Why Is Cardano (ADA) Still Struggling? Coinbase Hype & XRP Integration Fail to Move the Needle

Cardano's ADA token keeps defying bullish catalysts—what gives?

Coinbase's high-profile listing and Ripple's XRP bridge should've been moon fuel. Instead, ADA's chart looks like a flat ECG. Market makers clearly didn't get the memo.

The institutional cold shoulder

While retail traders piled into the Coinbase listing, whales stayed sidelined. Trading volume tells the story: all sizzle, no steak. The 'Ethereum killer' narrative isn't moving bags like it used to.

XRP's shadow play

Ripple's cross-chain bridge got devs excited—but price action? Crickets. Turns out interoperability doesn't automatically mean buy pressure. Who knew?

Meanwhile, in TradFi land...

Hedge funds are too busy chasing AI stocks and pretending to understand quantum finance to care about proof-of-stake protocols. Their loss? Maybe. Their problem? Definitely not.

ADA's stuck in no-man's land: too 'academic' for degens, not boring enough for institutions. Until that changes, expect more sideways action—because in crypto, fundamentals are just cocktail party talk until the liquidity faucet turns on.

Cardano’s Big Month, But Bad Outcome for ADA

On June 14, Cardano founder Charles Hoskinson announced the network’s plans for a full integration with the XRP ecosystem, an interoperability step aimed at strengthening cross-chain liquidity.

Later in the month, on June 25, top cryptocurrency exchange Coinbase unveiled cbADA, a wrapped version of ADA launched on its Layer 2 network, Base. This move was designed to enable ADA holders to participate in decentralized applications (dApps) within the Coinbase ecosystem while remaining connected to Cardano.

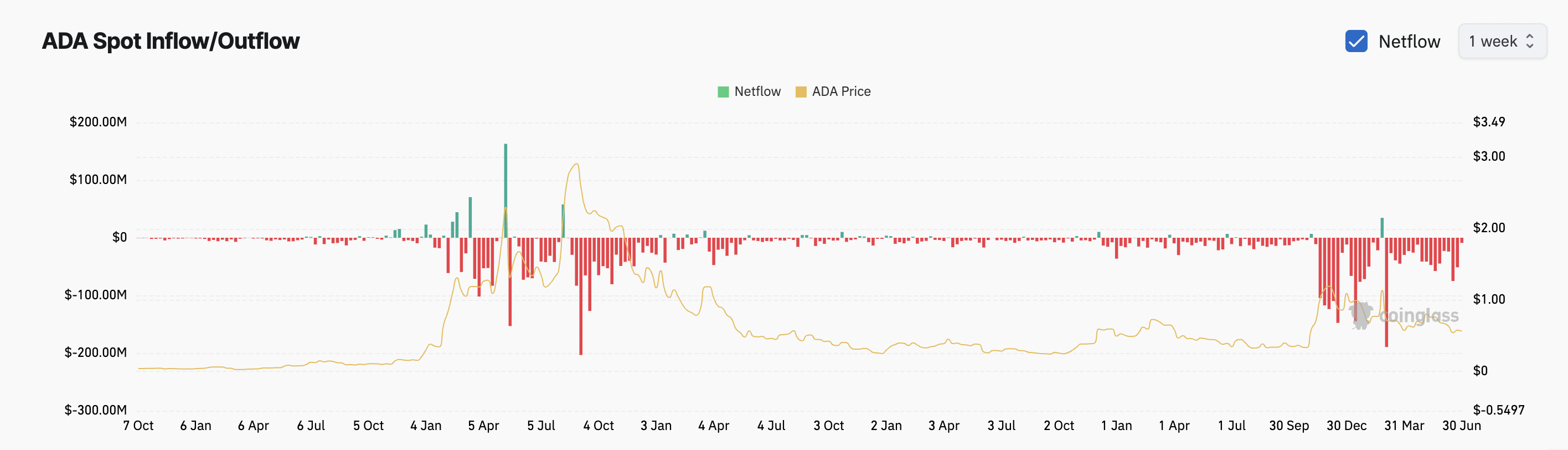

However, despite these developments, ADA’s price performance has remained lackluster. Data from CoinGlass shows that the coin has recorded consistent weekly outflows from spot markets since February, signaling persistent selling pressure and declining investor interest.

In June, weekly outflows from the ADA spot markets totaled $182.1 million as demand for the altcoin tanked. When an asset records steady spot outflows like this, traders and investors are withdrawing their assets because they lack confidence in near-term price growth.

With fewer buyers actively participating in the market and ongoing sell-offs outweighing demand, ADA may struggle to find strong support, increasing the likelihood of further price declines in July.

Moreover, on-chain data shows that the percentage supply of ADA in profit has continued to fall. At press time, it was 45.97%, plummeting 27% over the past month.

This metric serves as a proxy for market sentiment. When fewer holders are in profit, conviction among bulls typically weakens, leading to less aggressive buying and further downside risks.

ADA Struggles as Sellers Dominate

On the daily chart, ADA’s Elder-Ray Index confirms the bearish strength in the market. The momentum indicator has consistently printed red bars since June 12, indicating strong seller dominance. At press time, ADA’s Elder-Ray Index is at -0.0204.

If the sellers remain in control, they could trigger a price decline to $0.52.

However, if sentiment shifts and the new developments within cardano finally spark renewed demand, the price could climb toward $0.59 as July progresses. A break above this resistance level could propel Cardano’s price to $0.64.