Trump’s ’Big Beautiful Bill’ Clears US Senate – Here’s How It Could Reshape Crypto Markets

Washington just dropped a bombshell that'll send shockwaves through digital asset markets. The Senate's approval of Trump's sweeping legislation leaves crypto traders scrambling to decode the implications.

Buckle up – we're breaking down what this political earthquake means for your portfolio.

The Regulatory Hammer Looms

Behind the patriotic branding lies provisions that could gut decentralized protocols or legitimize them overnight. Institutional money's already placing bets – Coinbase derivatives volume spiked 300% post-vote.

Tax Trap or Innovation Springboard?

That 'beautiful' 800-page bill contains more traps than a Vegas casino. One clause lets the IRS treat DeFi like offshore accounts – another creates fast-tracked crypto ETFs. Only Wall Street lawyers win this game.

Market Reactions Tell the Real Story

Bitcoin barely budged (classic), while governance tokens for compliance-focused chains mooned 40%. Smart money's hedging – as usual, retail will be last to know which way the wind's blowing.

Welcome to 2025's great crypto reckoning. Whether this bill becomes the industry's Magna Carta or its PATRIOT Act depends entirely on who's holding the pen during implementation. Place your bets – the house always changes the rules mid-game.

Bitcoin Likely to Gain as a Fiscal Hedge

The most immediate impact WOULD be on Bitcoin. The bill expected to raise the national debt by over $3 trillion. So, market participants are already bracing for longer-term inflationary pressure.

Bitcoin, often viewed as a hedge against fiat currency debasement, could benefit from renewed demand.

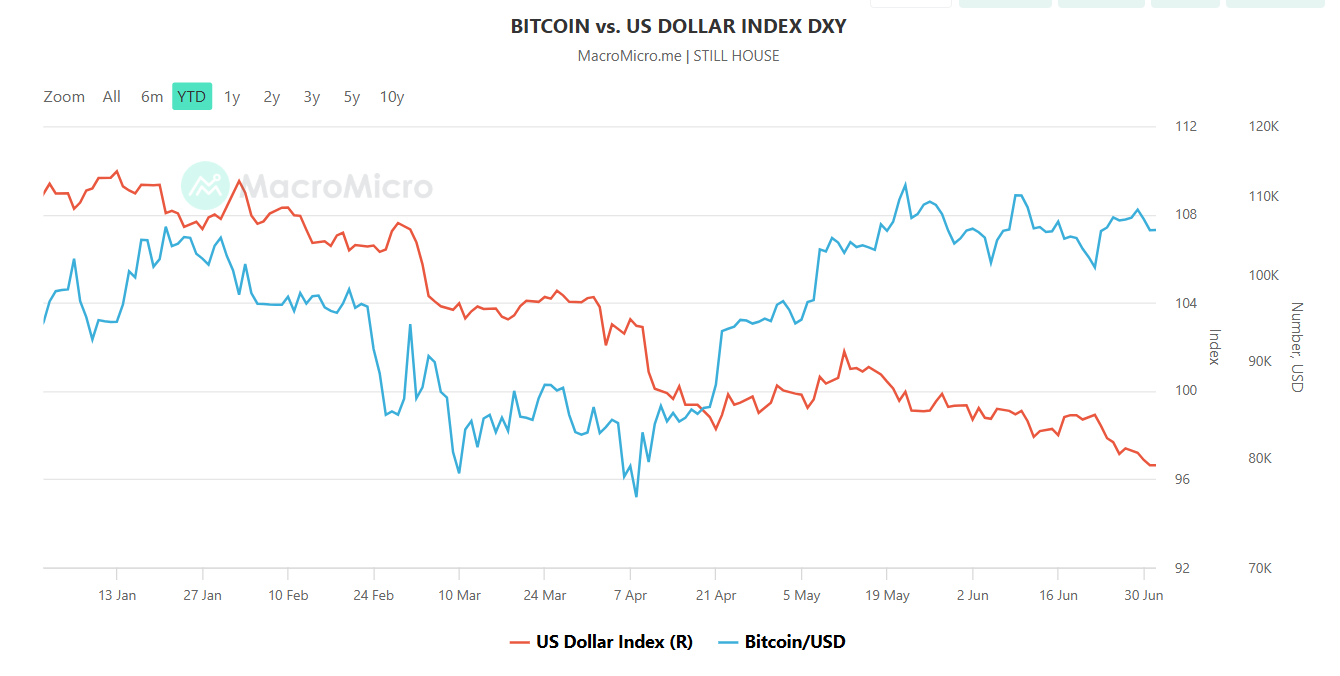

Most importantly, a weaker dollar and declining confidence in US fiscal management would likely reinforce Bitcoin’s “digital gold” narrative.

Altcoins Could See Uneven Benefits

Ethereum and other large-cap altcoins may also gain short-term support. Risk rotation out of bonds and into alternative assets often lifts crypto broadly.

However, not all tokens are positioned equally. Infrastructure and utility tokens stand to benefit from increasing activity and capital flows.

The Big Beautiful Bill (BBB) passed the Senate. It returns to the House and will likely pass to Trump's desk for his signature. The more debt, the better for Altcoins. pic.twitter.com/2Aeb8Wp7C9

— Marius BitcoinTAF.com (@LandM_Marius) July 1, 2025Meme coins and speculative assets, on the other hand, may remain volatile or underperform.

Clearer tax rules — such as exemptions for small crypto transactions — could encourage broader adoption, particularly among retail users.

Retail and Institutional Sentiment Will Likely Diverge

Retail investors could respond positively to lower personal taxes and simplified crypto reporting.

If the final bill includes crypto-friendly tax reforms — including de minimis exemptions and staking income clarity — it could lower friction for small traders and DeFi users.

Institutional sentiment may be more cautious. Rapid debt accumulation and a potentially inflationary outlook could lead institutional investors to adopt a wait-and-see approach, especially if the Federal Reserve tightens policy in response.

One Big Beautiful Bill and #Bitcoin taxation

The "One Big Beautiful Bill" includes provisions that could impact Bitcoin and other digital asset taxes. Specifically, it proposes eliminating capital gains tax on Bitcoin transactions under $600, aiming to treat small crypto…

Short-Term Outlook: Crypto Market Could Push Higher

If the House passes the bill with crypto provisions intact, Bitcoin and Ethereum may rally further. Capital rotation out of Treasuries, driven by rising US debt and fiscal uncertainty, could drive prices higher.

The total crypto market cap could test the $3.5 to $3.7 trillion range in the near term.

However, the extent of the rally will depend on broader macroeconomic conditions, including interest rate policy, regulatory enforcement, and global liquidity trends.

Medium-Term Outlook: Fed Policy Will Be Key

The longer-term impact on crypto hinges on how the Federal Reserve responds to the bill’s inflationary effects.

If the Fed raises interest rates to counter fiscal expansion, this could strengthen the dollar and pressure crypto markets. Conversely, if the Fed remains accommodative, digital assets may continue to benefit.

The Fed is bracing for stagflation:

The number of FOMC members who see upside risks to both their inflation and unemployment forecasts reached 14 in May.

Furthermore, 18 and 17 members saw upside risks to inflation and unemployment, respectively, in March.

On the other hand,… pic.twitter.com/G4674kS2iB

The survival of the bill’s crypto provisions will also be crucial. If tax relief measures are stripped out or watered down in the House version, the sector could face renewed headwinds.

Bottom Line

The Senate’s passage of Trump’s “Big Beautiful Bill” marks a major fiscal shift.

If it clears the House, crypto assets — especially bitcoin — are likely to benefit from growing fiscal concerns and investor desire for alternative hedges.

Yet volatility remains a risk. Fed policy, inflation data, and legislative negotiations will shape how sustainable any crypto rally becomes.