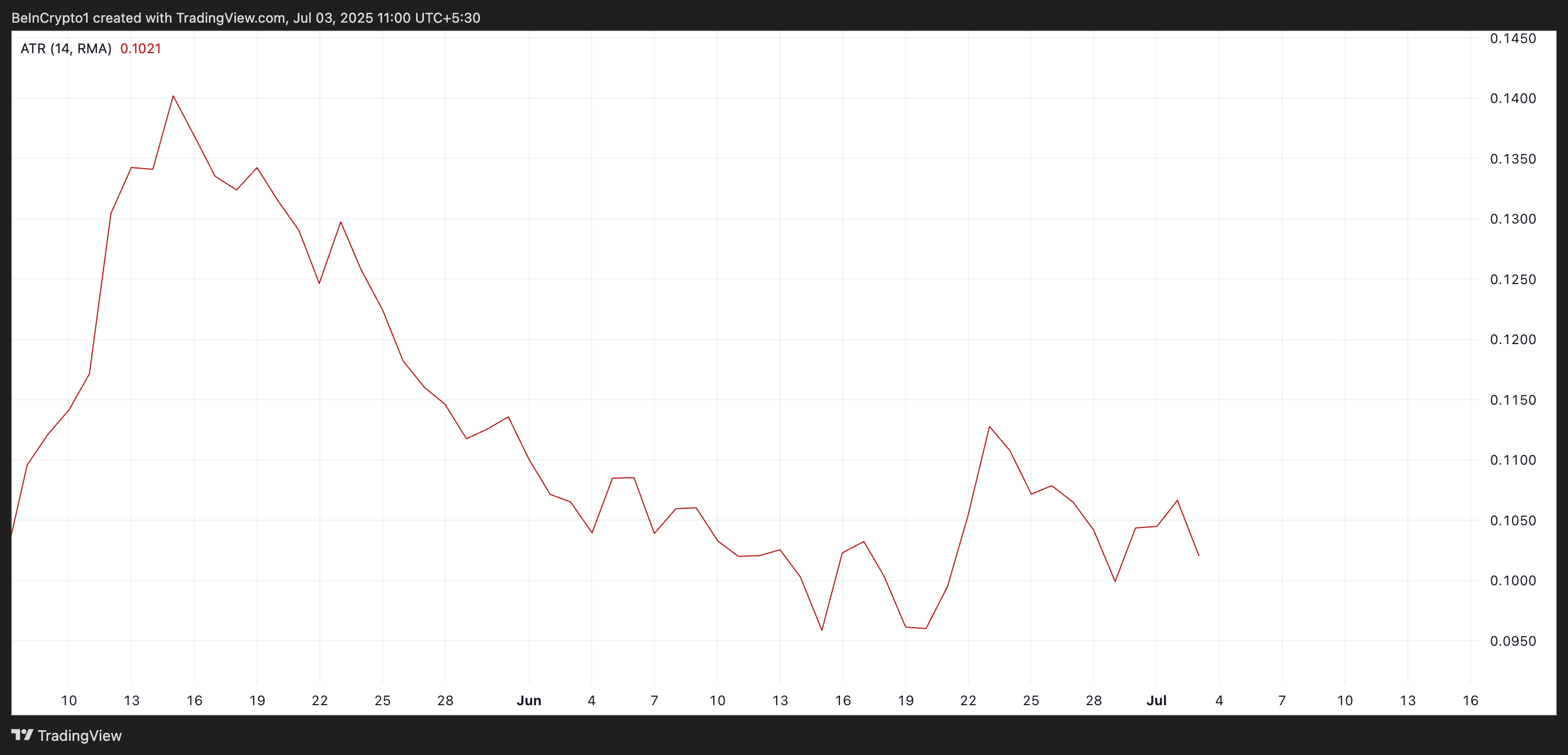

Furthermore, XRP’s plunging Average True Range (ATR) confirms the indecision among market participants. At press time, this sits at 0.051.

The ATR indicator measures the degree of price movement over a given period. When it trends downward like this, it often suggests that price fluctuations are narrowing and momentum is weakening.

XRP Awaits Catalyst as Price Tightens Between Key Levels

XRP’s fluctuating sentiment and declining volatility reinforce the narrative of a consolidating market. The altcoin is likely to remain range-bound until a catalyst shifts the trend.

If new demand enters the market, it could trigger a break above the $2.33 resistance level, toward $2.45.

On the other hand, if the bears strengthen their dominance, they could push XRP’s price below $2.08 and target $1.96.