Bitcoin’s Perfect Storm: 3 Catalysts That Could Propel It to New All-Time Highs

Bitcoin's gearing up for a gravity-defying act—and Wall Street's not ready. Here's why the crypto king could shatter records before the champagne corks pop on New Year's.

The Halving Effect Just Kicked In

Miners now get half the rewards. History says prices double within 18 months when supply gets choked—and we're right on schedule.

BlackRock's ETF On-Ramp Is Flooded

Boomers finally figured out how to buy crypto (thanks to ticker symbols). Institutional inflows just hit $12B this quarter—enough to make a gold bug cry into their hedge fund prospectus.

The Fed's Printing Press Has a Bitcoin Setting Now

With rate cuts back on the menu, fiat's looking flakier than a bank CEO's apology. Smart money's rotating into hard assets—and BTC's the hardest.

Will it actually happen? Who knows—but watching finance guys FOMO into decentralized money? Priceless.

These Key Drivers Suggest a Potential Bitcoin Price Surge

BeInCrypto reported yesterday that the renewed feud between Donald Trump and billionaire Elon Musk put downward pressure on the broader market. Thus, Bitcoin also suffered.

However, BTC managed to recover its gains. At the time of writing, it traded at $107,688, up 1.05% over the past day.

With BTC just 3.8% from its record high, analysts are growing increasingly hopeful that this gap will close soon. Three key factors support this view.

The first is the M2 money supply. According to the latest data, the US M2 money supply has reached a record high of $21.94 trillion.

BREAKING: The US M2 money supply jumped +4.5% Y/Y in May, to a record $21.94 trillion.

This marks the 19th consecutive monthly increase.

It has now surpassed the previous all-time high of $21.86 trillion, posted in March 2022.

Furthermore, inflation-adjusted M2 money supply… pic.twitter.com/HsCLFZSgAT

Historically, bitcoin has shown a strong correlation with M2. If this pattern continues, BTC may soon follow suit. Moreover, rising M2 also signals more money in circulation, which can lead to inflationary pressures and a weaker dollar.

In fact, recent Barchart data shows that the US Dollar Index (DXY) has dropped to levels not seen since February 2022.

“US Dollar Index DXY fell as low as 96.37, its lowest level since February 2022,” the post read.

Once again, Bitcoin has demonstrated an inverse relationship with the DXY. Investors often turn to Bitcoin as a hedge against inflation as the dollar weakens. This trend could drive prices higher.

Next, in addition to the M2 money supply, several major indices, including NVIDIA, S&P 500, and the US100, have reached new all-time highs (ATH). But how does Bitcoin benefit from this?

Over the past five years, Bitcoin and the S&P 500 have shown a strong correlation. Therefore, Bitcoin may also experience positive momentum.

“Bitcoin is expected to reach a new all-time high in July, as history shows strong returns for risk assets this month. BTC has never dropped over 10% in July, and the S&P 500 has gained for 10 consecutive years,” an analyst stated.

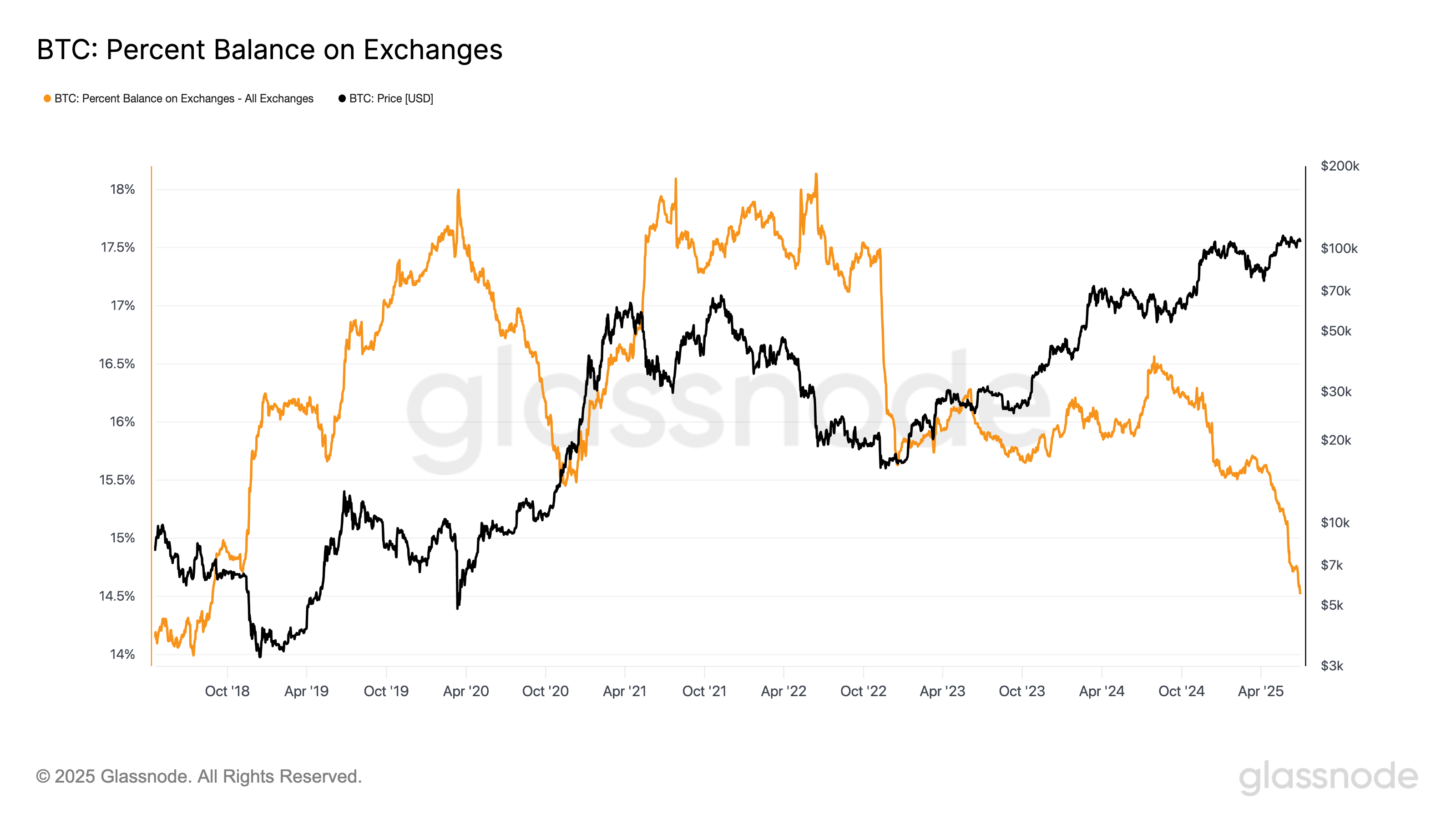

Lastly, a significant reduction in Bitcoin’s supply on exchanges has emerged as a bullish indicator. According to data from Glassnode, Bitcoin’s percent supply on exchanges has dropped to 14.5%, the lowest since August 2018.

This decline suggests reduced selling pressure as investors MOVE holdings to long-term storage, a classic precursor to price rallies.

Moreover, analyst Crypto Rover highlighted a bull flag pattern on the BTC price chart. A bull flag is a chart pattern indicating a continuation of an uptrend, so Bitcoin could continue moving north.

“This bull flag will send Bitcoin to $120,000!” Rover added.

BTC Market Structure Favors Upside, But Challenges Remain

While all these factors create a compelling case for Bitcoin’s next rally, RAY Youssef, CEO of NoOnes, remains cautiously optimistic.

“BTC price action has remained range-bound between $106,000 and $108,700 for 7 consecutive days, with market momentum stalling and no decisive breakout in sight. BTC has repeatedly failed to break and hold above $108,500 despite the resilient institutional appetite,” Youssef told BeInCrypto.

He acknowledged that traditional stocks’ performance and the macroeconomic conditions, like a falling dollar, support a bullish outlook.

However, the executive believes that Bitcoin still needs a clear macro catalyst to emerge. In the absence of this, the market appears cautious and reluctant to break higher.

“A clean break above $108,800 could open the door to retest the previous all-time range at $111,980, potentially $130,000 by the end of Q3 and $150,000 by EOY, provided institutional demand remains resilient and macro conditions create a favorable backdrop. Sellers are actively defending the $108,500 resistance zone, but the market structure favours upside continuation if bulls can regain control with volume,” he stated.

Youssef stressed that if the price fails to stay above $107,000, the short-term outlook could shift, with potential targets of $105,000 or even $102,000 coming into play.