BONK Skyrockets 22% as ETF Frenzy Ignites Memecoin Mania

Move over, Bitcoin—the dogs are barking again. BONK, the Solana-based memecoin that refuses to die, just ripped 22% higher as ETF hype bleeds into altcoins.

Wall Street’s latest crypto crush

Suddenly every hedge fund manager wants a slice of the ‘digital asset future’ (read: FOMO). BONK’s rally mirrors the 2021 meme-stock chaos—except this time, the suits are using ‘ETF’ as a permission slip to gamble.

Pump now, ask questions later

The ‘fundamentals’? A viral tweet from a pseudonymous trader and whispers of a potential futures product. Classic crypto: build the narrative first, maybe the utility later. Meanwhile, actual DeFi projects keep shipping—quietly.

Memecoins: The canary in the speculation mine

When BONK moves, it’s either a leading indicator or a warning siren. Today’s action suggests traders are back to chasing beta—and leverage is flowing. Just don’t ask about risk management when the Fed meeting minutes drop tomorrow.

*Cue the ‘this time it’s different’ chorus from VC Twitter.*

Traders Bet Big on BONK as Potential ETF Launch Nears

Tuttle Capital recently submitted a post-effective amendment to the US Securities and Exchange Commission (SEC) for its proposed suite of leveraged ETFs, including a 2x Long BONK ETF. The filing indicates the product could go live as early as July 16.

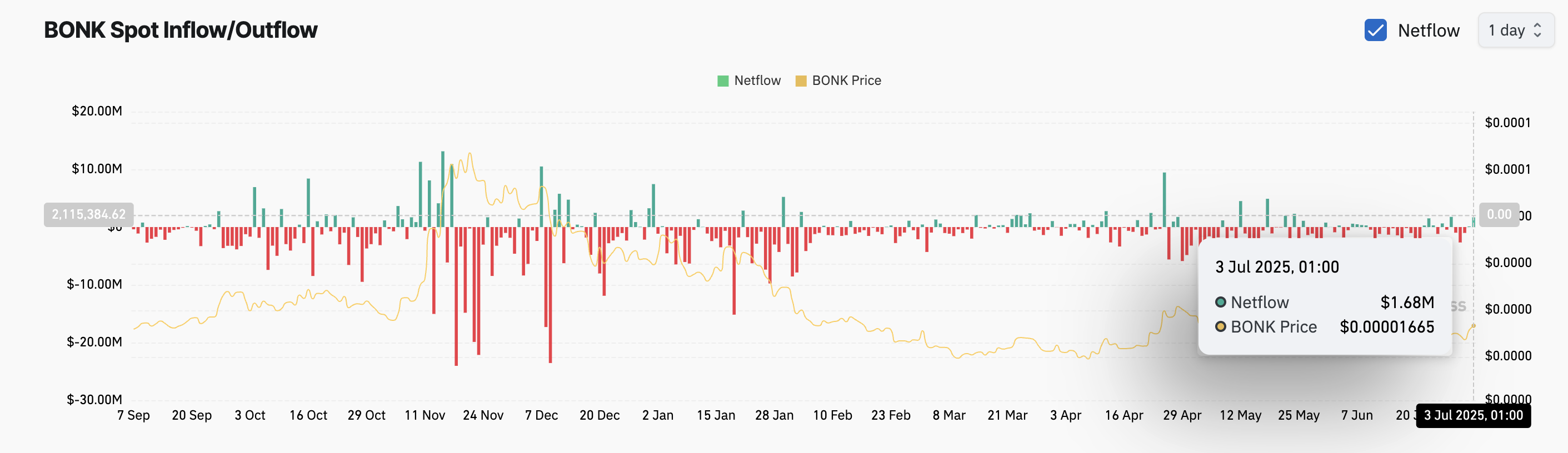

This has reignited enthusiasm around BONK, with traders piling in on speculation that the ETF could attract further inflows and institutional attention. The interest is evident in the token’s rising spot net inflow. As of this writing, netflow totals $1.68 million, climbing over 100% over the past day.

Spot net inflow tracks the capital entering an asset through direct purchases, indicating growing investor interest and demand. When an asset’s spot net inflows climb, it signals a bullish sentiment in the market.

BONK’s rising net inflow reflects growing investor confidence in the asset, and it could contribute to its upward price pressure as more capital flows into the market.

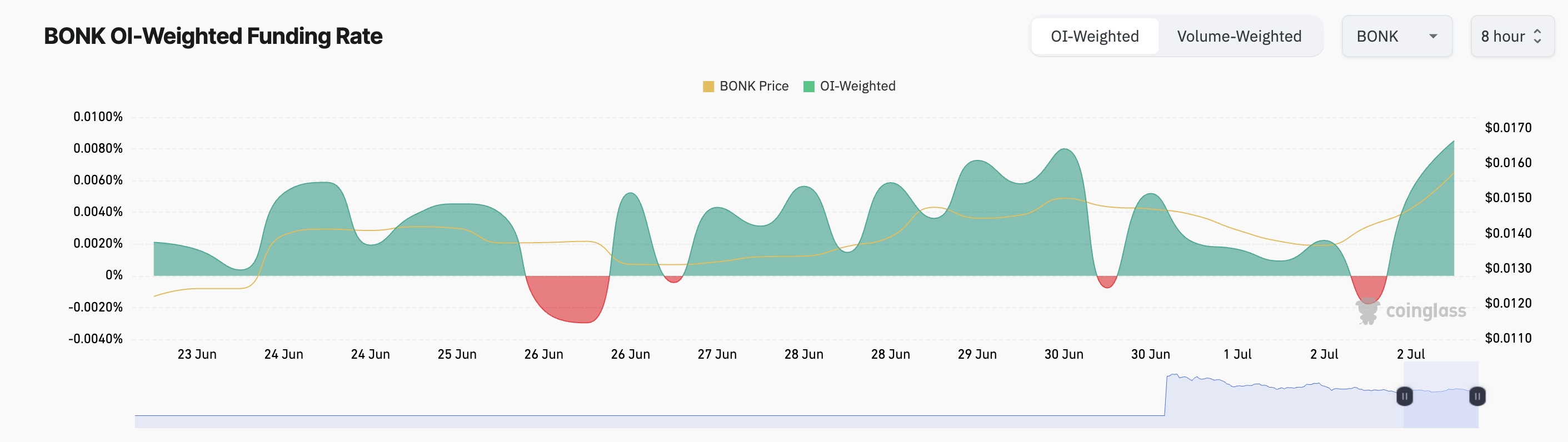

Moreover, the meme coin’s positive funding rate confirms this bullish outlook. As of this writing, it is 0.0085%, signalling a preference for BONK longs over shorts among futures market participants.

The funding rate is a periodic payment between traders in perpetual futures contracts to keep the contract price aligned with the spot price. When the funding rate is positive, there is a higher demand for long positions.

This means that more traders are betting on BONK’s price extending its gains in the short term.

BONK Breaks Above 20-Day EMA, Signals Fresh Bullish Momentum

The spike in BONK’s price has pushed it above its 20-day exponential moving average (EMA), which now forms dynamic support below it at $0.000014.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving more weight to recent prices. When an asset’s price trades above its 20-day EMA, it signals short-term bullish momentum and potential continued upside.

If the bulls retain control, they could drive BONK’s price toward $0.000018.

Conversely, if demand plunges, the altcoin’s price could break below $0.000016, falling to $0.000012.