PI Token Under Siege: Weak Demand Collides With $152M Unlock—Can It Survive?

PI Token's perfect storm hits: A $152 million tidal wave of unlocks crashes into crumbling demand.

Blood in the water? The project's tokenomics face their ultimate stress test as sell pressure mounts. Retail investors brace for impact while whales circle—because nothing unites crypto like a good old-fashioned dump.

Market makers sweating bullets as liquidity threatens to evaporate. Will PI join the graveyard of 'VC exit coins' or pull off a miraculous recovery? Place your bets—the casino is open.

Bonus jab: Another day, another token proving that 'unlock' is just finance-speak for 'get ready to hold these bags.'

Bearish Signals Mount for PI

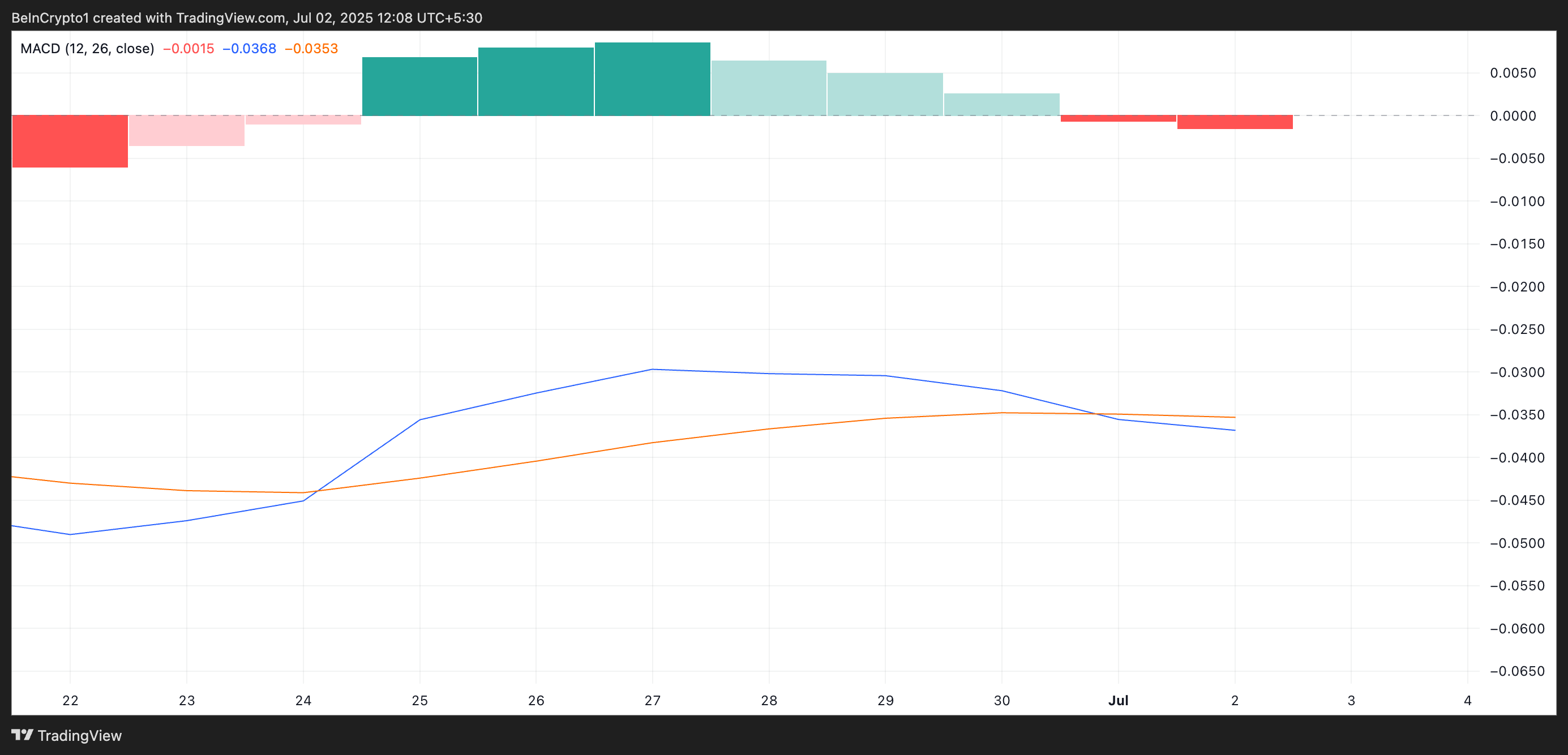

The fresh bearish crossover on PI’s Moving Average Convergence Divergence (MACD) suggests the potential for deeper losses in the NEAR term. This pattern emerges when an asset’s MACD line (blue) falls below its signal line (orange), indicating a breakdown in the market’s bullish structure.

The MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As is the case with PI, when the MACD line crosses below the signal line, it signals growing bearish momentum and fading buying strength. Traders interpret this setup as a sell signal. If selling activity accelerates as a result, it could intensify the downward pressure on PI’s price.

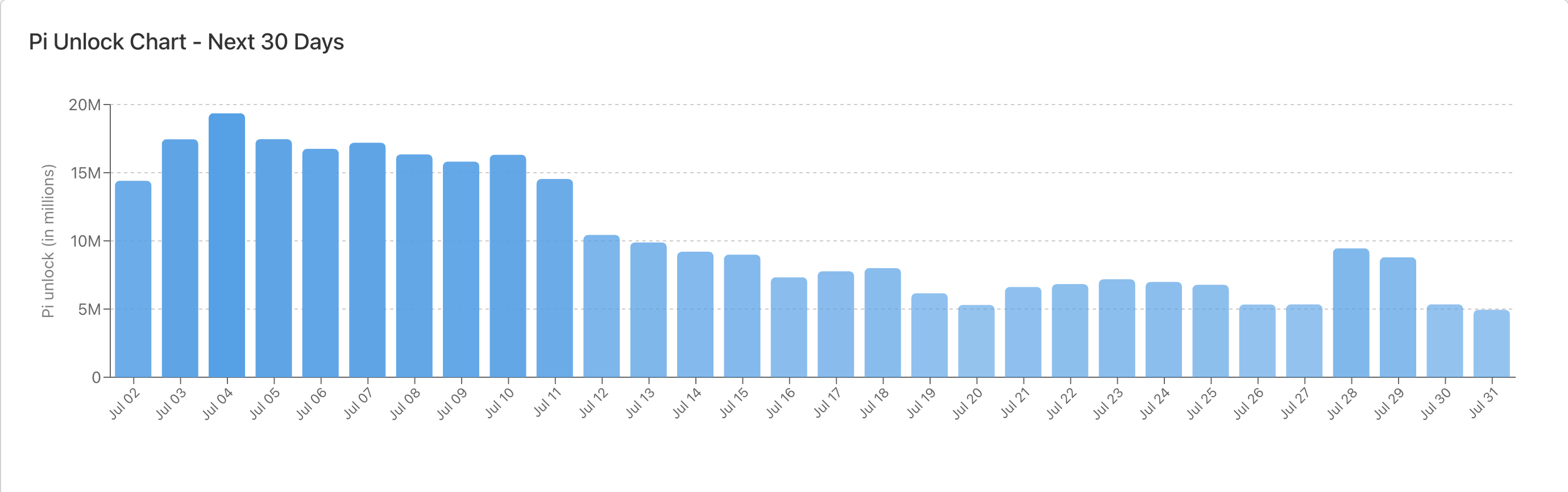

Furthermore, Pi faces a significant token unlock event in the coming month. Data from PiScan shows that 312.29 million PI tokens, valued at $152 million at current prices, will be unlocked over the next 30 days.

This unlock presents a major challenge for the altcoin, especially given the already weak bullish sentiment surrounding PI. With buying interest in the market noticeably low, there is little assurance that the newly unlocked tokens will be absorbed by sufficient demand.

If demand fails to match the increase in circulating supply, the imbalance could trigger heightened sell pressure. In such a scenario, supply WOULD overwhelmingly outpace demand, putting further downward pressure on PI’s price.

PI Slides Back Into Decline—Will Buyers Step In Before $0.40?

On the daily chart, PI has slipped back into its descending trendline. It had broken above this trendline on June 25, but the rally proved unsustainable as buying pressure quickly faded, sending the token back into its downtrend.

With bearish momentum continuing to build, PI risks revisiting its all-time low of $0.40.

However, if a surge in new demand emerges, it could help stabilize the price and invalidate the bearish outlook. In that case, PI could rebound and MOVE toward the $0.57 resistance level.